Your Completed form 3115 example images are ready in this website. Completed form 3115 example are a topic that is being searched for and liked by netizens today. You can Find and Download the Completed form 3115 example files here. Find and Download all free photos.

If you’re looking for completed form 3115 example images information related to the completed form 3115 example interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

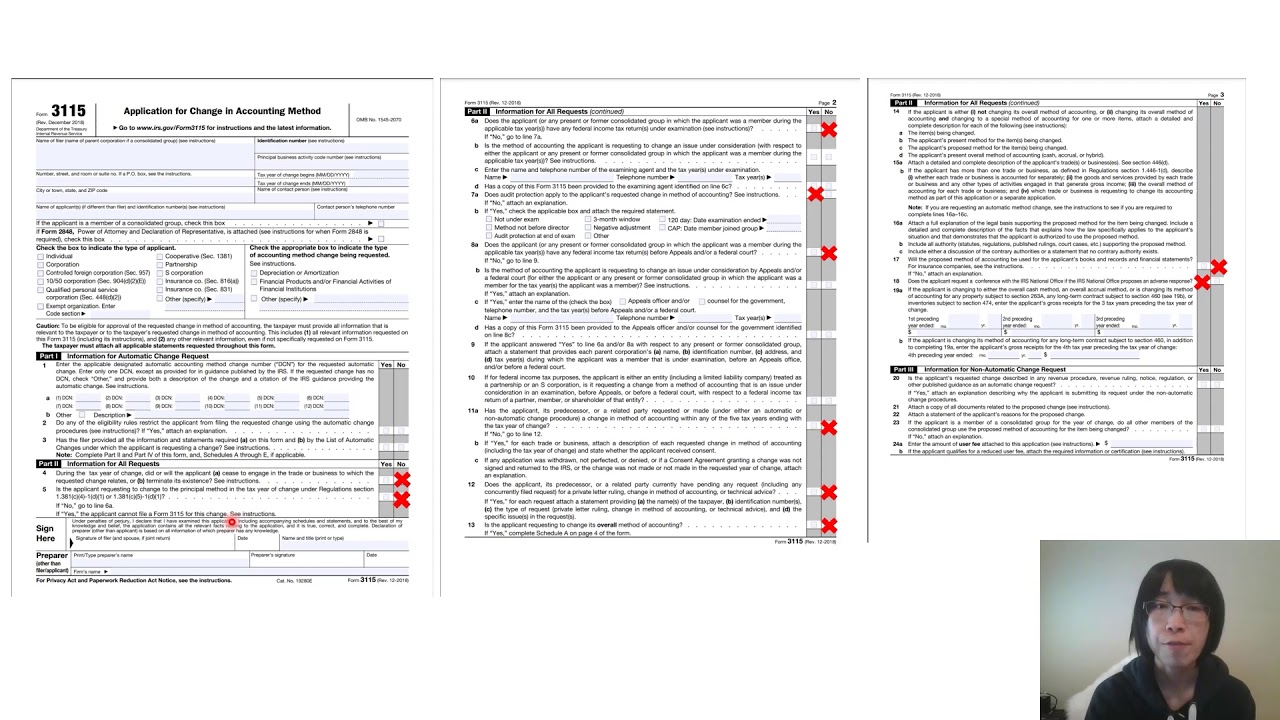

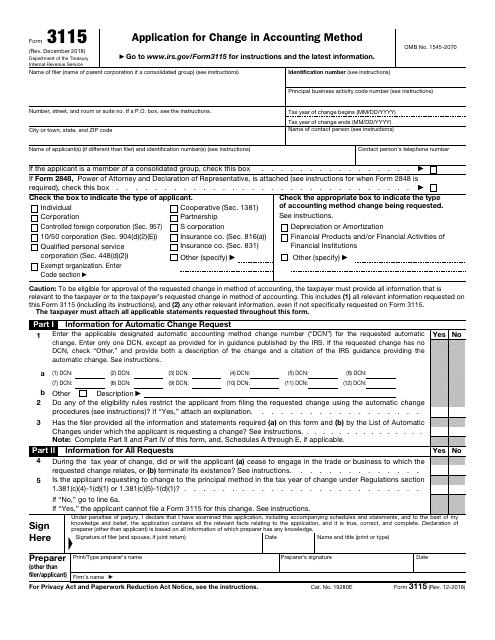

Completed Form 3115 Example. Notes on SAMPLE Form 3115 1. Alternatively taxpayers may file an automatic Form 3115 DCN 244 with their 2020 return to claim the missed depreciation as a favorable Section 481a adjustment Note - continuing to treat QIP as 39-year property is an impermissible method of accounting and the IRS expects the change to be made 29. Filed including extensions original return for the year of the change. 2015-13 requires that a signed copy of Form 3115 be filed to the IRS office.

204 rows The filer must complete Form 3115 including any required statements or. HIS BUSINESS b OPERATES IN HE CONDO AND PAYS RENT 7 Impermissable to Permissable Depreciation. Was looking at the example of completed form 3115 attached to the response from InfoTaxes and was very excited to see the example. Fill in the requested fields they are marked in yellow. I need an example of a completed for 3115 to correct for depreciation not previously taken on a rental property using the current Form 3115. KBKG authored a comprehensive overview of the new procedures that can be found here.

The when and how of IRC Section 481a adjustments will be discussed.

It assumes that the reduced reporting rules for qualified small taxpayers apply. Also what changes were brought about under TCJA regarding changes in accounting methods and how it applies to Form 3115. No advance approval is required to correct the error as this is an automatic approval change in most cases. Alternatively taxpayers may file an automatic Form 3115 DCN 244 with their 2020 return to claim the missed depreciation as a favorable Section 481a adjustment Note - continuing to treat QIP as 39-year property is an impermissible method of accounting and the IRS expects the change to be made 29. Thank you so much. KBKG has put together a sample Form 3115 template with attachments for the concurrent Designated Change Numbers DCN 244 and 7.

I need an example of a completed for 3115 to correct for depreciation not previously taken on a rental property using the current Form 3115. The sample Form 3115 relates to a residential rental property where the entire building depreciated using 275-year recovery period and no allocation was previously made to land improvements or personal property. KBKG has put together a sample Form 3115 template with attachments for the concurrent Designated Change Numbers DCN 244 and 7. Both changes require the filing of Form 3115 completing all applicable parts of the form. Fill in the requested fields they are marked in yellow.

Source: formupack.com

Source: formupack.com

KBKG authored a comprehensive overview of the new procedures that can be found here. The e-book also provides three sample completed 3115 forms for the most common and perhaps the only accounting method change requests small taxpayers will need to make and also a sample accounting policy which should help a small taxpayer stay in compliance in the future. Fill in the requested fields they are marked in yellow. December 2003 OMB No. Take the course to view this content.

Thank you so much. Maybe I should have specified that I was hoping to see an example of a completed Form 3115 for a depreciation change. You requesting permission to make this changea change required by tax lawseems crazy I know. 204 rows The filer must complete Form 3115 including any required statements or. About Form 3115 Application for Change in Accounting Method.

Select the Get form button to open the document and start editing. However the form was revised in 2009. Since this is an automatic request and there is no need for a request of an advanced consent from the Internal Revenue Service Part III of Form 3115 and Part II of Schedule A are irrelevant and should not be completed. 2011-14 the taxpayer must attach Form 3115 to a timely. The correct procedure is to catch up all in one year.

Source: youtube.com

Source: youtube.com

Filed including extensions original return for the year of the change. More In Forms and Instructions. Complete disposal of assets final entity tax return. Execute Form 3115 Example in a few moments following the instructions listed below. Form 3115 will use Code 107 as the Code number of change on Page 1 of Form 3115 if the asset has been sold and Rev.

In addition the taxpayer. The e-book also provides three sample completed 3115 forms for the most common and perhaps the only accounting method change requests small taxpayers will need to make and also a sample accounting policy which should help a small taxpayer stay in compliance in the future. Filed including extensions original return for the year of the change. Form 3115 Application for Change in Accounting Method Rev. Take the course to view this content.

If not an example of a finished one without use of namesSSNs maybe guidance on how to complete the last page of. Alternatively taxpayers may file an automatic Form 3115 DCN 244 with their 2020 return to claim the missed depreciation as a favorable Section 481a adjustment Note - continuing to treat QIP as 39-year property is an impermissible method of accounting and the IRS expects the change to be made 29. Thank you so much. These taxpayers may not be required to file Form 3115 under Rev. Reporting the changes for Sec.

About Form 3115 Application for Change in Accounting Method. Select the Get form button to open the document and start editing. Select the template you require in the collection of legal form samples. More In Forms and Instructions. 1545-0152 Department of the Treasury Internal Revenue Service Name of filer name of parent corporation if a consolidated group see instructions Identification number see instructions Number street and room or suite no.

KBKG has put together a sample Form 3115 template with attachments for these new changes using Designated Change Numbers DCN 244 and 245. This template is free and can be accessed in our Resource Library. KBKG authored a comprehensive overview of the new procedures that can be found here. In that case they may use the short Form 3115. December 2003 OMB No.

If you mark the Individual box you must enter T for taxpayer S for spouse or J for a joint return. You requesting permission to make this changea change required by tax lawseems crazy I know. KBKG has put together a sample Form 3115 template with attachments for these new changes using Designated Change Numbers DCN 244 and 245. In addition the taxpayer. Thank you so much.

Completing Form 3115 Application for Change in Accounting Method Chris Bynum. Select the template you require in the collection of legal form samples. Since this is an automatic request and there is no need for a request of an advanced consent from the Internal Revenue Service Part III of Form 3115 and Part II of Schedule A are irrelevant and should not be completed. 8z2 Form 3115 case studues. Execute Form 3115 Example in a few moments following the instructions listed below.

More In Forms and Instructions. Take the course to view this content. If not an example of a finished one without use of namesSSNs maybe guidance on how to complete the last page of. Today I mailed a 3115 claiming a 21 million 481a adjustment for missed depreciation between 2006 and 2016. The accounting treatment of any item.

Source: docplayer.net

Source: docplayer.net

KBKG authored a comprehensive overview of the new procedures that can be found here. Completing Form 3115 Application for Change in Accounting Method Chris Bynum. About Form 3115 Application for Change in Accounting Method. Maybe I should have specified that I was hoping to see an example of a completed Form 3115 for a depreciation change. An overall method of accounting or.

Source: slideplayer.com

Source: slideplayer.com

But let me make two other points about Form 3115 and the Sec. This template is free and can be accessed in our Resource Library. Complete disposal of assets final entity tax return. Completing Form 3115 Application for Change in Accounting Method Chris Bynum. 204 rows The filer must complete Form 3115 including any required statements or.

Source: templateroller.com

Source: templateroller.com

This template is free and can be accessed in our Resource Library. Fill in the requested fields they are marked in yellow. No advance approval is required to correct the error as this is an automatic approval change in most cases. Alternatively taxpayers may file an automatic Form 3115 DCN 244 with their 2020 return to claim the missed depreciation as a favorable Section 481a adjustment Note - continuing to treat QIP as 39-year property is an impermissible method of accounting and the IRS expects the change to be made 29. 2015-20 but may choose to do so.

10 million or less for the three preceding tax years. Must file a copy of Form 3115 with the IRS National Office no earlier than the first day of the. 2015-13 requires that a signed copy of Form 3115 be filed to the IRS office. Execute Form 3115 Example in a few moments following the instructions listed below. You requesting permission to make this changea change required by tax lawseems crazy I know.

Form 3115 Application for Change in Accounting Method Rev. Complete disposal of assets final entity tax return. Identification section of page 1 above Part I applies to all four change sections. Reporting the changes for Sec. Filed including extensions original return for the year of the change.

Maybe I should have specified that I was hoping to see an example of a completed Form 3115 for a depreciation change. QIP is defined as any improvement made by the taxpayer. 10 million or less for the three preceding tax years. No advance approval is required to correct the error as this is an automatic approval change in most cases. 2015-20 but may choose to do so.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title completed form 3115 example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.