Your Cost segregation study example images are ready. Cost segregation study example are a topic that is being searched for and liked by netizens now. You can Get the Cost segregation study example files here. Get all free photos and vectors.

If you’re searching for cost segregation study example images information linked to the cost segregation study example keyword, you have visit the right site. Our website frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Cost Segregation Study Example. Land isnt depreciable so you decide the land is worth 200000 and the building is worth 800000. You only fill out the portions of the form applicable to your situation. Treasury Regulation 1446-1e2iii Example 9 provides an illustration of a change in accounting method due to changes in depreciation method recovery period and convention all. Ad Get a Free No Obligation Cost Segregation Analysis Today.

Case Studies For Book Tax Differences In The Classroom From thetaxadviser.com

Case Studies For Book Tax Differences In The Classroom From thetaxadviser.com

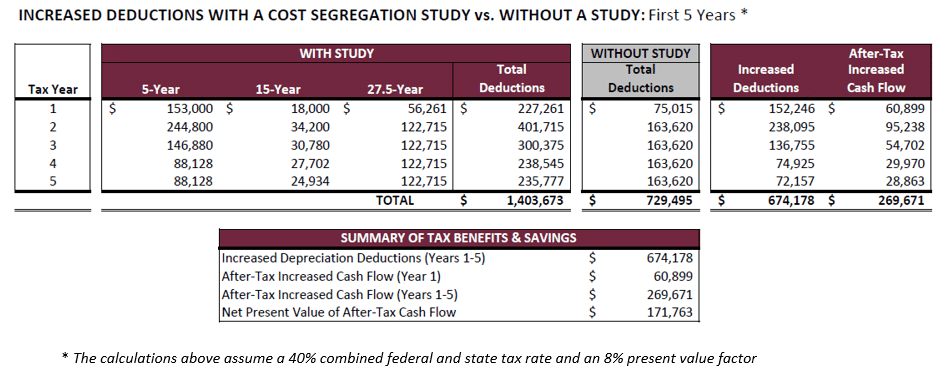

The following examples demonstrate the impact of a cost segregation study on two residential rental properties. The Cost Segregation Study. Not to be afraid. First and most easily quantifiable is the actual cost of the engineering study. A cost segregation study can run 30 pages or more. While the fees vary widely a well-done study is not.

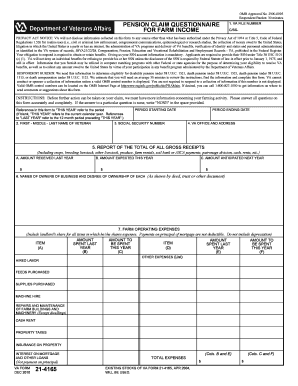

A simple example illustrates the tax benefits of a cost segregation study.

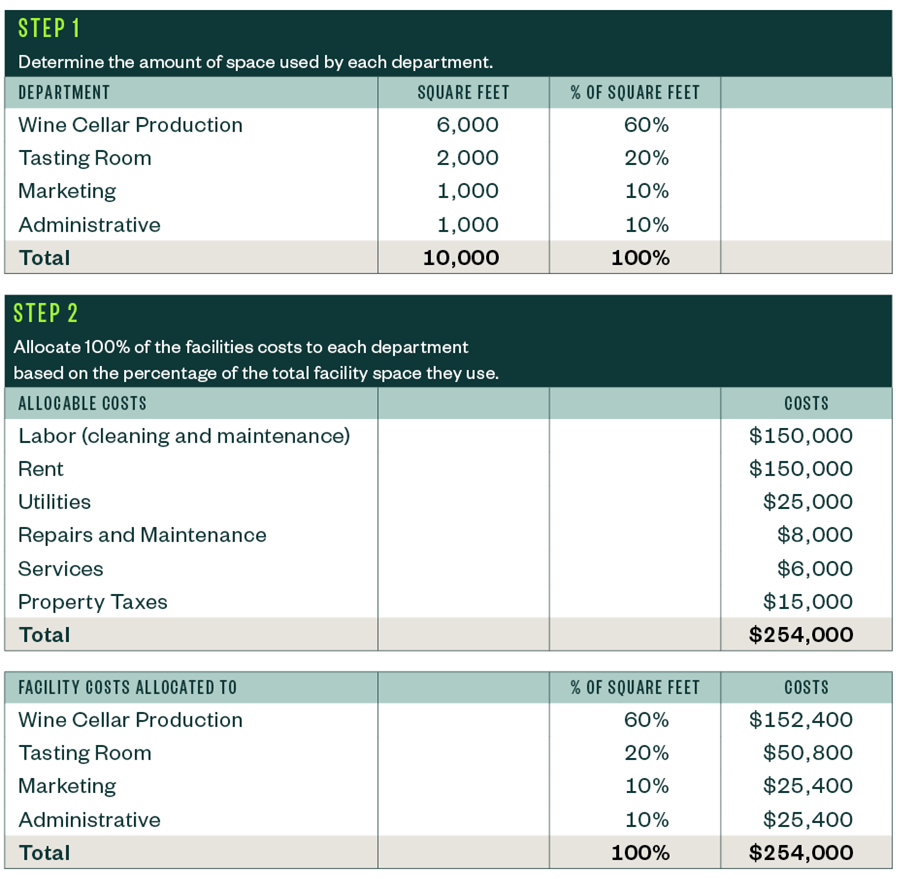

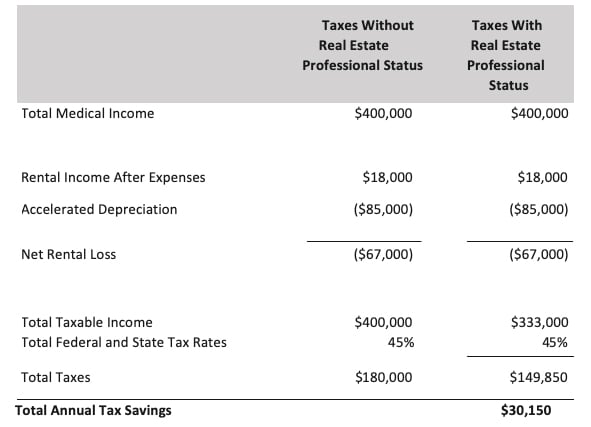

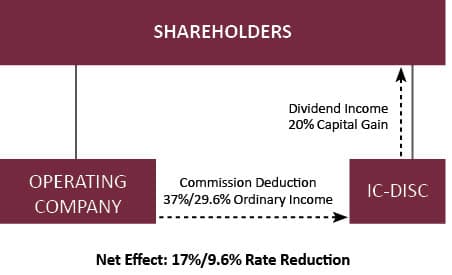

Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. However a cost segregation study may also report certain building occupancy items eg carpeting wall coverings partitions millwork lighting fixtures as 1245 property that would. Reduce Your Income Taxes - Request Your Free Quote - Call Today. The primary goal of a Cost Segregation. Tax Benefit in Year of Study 543588 The bottom line by performing an engineering-based cost segregation study the building owner was able to increase the amount of depreciation. Cost segregation is a tax deferral strategy that frontloads depreciation deductions for real estate assets into the early years of ownership.

Source: kbkg.com

Source: kbkg.com

Cost Segregation Study Example. Cost Segregation Study 123 Davis Drive St. A cost segregation study is too expensive Cost segregation studies are not free but if you are able to save significant tax dollars early on then the study will pay for itself from the. Typically capital improvement projects. Ad Get a Free No Obligation Cost Segregation Analysis Today.

Source: cshco.com

Source: cshco.com

A cost segregation study can run 30 pages or more. For example if a taxpayer purchased an apartment building in 2019 for 2 million and a cost segregation study classified 150000 of that amount as 5-year personal property the taxpayer. The following examples demonstrate the impact of a cost segregation study on two residential rental properties. In our example if a cost segregation study is performed in 2017 for a property purchased in 2012 the catch-up amount or the 481 a adjustment is a depreciation expense deduction of. Ad Get a Free No Obligation Cost Segregation Analysis Today.

The primary goal of a Cost Segregation. Our DIY cost segregation software has a cost of 495 for residential properties of 4 units or less 1295 for commercial buildings and residential properties with 5 or more units. Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. You only fill out the portions of the form applicable to your situation. Reduce Your Income Taxes - Request Your Free Quote - Call Today.

Source: therealestatecpa.com

Source: therealestatecpa.com

A study segregates the cost components of a building. You buy an office building for 1000000. Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. Cost segregation studies offer significant tax savings especially for businesses such as manufacturers with specialized facilities. For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary.

Source: thetaxadviser.com

Source: thetaxadviser.com

A cost segregation study can run 30 pages or more. The impact of cost-segregation studies can be significant. Cost segregation studies analyze all the components that make up the building you own from expensive chandeliers to the heating system roof and driveway so they can assign a value to. After receiving a no-cost preliminary analysis the client was eager to proceed with the study. Tax Benefit in Year of Study 543588 The bottom line by performing an engineering-based cost segregation study the building owner was able to increase the amount of depreciation.

Source: costsegregationconsulting.com

Source: costsegregationconsulting.com

While the fees vary widely a well-done study is not. For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary. The impact of cost-segregation studies can be significant. Treasury Regulation 1446-1e2iii Example 9 provides an illustration of a change in accounting method due to changes in depreciation method recovery period and convention all. Tax Benefit in Year of Study 543588 The bottom line by performing an engineering-based cost segregation study the building owner was able to increase the amount of depreciation.

Source: mossadams.com

Source: mossadams.com

The following examples demonstrate the impact of a cost segregation study on two residential rental properties. In our example if a cost segregation study is performed in 2017 for a property purchased in 2012 the catch-up amount or the 481 a adjustment is a depreciation expense deduction of. Treasury Regulation 1446-1e2iii Example 9 provides an illustration of a change in accounting method due to changes in depreciation method recovery period and convention all. The impact of cost-segregation studies can be significant. The clients CPA was looking for a solution to eliminate a large tax burden.

Source: mossadams.com

Source: mossadams.com

In general a turnkey construction project includes elements of tangible personal property eg phone system. While the fees vary widely a well-done study is not. Our DIY cost segregation software has a cost of 495 for residential properties of 4 units or less 1295 for commercial buildings and residential properties with 5 or more units. The following examples demonstrate the impact of a cost segregation study on two residential rental properties. A Cost Segregation study dissects the construction cost or purchase price of the property that would otherwise be depreciated over 27 ½ or 39 years.

Source: iemed.org

Source: iemed.org

While the fees vary widely a well-done study is not. Washington State Residential Cost Segregation Study. After receiving a no-cost preliminary analysis the client was eager to proceed with the study. Our DIY cost segregation software has a cost of 495 for residential properties of 4 units or less 1295 for commercial buildings and residential properties with 5 or more units. You buy an office building for 1000000.

Source: andersonadvisors.com

Source: andersonadvisors.com

You buy an office building for 1000000. In our example if a cost segregation study is performed in 2017 for a property purchased in 2012 the catch-up amount or the 481 a adjustment is a depreciation expense deduction of. A simple example illustrates the tax benefits of a cost segregation study. Washington State Residential Cost Segregation Study. However a cost segregation study may also report certain building occupancy items eg carpeting wall coverings partitions millwork lighting fixtures as 1245 property that would.

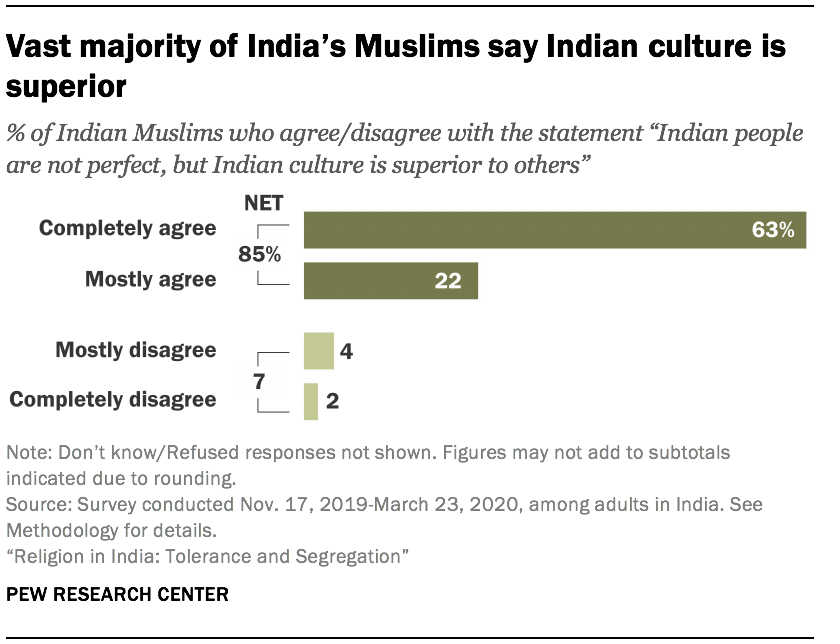

Source: pewforum.org

Source: pewforum.org

You only fill out the portions of the form applicable to your situation. The potential tax saving benefits derived from a Cost Segregation Study can be significant based on the cost basis of the project and type of property. Ad Get a Free No Obligation Cost Segregation Analysis Today. A cost segregation study can run 30 pages or more. Treasury Regulation 1446-1e2iii Example 9 provides an illustration of a change in accounting method due to changes in depreciation method recovery period and convention all.

Source: investopedia.com

Source: investopedia.com

For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary. If time permits I will write a post this summer with a filled-in Form 3115 as it applies to cost. Typically capital improvement projects. The potential tax saving benefits derived from a Cost Segregation Study can be significant based on the cost basis of the project and type of property. Tax Benefit in Year of Study 543588 The bottom line by performing an engineering-based cost segregation study the building owner was able to increase the amount of depreciation.

Source: biggerpockets.com

Source: biggerpockets.com

Reduce Your Income Taxes - Request Your Free Quote - Call Today. The impact of cost-segregation studies can be significant. For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary. Tax Benefit in Year of Study 543588 The bottom line by performing an engineering-based cost segregation study the building owner was able to increase the amount of depreciation. The potential tax saving benefits derived from a Cost Segregation Study can be significant based on the cost basis of the project and type of property.

Source: mossadams.com

Source: mossadams.com

You only fill out the portions of the form applicable to your situation. You only fill out the portions of the form applicable to your situation. The impact of cost-segregation studies can be significant. The potential tax saving benefits derived from a Cost Segregation Study can be significant based on the cost basis of the project and type of property. A cost segregation study can run 30 pages or more.

Source: thetaxadviser.com

Source: thetaxadviser.com

Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary. You buy an office building for 1000000. Treasury Regulation 1446-1e2iii Example 9 provides an illustration of a change in accounting method due to changes in depreciation method recovery period and convention all. Ad Get a Free No Obligation Cost Segregation Analysis Today.

Source: kbkg.com

Source: kbkg.com

Cost Segregation Study Example. For tax preparation purposes the pages you are interested in are the Cost Detail and Cost Summary. While the fees vary widely a well-done study is not. The following examples demonstrate the impact of a cost segregation study on two residential rental properties. Ad Get a Free No Obligation Cost Segregation Analysis Today.

Source: biggerpockets.com

Source: biggerpockets.com

Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. Reduce Your Income Taxes - Request Your Free Quote - Call Today. Cost segregation is a tax deferral strategy that frontloads depreciation deductions for real estate assets into the early years of ownership. A study segregates the cost components of a building. Not to be afraid.

Source: americanprogress.org

Source: americanprogress.org

The potential tax saving benefits derived from a Cost Segregation Study can be significant based on the cost basis of the project and type of property. Typically capital improvement projects. Property Analysis Example The best way to illustrate the effects of cost segregation is to compare a property with and without a. The following examples demonstrate the impact of a cost segregation study on two residential rental properties. After receiving a no-cost preliminary analysis the client was eager to proceed with the study.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cost segregation study example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.