Your Bull put spread example images are ready in this website. Bull put spread example are a topic that is being searched for and liked by netizens now. You can Find and Download the Bull put spread example files here. Find and Download all free images.

If you’re searching for bull put spread example images information linked to the bull put spread example topic, you have visit the ideal blog. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

Bull Put Spread Example. To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call. The break-even point would be the short put strike minus the premium received. Bull Put Spread Example An options trader believes that XYZ stock trading at 43 is going to rally soon and enters a bull put spread by buying a JUL 40 put for 100 and writing a JUL 45 put for 300. Entering a Bull Put Credit Spread.

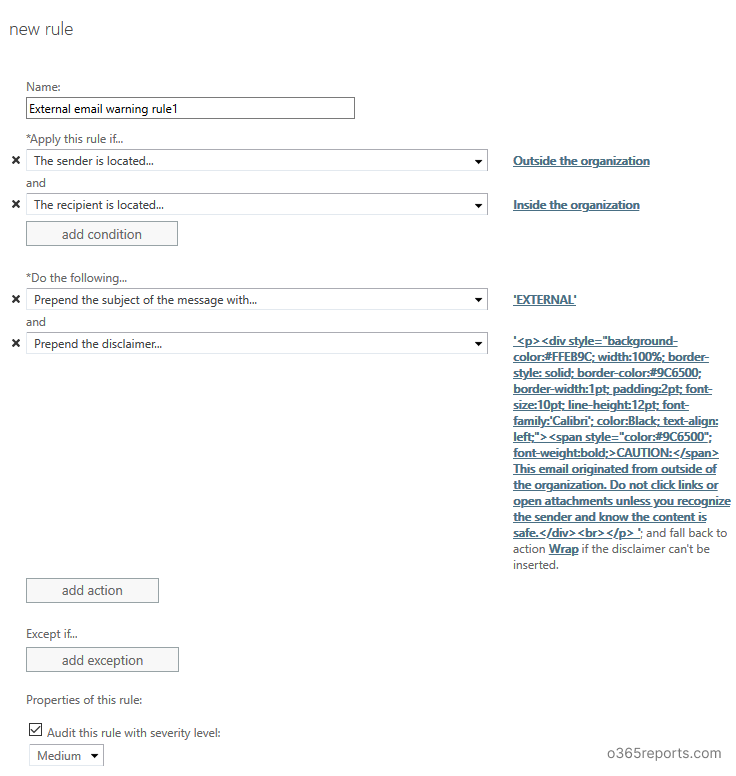

Basic Vertical Option Spreads Which To Use From investopedia.com

Basic Vertical Option Spreads Which To Use From investopedia.com

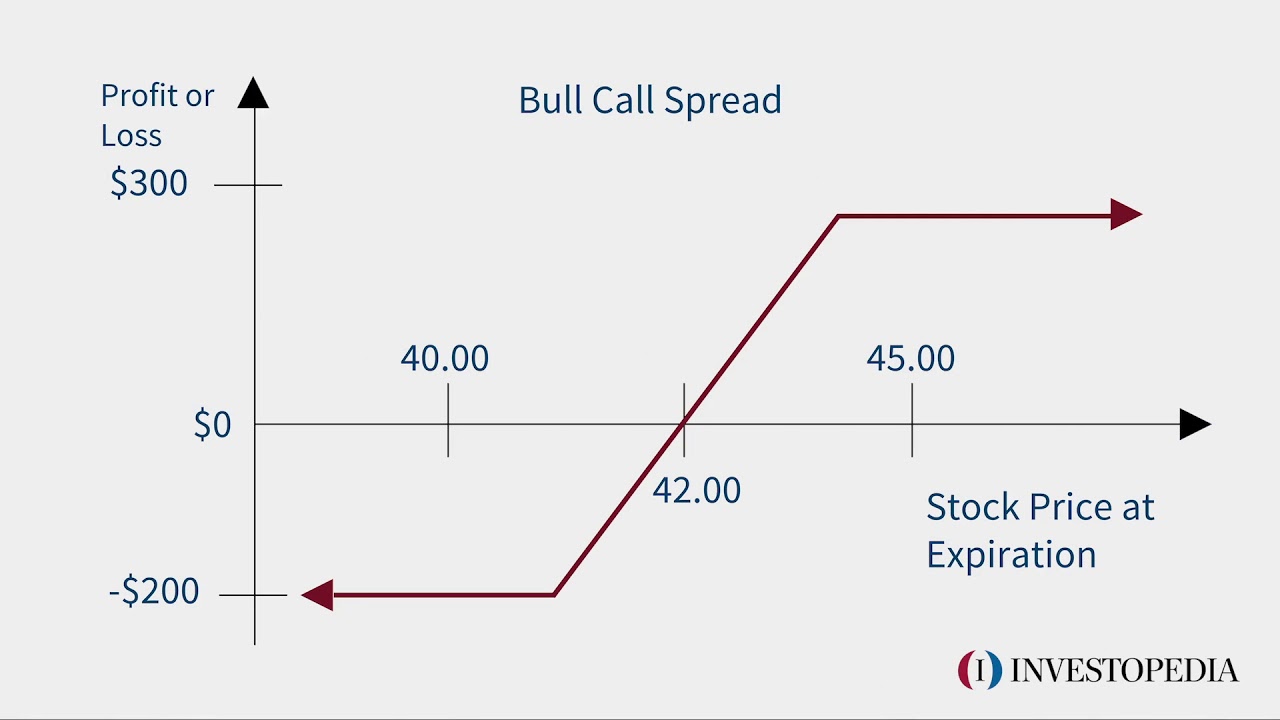

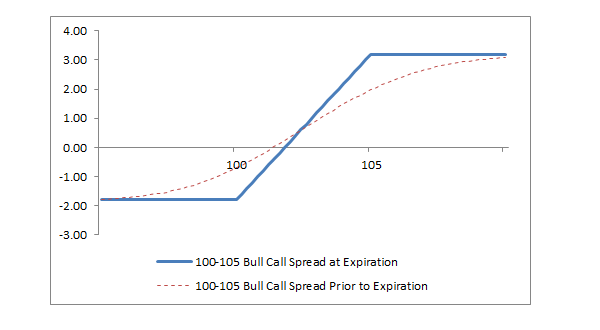

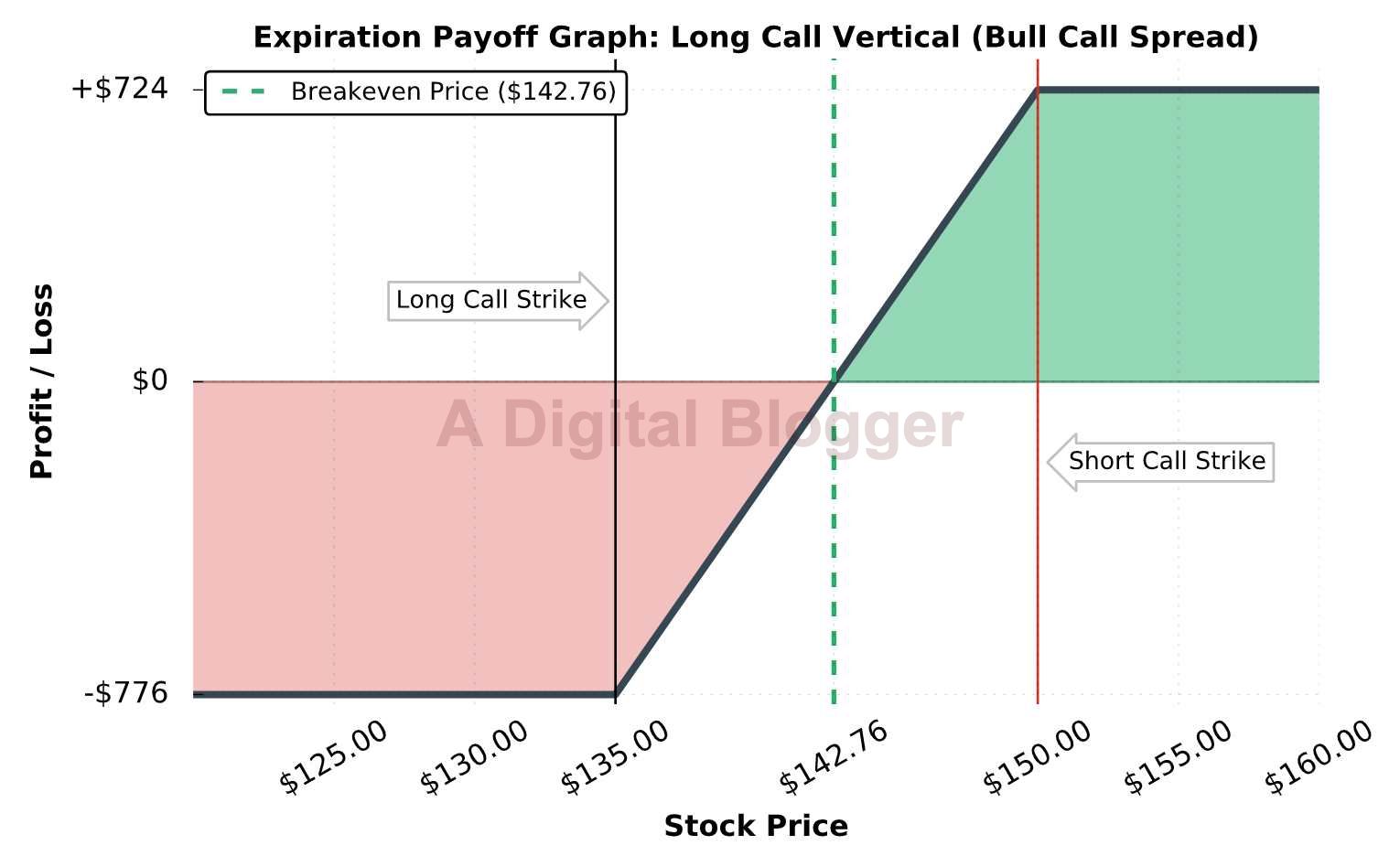

To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call. Keeping this in consideration how does a bull spread work. A bull spread is an optimistic options strategy used when the investor expects a moderate rise in the. Initial cash flow is therefore 449 187 262 net positive. Get one projectoption course for FREE when you open and fund your first tastyworks brokerage account with more than 2000. For example a bull call calendar spread will have the following risk profile below.

Imagine the stock currently trades at 275 per share.

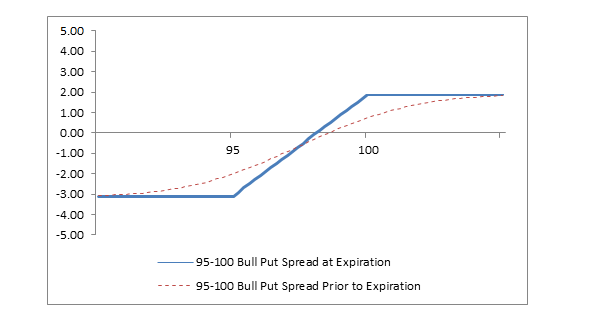

A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. For example a bull put spread is basically a bull spread that is also a credit spread while the iron butterfly can be broken down into a combination of a bull put spread and a bear call spread. In this example both the call spread and put spread are 50 wide 400450 put spread and 550600 call spread. Buy a 45 strike put option for 187 per share or 187 total cost assuming 100 shares per contract as for standard US equity options. Both calls have the same underlying stock and the same expiration date. Bull Put Spread Example.

Source: investopedia.com

Source: investopedia.com

Box spread A box spread consists of a bull call spread and a bear put spread. However one significant drawback from using a bull call spread is that potential gains are limited. SP 500 SPY Bullish Put Spread Example. Bob a qualified investor thinks that the price of XYZ stock may increase modestly or hold at its current price of 50 over the next 30. Thus the trader receives a net credit of 200 when entering the spread position.

Source: investopedia.com

Source: investopedia.com

The main reason behind using a bull put spread is to immediately realize the maximum profit upon executing the spread. Example of a Bull Put Spread Lets say an investor is bullish on Apple AAPL over the next month. Even if the stock price were to skyrocket to 500 Jorge would only be able to realize a gain of 27. The bull call spread strategy for example requires the trader to place a call option with a higher strike price than the one of the current long calls market. The break-even point would be the short put strike minus the premium received.

Source: optionsbro.com

Source: optionsbro.com

Buy a 45 strike put option for 187 per share or 187 total cost assuming 100 shares per contract as for standard US equity options. For example a bull put spread is basically a bull spread that is also a credit spread while the iron butterfly can be broken down into a combination of a bull put spread and a bear call spread. Both puts have the same underlying stock and the same expiration date. Bob a qualified investor thinks that the price of XYZ stock may increase modestly or hold at its current price of 50 over the next 30. If the Iron Condor is sold for 1500 an increase to its maximum value of 5000 would represent a loss of 3500.

Source: youtube.com

Source: youtube.com

Let us consider that Nifty Spot is at 6805 on March 20 2018 and the OTM put option is at 6700 with a premium of 62 and the ITM put option is at 6900 with a premium of 153. The main reason behind using a bull put spread is to immediately realize the maximum profit upon executing the spread. For example if a 5 wide bull put spread collects 100 of credit the maximum gain is 100 if the stock price is above the short put at expiration. Get one projectoption course for FREE when you open and fund your first tastyworks brokerage account with more than 2000. Sell a 50 strike put for 449 per share or 449 total cash inflow.

Source: fidelity.com

Source: fidelity.com

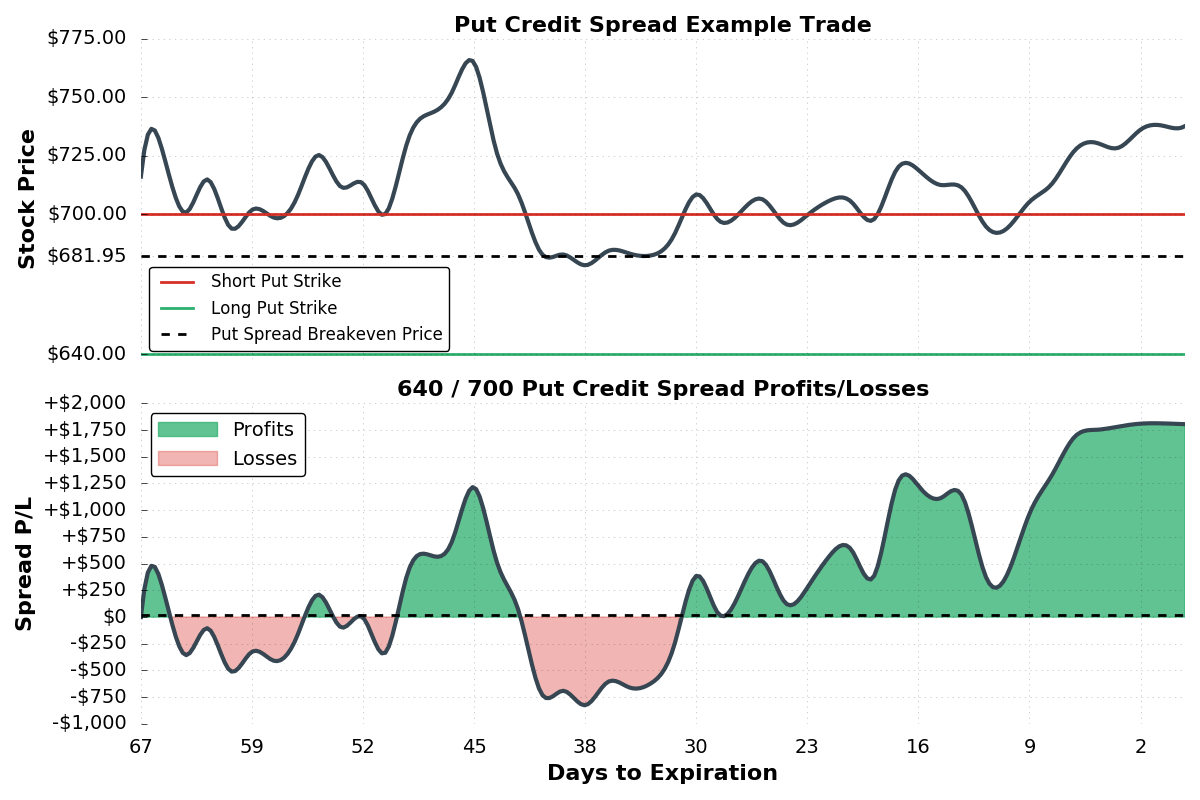

Bull Put Spread Example When we place a bull put spread we sell an out-of-the-money OTM put option then buy a further OTM put. To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call. Example Alan owns 100 shares of a company that trades at 68 per share. Selling the November 19 700 put and buying the 695 put would create a bull put spread. I like to sell the 15 delta as the short leg of my bull put spread then buy a further OTM option as insurance.

Source: zerodha.com

Source: zerodha.com

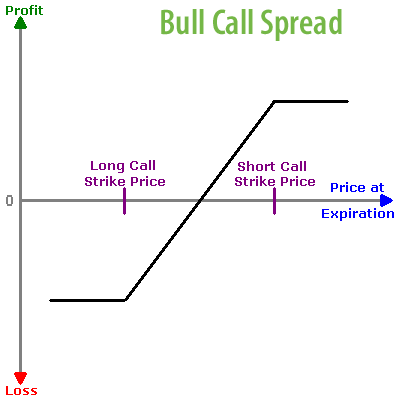

Its currently trading at 54 so you sell a put at 50 and buy a put at 45. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call. A bull spread is an optimistic options strategy used when the investor expects a moderate rise in the. Even if the stock price were to skyrocket to 500 Jorge would only be able to realize a gain of 27.

Bob a qualified investor thinks that the price of XYZ stock may increase modestly or hold at its current price of 50 over the next 30. In order to enter bull put spreads you buy a JUL 40 put 100 and write sell a JUL 45 put for 300. Bull Put Spread Example When we place a bull put spread we sell an out-of-the-money OTM put option then buy a further OTM put. Buy a 45 strike put option for 187 per share or 187 total cost assuming 100 shares per contract as for standard US equity options. Thus the trader receives a net credit of 200 when entering the spread position.

Source: bullishbears.com

Source: bullishbears.com

Imagine the stock currently trades at 275 per share. A bull put spread is established for a net credit or net amount received and profits from either a rising stock price or from time erosion or from both. In order to enter bull put spreads you buy a JUL 40 put 100 and write sell a JUL 45 put for 300. The bull call spread strategy for example requires the trader to place a call option with a higher strike price than the one of the current long calls market. For example in the example above the maximum gain Jorge can realize is only 27 due to the short call option position.

Source: theoptionsguide.com

Source: theoptionsguide.com

To best implement a bull put spread strategy investors should be sure that the stock price will not drop to the lower strike put and that it will remain at the same level or rise higher than the upper strike put to maturity. However one significant drawback from using a bull call spread is that potential gains are limited. The main reason behind using a bull put spread is to immediately realize the maximum profit upon executing the spread. Get one projectoption course for FREE when you open and fund your first tastyworks brokerage account with more than 2000. Lets look at an example.

Source: youtube.com

Source: youtube.com

A bull spread is an optimistic options strategy used when the investor expects a moderate rise in the. With SPY trading for 43988 and near all-time highs I want to place a bull put spread with a high probability of success. To best implement a bull put spread strategy investors should be sure that the stock price will not drop to the lower strike put and that it will remain at the same level or rise higher than the upper strike put to maturity. Example of a Bull Put Credit Spread Heres an example of how trading a bull put credit spread can work. A Real Life Example of Bull Put Spreads Youve done your research checked out the fundamentals and feel that shares of American Airlines AAL are going to rise from their current price of 43.

Source: bullishbears.com

Source: bullishbears.com

In order to enter bull put spreads you buy a JUL 40 put 100 and write sell a JUL 45 put for 300. Example Alan owns 100 shares of a company that trades at 68 per share. If the Iron Condor is sold for 1500 an increase to its maximum value of 5000 would represent a loss of 3500. Example of bull call spread. Initial cash flow is therefore 449 187 262 net positive.

Source: fidelity.com

Source: fidelity.com

For example in the example above the maximum gain Jorge can realize is only 27 due to the short call option position. Entering a Bull Put Credit Spread. Bull Put Spread Example Consider a position made up of two legs options. Sell a 50 strike put for 449 per share or 449 total cash inflow. Potential profit is limited to the net premium.

Source: theoptionsguide.com

Source: theoptionsguide.com

Selling the November 19 700 put and buying the 695 put would create a bull put spread. Both calls have the same underlying stock and the same expiration date. Bull Put Spread Example When we place a bull put spread we sell an out-of-the-money OTM put option then buy a further OTM put. Potential profit is limited to the net premium. 1500 Sale Price 5000 Maximum Trade Value x 100 -3500.

Source: investopedia.com

Source: investopedia.com

The main reason behind using a bull put spread is to immediately realize the maximum profit upon executing the spread. In addition although the maximum gains are capped the investor is protected from downside risk as well. The maximum loss is 400 if the stock price is below the long put at expiration. A bull put spread is established for a net credit or net amount received and profits from either a rising stock price or from time erosion or from both. For example in the example above the maximum gain Jorge can realize is only 27 due to the short call option position.

Source: adigitalblogger.com

Source: adigitalblogger.com

As an example you believe ABC company is going to rally soon and you want to use a bull put spread strategy. For example if a 5 wide bull put spread collects 100 of credit the maximum gain is 100 if the stock price is above the short put at expiration. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. The cash flow of this transaction is 153-6291. Bull Put Spread Example Consider a position made up of two legs options.

Source: optionalpha.com

Source: optionalpha.com

To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call. Both puts have the same underlying stock and the same expiration date. Bull Put Spread Example. The main reason behind using a bull put spread is to immediately realize the maximum profit upon executing the spread. Bob a qualified investor thinks that the price of XYZ stock may increase modestly or hold at its current price of 50 over the next 30.

Source: projectoption.com

Source: projectoption.com

For example in the example above the maximum gain Jorge can realize is only 27 due to the short call option position. The break-even point would be the short put strike minus the premium received. Both puts have the same underlying stock and the same expiration date. Sell 1 June APPL 180 call 40 Buy 1 July AAPL 180 call -50 Net debit paid 10. To make it work the trader should simultaneously buy and sell a call option with the same expiration date ie a short call.

Source: adigitalblogger.com

Source: adigitalblogger.com

A bull spread is an optimistic options strategy used when the investor expects a moderate rise in the. Entering a Bull Put Credit Spread. In this example both the call spread and put spread are 50 wide 400450 put spread and 550600 call spread. SP 500 SPY Bullish Put Spread Example. For example a bull put spread is basically a bull spread that is also a credit spread while the iron butterfly can be broken down into a combination of a bull put spread and a bear call spread.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bull put spread example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.