Your Cis reverse charge example images are ready. Cis reverse charge example are a topic that is being searched for and liked by netizens now. You can Find and Download the Cis reverse charge example files here. Get all free vectors.

If you’re looking for cis reverse charge example pictures information connected with to the cis reverse charge example keyword, you have pay a visit to the right site. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

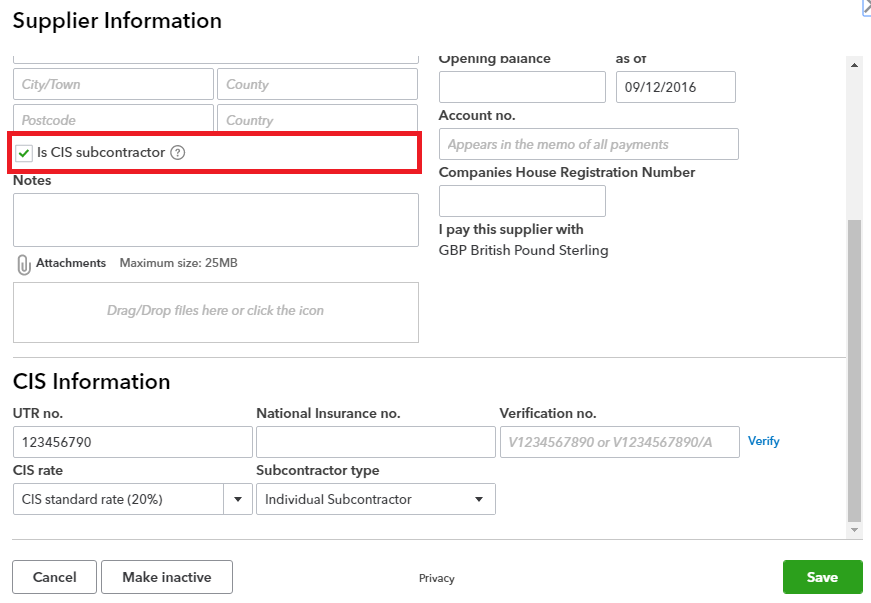

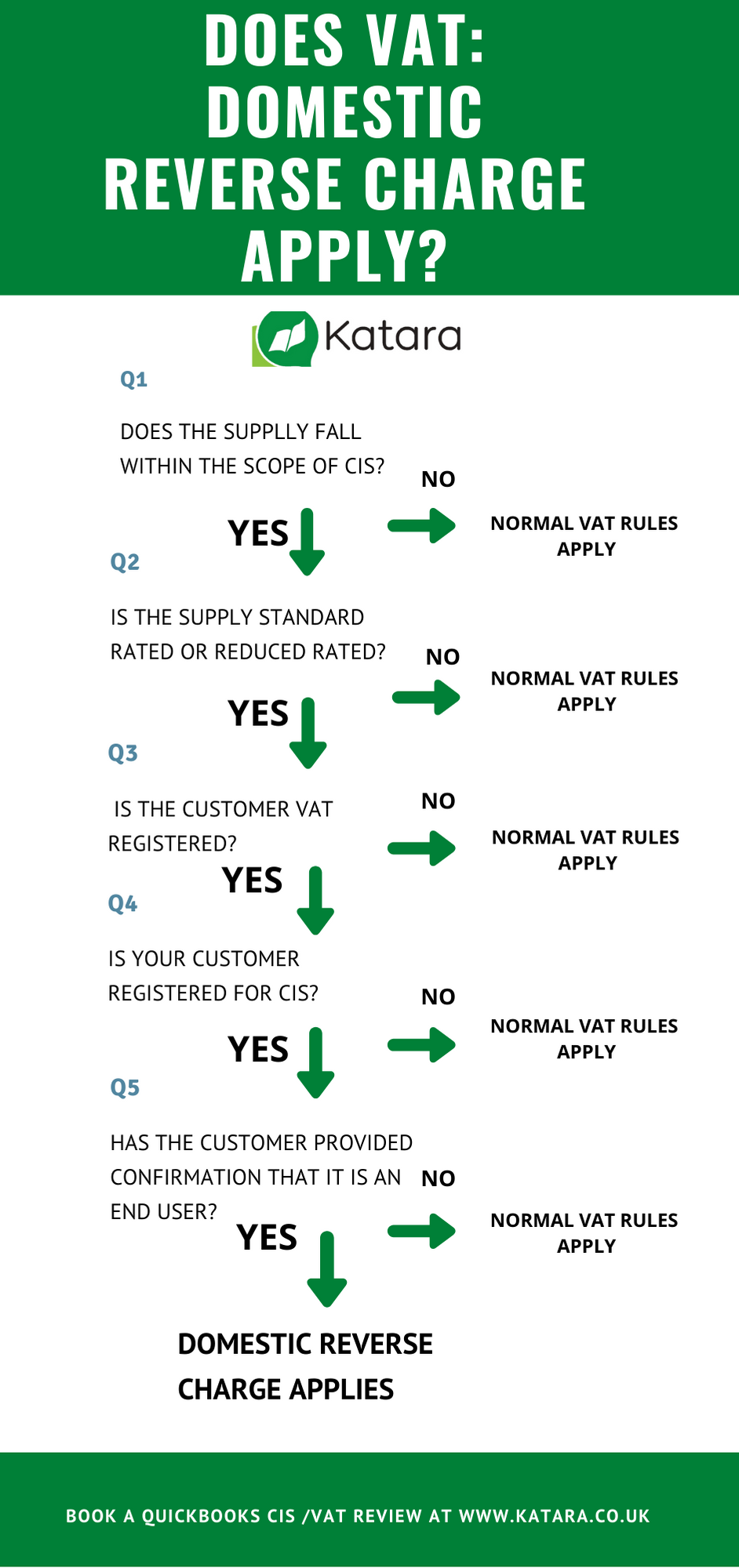

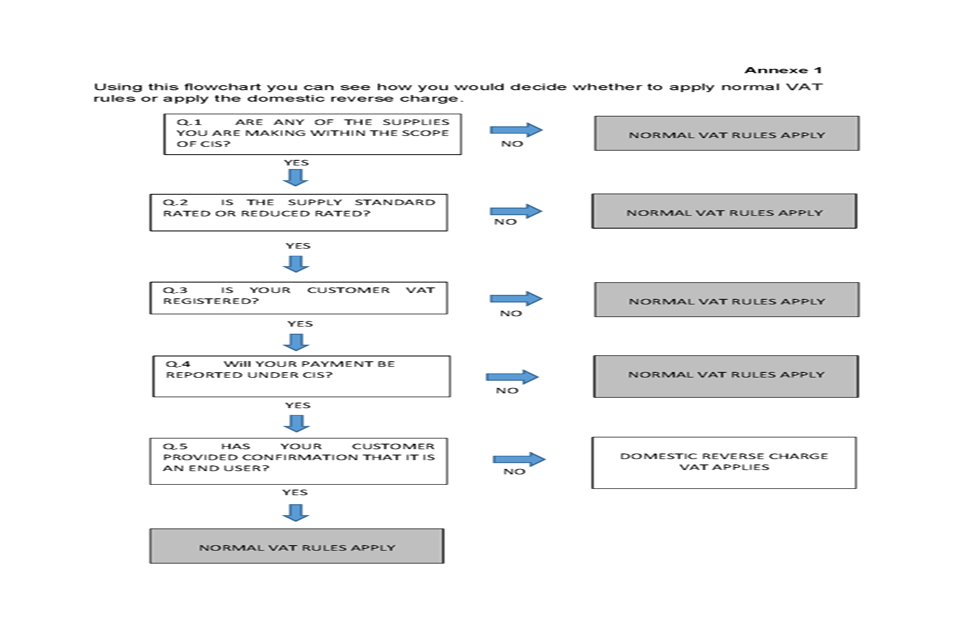

Cis Reverse Charge Example. The UK government has introduced a new VAT domestic reverse charge procedure that shifts VAT liability from the supplier to the customer. The CIS deduction is also stated in the cost breakdown. The domestic reverse charge applies to VAT-registered businesses throughout the CIS supply chain but is designed not to apply to end users or intermediary suppliers. For example for sales invoices for 200 Labour with a 30 deduction rate.

Laying The Foundations For The Construction Industry Vat Reverse Charge Construction Uk Magazine From constructionmaguk.co.uk

Laying The Foundations For The Construction Industry Vat Reverse Charge Construction Uk Magazine From constructionmaguk.co.uk

The contractor would therefore pay 100 to HMRC and the subcontractor 640. Under the new CIS reverse charge mechanism he invoices 100000. 090221 Reverse VAT Charge for CIS. How do invoices change with the new VAT Reverse charge for Construction Post 1st March 2021. For example for sales invoices for 200 Labour with a 30 deduction rate. This then gives the 100 CIS tax to deduct.

This scheme means that if you are both CIS and VAT registered the way you do your invoicing may change as you may fall under the new scheme.

The domestic reverse charge applies to VAT-registered businesses throughout the CIS supply chain but is designed not to apply to end users or intermediary suppliers. Right click on the page and select New. He is supplying materials and labour to Builder A who is also VAT registered. For example a joiner constructing a staircase offsite then installing it onsite will be making a reverse charge service even if the charge for installation is. If you fall under the new scheme and you are not providing your service to an end user the public for example then. Sales transactions are not posted to the VAT on Sales category.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

End users are VAT and CIS registered businesses receiving supplies of specified services which are not sold on as construction services. 090221 Reverse VAT Charge for CIS. Developer pays Bob the net 100000 fee. These are called specified supplies. So if an electrician were to visit a site to wire a security system and also took care of some lighting wiring while there and the latter work represented 5 of less of the invoice amount then the CIS VAT reverse charge.

Source: electricaltimes.co.uk

Source: electricaltimes.co.uk

Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. For example for sales invoices for 200 Labour with a 30 deduction rate. For example installing a security system does not fall under the CIS reverse charge rules. The subcontractor would invoice 1000 but state reverse charge VAT rules apply. Sales transactions are not posted to the VAT on Sales category.

Source: katara.co.uk

Source: katara.co.uk

Enter CR5 on the VAT Code field. An example of how the reverse charge would work in practice is. Reverse charge VAT and CIS. Check your customers CIS registration. Sales transactions are not posted to the VAT on Sales category.

CIS tax to deduct 100 This is calculated as the gross amount of 740 less the materials of 240. Sales transactions are not posted to the VAT on Sales category. Company B sells developed properties to other businesses. The CIS reverse charge scheme comes into force from the 1 st of March 2021. End users are VAT and CIS registered businesses receiving supplies of specified services which are not sold on as construction services.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

The new treatment will apply from the point the customers circumstances change. In both examples the CIS tax. How to set up and apply reverse charge VAT to your CIS invoices. If you fall under the new scheme and you are not providing your service to an end user the public for example then. His invoice states that the CIS reverse charge applies and that the applicable rate of VAT is 20.

The domestic reverse charge only affects supplies at the standard or reduced rates where payments are required to be reported through the CIS. This work is a business-to-business supply so it falls under the reverse charge regulations. Sub-contractor Supplier Suppliers Address. The domestic reverse charge only affects supplies at the standard or reduced rates where payments are required to be reported through the CIS. For example a joiner constructing a staircase offsite then installing it onsite will be making a reverse charge service even if the charge for installation is.

In the above examples the customer should notify the supplier that the end user exclusion no longer applies and charges for services in future would be subject to the CIS reverse charge. Builder A is supplying his own services to Company B who is a property developer and is VAT registered. Pete the plumber is VAT registered. From 1st March 2021 the way in which VAT is charged on the supply of services within the construction industry is changing. The new rules affect companies that operate within the Construction Industry Scheme CIS with a few exceptions that well detail later onand have an impact on VAT compliance as well as cash flow.

![]() Source: sicon.co.uk

Source: sicon.co.uk

Pete the plumber is VAT registered. If you are using the CIS feature Xero will also calculate the amount of CIS to withhold. An example of how the reverse charge would work in practice is. For example for sales invoices for 200 Labour with a 30 deduction rate. For example installing a security system does not fall under the CIS reverse charge rules.

For example a joiner constructing a staircase offsite then installing it onsite will be making a reverse charge service even if the charge for installation is. An example of how the reverse charge would work in practice is. Company B sells developed properties to other businesses. How reverse charge affects your ledger accounts. Developer pays Bob the net 100000 fee.

Source: taxassist.co.uk

Source: taxassist.co.uk

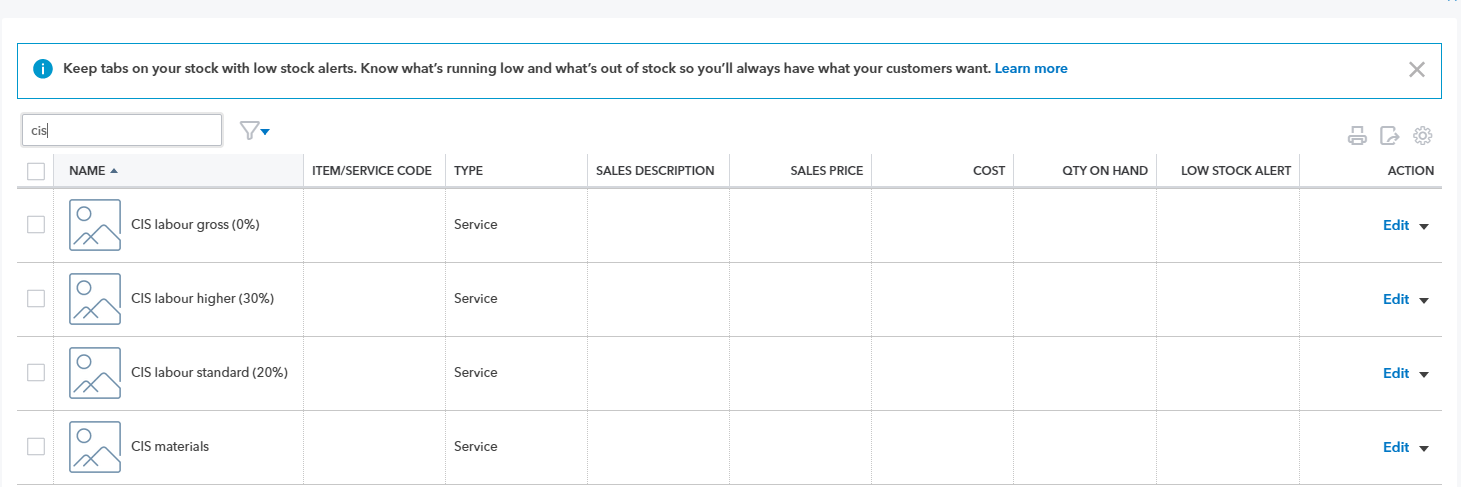

How to set up and apply reverse charge VAT to your CIS invoices. Builder A is supplying his own services to Company B who is a property developer and is VAT registered. For example installing a security system does not fall under the CIS reverse charge rules. Sales transactions are not posted to the VAT on Sales category. Below we have provided an example of a CIS domestic reverse charge invoice.

Right click on the page and select New. Check if your customer has a valid VAT number. Note that Reverse charge is clearly visible on the invoice and the VAT rate is set to 0. Brian the subcontractor is hired by Gary the contractor for building work that costs 2400 including VAT. This is made up of 2000 costs plus VAT at 20 400.

Source: mitchellsaccountants.co.uk

Source: mitchellsaccountants.co.uk

For example a joiner constructing a staircase offsite then installing it onsite will be making a reverse charge service even if the charge for installation is. Before you can use reverse charge VAT you must turn on the CIS options in the Settings. This is a major change to the VAT collection. End users are VAT and CIS registered businesses receiving supplies of specified services which are not sold on as construction services. For example a joiner constructing a staircase offsite then installing it onsite will be making a reverse charge service even if the charge for installation is.

Source: constructionmaguk.co.uk

Source: constructionmaguk.co.uk

What is it. For VAT Item for Purchases choose CIS RC Purchases 5 Group. The reverse charge affects supplies of building and construction services supplied at the standard or reduced rates that also need to be reported under CIS. How to set up and apply reverse charge VAT to your CIS invoices. The CIS amount is deducted from the net value of the invoice reducing the amount your customer owes you.

![]() Source: sicon.co.uk

Source: sicon.co.uk

090221 Reverse VAT Charge for CIS. The new rules are called the domestic reverse charge for supplies of building and construction services. The subcontractor would invoice 1000 but state reverse charge VAT rules apply. How the CIS reverse charge works. Enter CR5 on the VAT Code field.

![]() Source: sicon.co.uk

Source: sicon.co.uk

The subcontractor would invoice 1000 but state reverse charge VAT rules apply. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. Review your contracts to decide if the reverse charge will apply and tell your customers. Xero will know that reverse charge is to be applied and will automatically ensure the correct VAT is calculated. The CIS is scheme which involves amounts being deducted from payments made by a contractor to a subcontractor which relate to construction work.

Source: taxadvisermagazine.com

Source: taxadvisermagazine.com

Builder A is supplying his own services to Company B who is a property developer and is VAT registered. Enter CIS RC 5 in the Description field. In the above examples the customer should notify the supplier that the end user exclusion no longer applies and charges for services in future would be subject to the CIS reverse charge. The CIS reverse charge scheme comes into force from the 1 st of March 2021. The CIS is scheme which involves amounts being deducted from payments made by a contractor to a subcontractor which relate to construction work.

![]() Source: sicon.co.uk

Source: sicon.co.uk

Company B sells developed properties to other businesses. The CIS reverse charge scheme comes into force from the 1 st of March 2021. Below we have provided an example of a CIS domestic reverse charge invoice. For example for sales invoices for 200 Labour with a 30 deduction rate. Sub-contractor Supplier Suppliers Address.

![]() Source: sicon.co.uk

Source: sicon.co.uk

Enter CIS RC 5 in the Description field. How to set up and apply reverse charge VAT to your CIS invoices. The domestic reverse charge applies to VAT-registered businesses throughout the CIS supply chain but is designed not to apply to end users or intermediary suppliers. He is supplying materials and labour to Builder A who is also VAT registered. This then gives the 100 CIS tax to deduct.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cis reverse charge example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.