Your Book to tax reconciliation example images are available. Book to tax reconciliation example are a topic that is being searched for and liked by netizens today. You can Find and Download the Book to tax reconciliation example files here. Find and Download all free photos and vectors.

If you’re searching for book to tax reconciliation example images information related to the book to tax reconciliation example topic, you have visit the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly search and find more informative video content and images that match your interests.

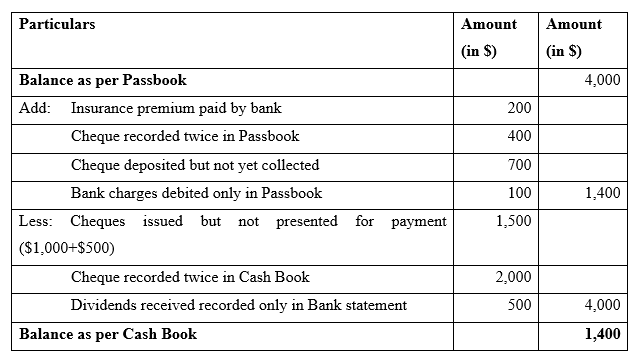

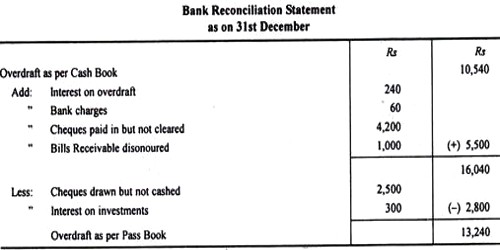

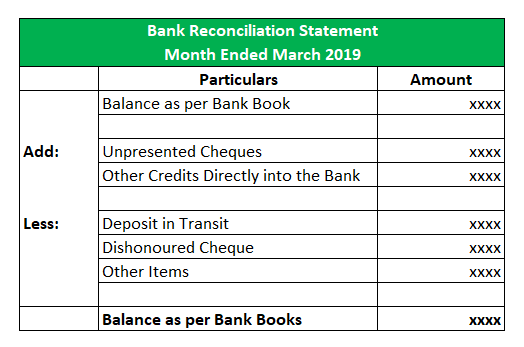

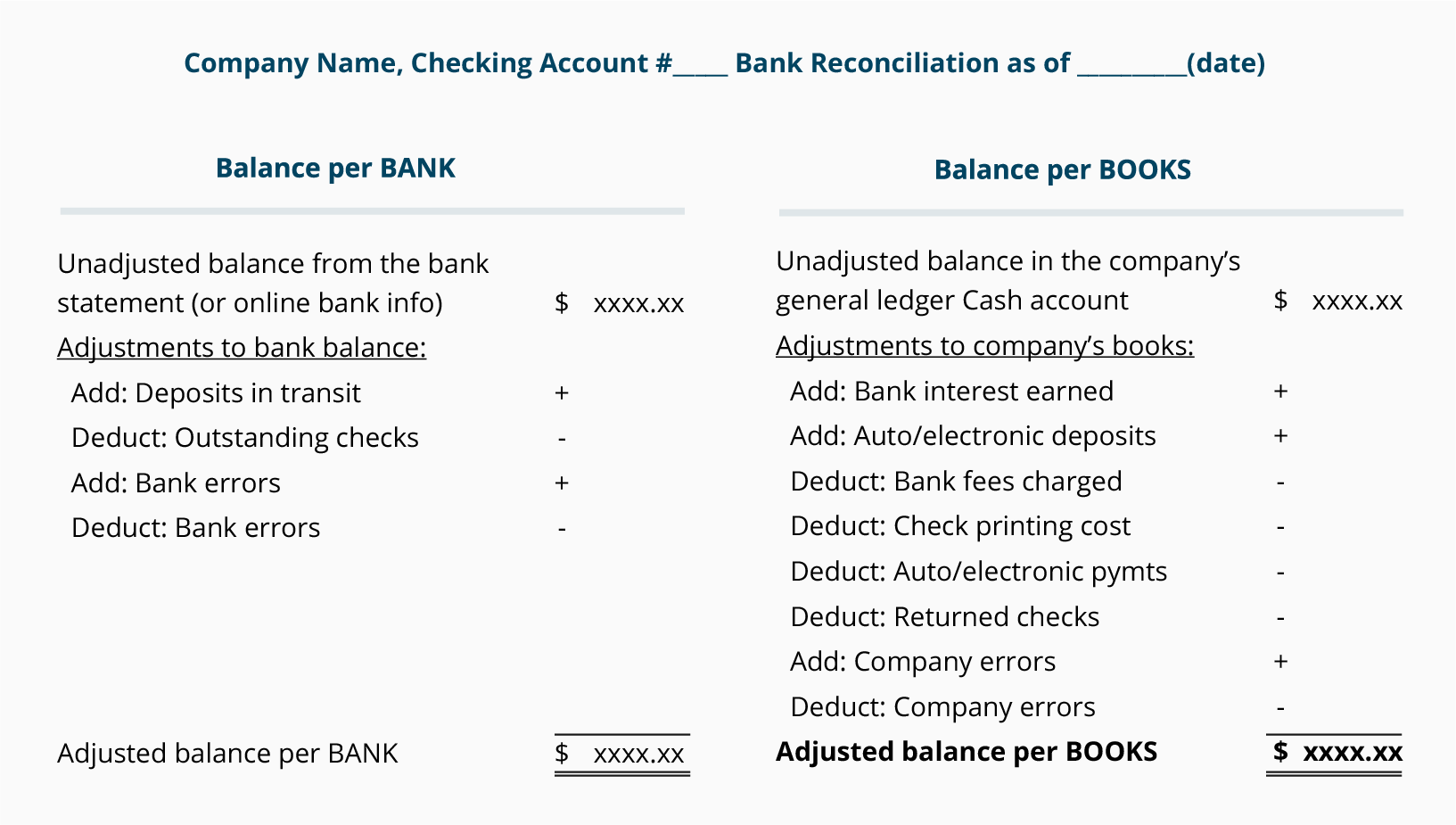

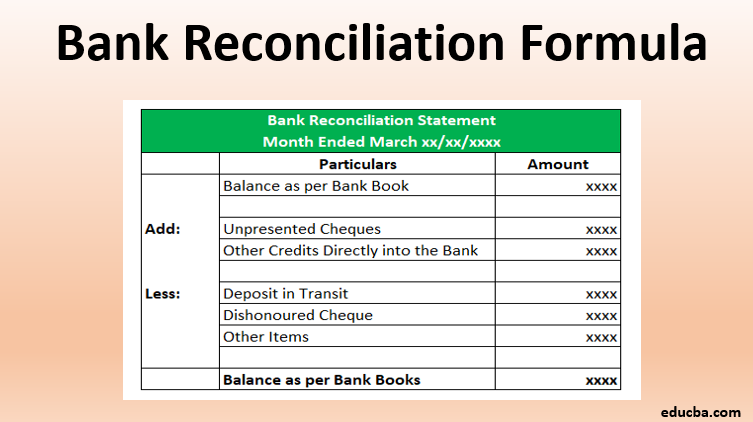

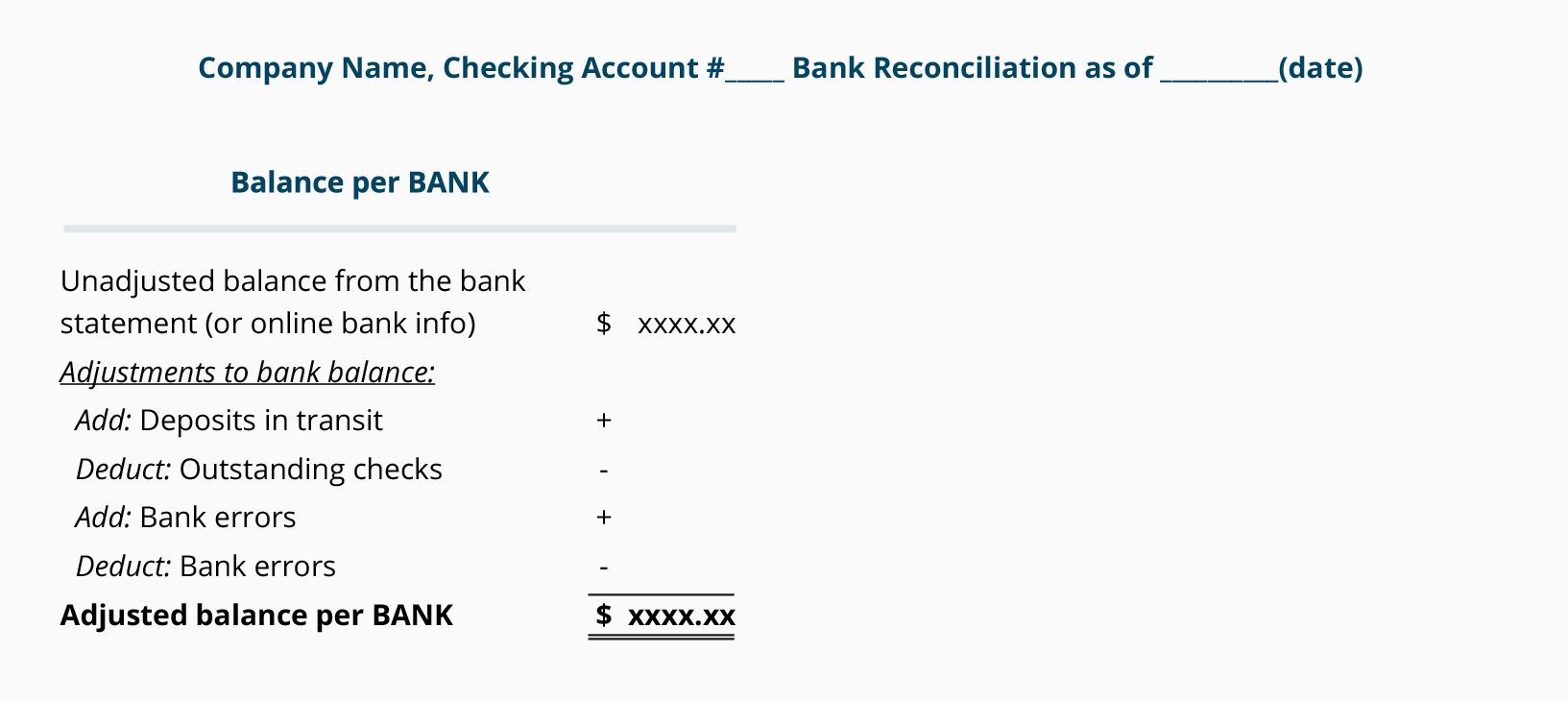

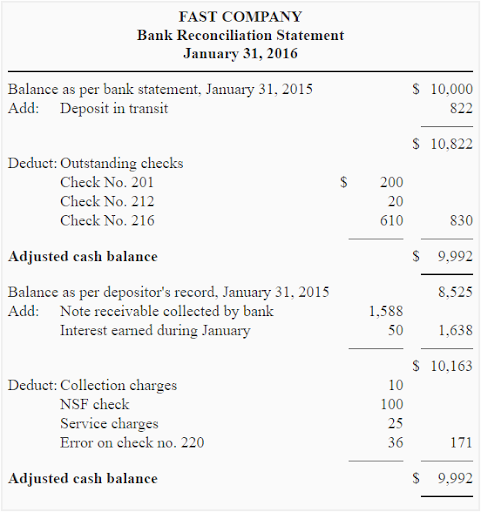

Book To Tax Reconciliation Example. A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items. This creates discrepancies between the corporations general ledger and its tax filings. Ad Tax research books that deliver. Filed by all corporations filing Form 355 Form 355C.

Accounting For Income Taxes Ppt Download From slideplayer.com

Accounting For Income Taxes Ppt Download From slideplayer.com

Tax code 88888 should be adjusted for the book-to-tax difference in the Tax. Reconciliation with data for Tax Years 19961998 1. Income by being recognized. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. Simplify your month-end close time consuming balance sheet reconciliations. Common Book-Tax Differences on Schedule M-1 for Form 1120.

Tax code 88888 should be adjusted for the book-to-tax difference in the Tax.

Common book-to-tax differences understanding your business. BOOK TO TAX RECONCILIATION. Ad Tax research books that deliver. Simplify your month-end close time consuming balance sheet reconciliations. Ad How to speed up reconciliations w a checklist built by accountants for accountants. Shop now for the 2021 tax year.

Source: pinterest.com

Source: pinterest.com

Accounting used on a companys audited financial statements. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. While most business owners are concerned with the accounting impact for certain transactions they are. In Example 1 the company has one book-tax difference that is temporary in nature. This article provides an overview of an updated.

Source: simple-accounting.org

Source: simple-accounting.org

In Example 1 the company has one book-tax difference that is temporary in nature. Income by being recognized. Common book-to-tax differences understanding your business. Shop now for the 2021 tax year. Estate Planning Under the 2017 Tax Reconciliation Act is a book addressing Tax Cuts and Jobs Acts.

Source: accountingclarified.com

Source: accountingclarified.com

BOOK TO TAX RECONCILIATION. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. And those S corporations filing Form 355S. Balance Sheets assets liabilities and equity and income statements should be. Common Book-Tax Differences on Schedule M-1 for Form 1120.

Source: qsstudy.com

Source: qsstudy.com

Book to Tax Terms. This article provides an overview of an updated. Ad Tax research books that deliver. Reconciliation with data for Tax Years 19961998 1. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions.

Source: educba.com

Source: educba.com

Ad How to speed up reconciliations w a checklist built by accountants for accountants. Shop now for the 2021 tax year. To Tax Reconciliation. However tax returns must be completed based on the actual income received during the tax year. Tax code 88888 should be adjusted for the book-to-tax difference in the Tax.

Source: docs.oracle.com

Source: docs.oracle.com

This creates discrepancies between the corporations general ledger and its tax filings. Ad How to speed up reconciliations w a checklist built by accountants for accountants. Accounting used on a companys audited financial statements. While most business owners are concerned with the accounting impact for certain transactions they are. Simplify your month-end close time consuming balance sheet reconciliations.

Source: youtube.com

Source: youtube.com

This article provides an overview of an updated. In Example 2 another company has one book-tax difference that is permanent. Common book-to-tax differences understanding your business. The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the. Reconciling Corporation Book and Tax Net Income Tax Years 1995-2001.

Source: accountingcoach.com

Source: accountingcoach.com

Ad How to speed up reconciliations w a checklist built by accountants for accountants. Schedule M-1 Book to Tax Reconciliation must be. Filed by all corporations filing Form 355 Form 355C. While most business owners are concerned with the accounting impact for certain transactions they are. BOOK TO TAX RECONCILIATION.

Source: slideplayer.com

Source: slideplayer.com

A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items. The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the. Ad How to speed up reconciliations w a checklist built by accountants for accountants. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. This article provides an overview of an updated.

Source: slideplayer.com

Source: slideplayer.com

Common book-to-tax differences understanding your business. Book to Tax Terms. This creates discrepancies between the corporations general ledger and its tax filings. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. The purpose of the Schedule M-1 is to reconcile the entitys accounting income book income with its taxable income.

Source: thetaxadviser.com

Source: thetaxadviser.com

And those S corporations filing Form 355S. Common book-to-tax differences understanding your business. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. Schedule M-1 Book to Tax Reconciliation must be. Shop now for the 2021 tax year.

Source: educba.com

Source: educba.com

Schedule M-1 Book to Tax Reconciliation must be. Schedule M-1 Book to Tax Reconciliation must be. Ad How to speed up reconciliations w a checklist built by accountants for accountants. The purpose of the Schedule M-1 is to reconcile the entitys accounting income book income with its taxable income. In Example 1 the company has one book-tax difference that is temporary in nature.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Reconciliation with data for Tax Years 19961998 1. Accounting used on a companys audited financial statements. Book to Tax Terms. Shop now for the 2021 tax year. This article provides an overview of an updated.

Source: accountingcoach.com

Source: accountingcoach.com

BOOK TO TAX RECONCILIATION. BOOK TO TAX RECONCILIATION. Ad Tax research books that deliver. Simplify your month-end close time consuming balance sheet reconciliations. Schedule M-1 Book to Tax Reconciliation must be.

Source: pinterest.com

Source: pinterest.com

Income by being recognized. BOOK TO TAX RECONCILIATION. In Example 1 the company has one book-tax difference that is temporary in nature. Simplify your month-end close time consuming balance sheet reconciliations. In Example 2 another company has one book-tax difference that is permanent.

Source: deskera.com

Source: deskera.com

Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. However tax returns must be completed based on the actual income received during the tax year. Reconciliation with data for Tax Years 19961998 1. Income by being recognized. The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Tax code 88888 should be adjusted for the book-to-tax difference in the Tax. Common book-to-tax differences understanding your business. View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. Simplify your month-end close time consuming balance sheet reconciliations. This article provides an overview of an updated.

Source: pdfsimpli.com

Source: pdfsimpli.com

Reconciliation with data for Tax Years 19961998 1. View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. Accounting used on a companys audited financial statements. The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the. Common book-to-tax differences understanding your business.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title book to tax reconciliation example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.