Your Deed of variation example images are available in this site. Deed of variation example are a topic that is being searched for and liked by netizens today. You can Download the Deed of variation example files here. Get all free photos.

If you’re searching for deed of variation example images information linked to the deed of variation example keyword, you have visit the right blog. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

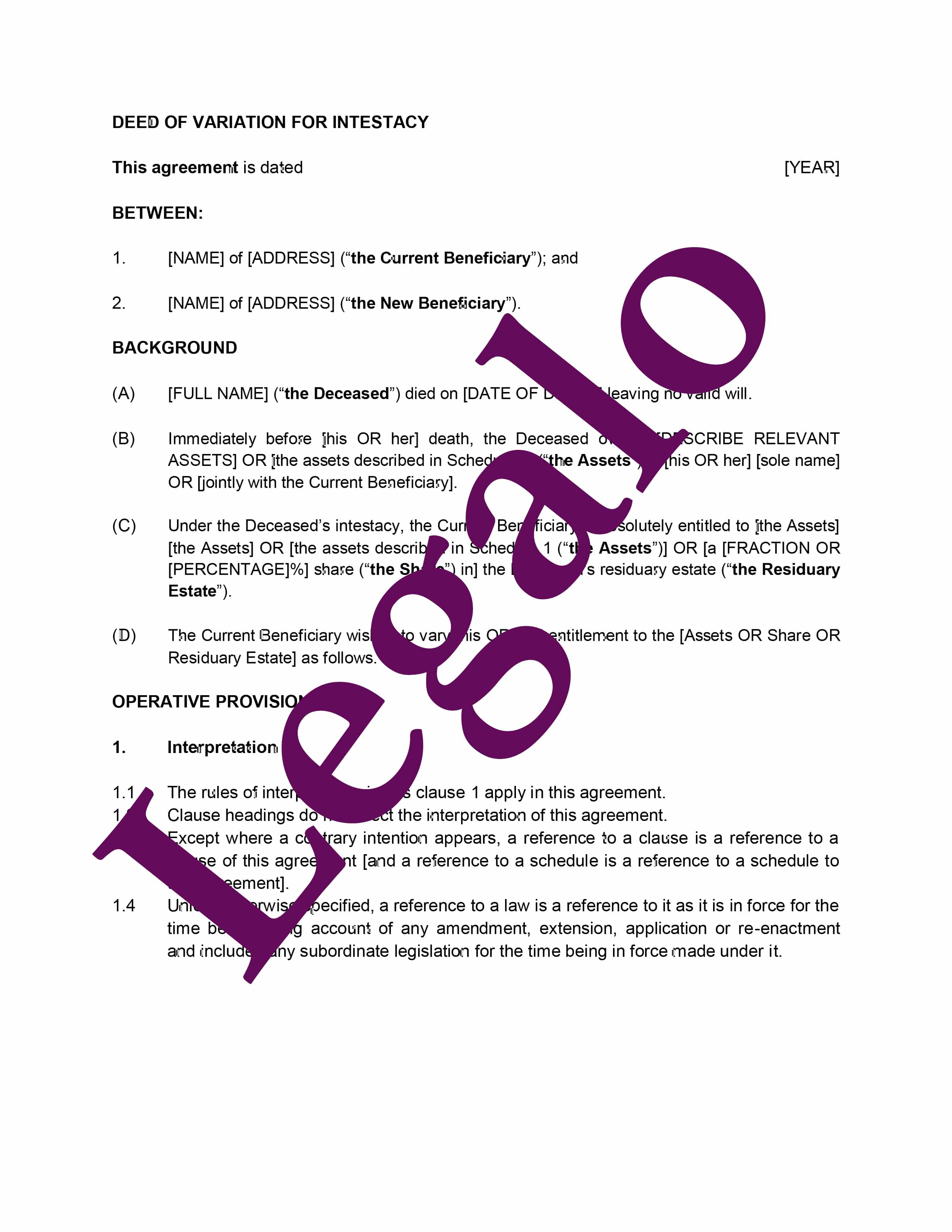

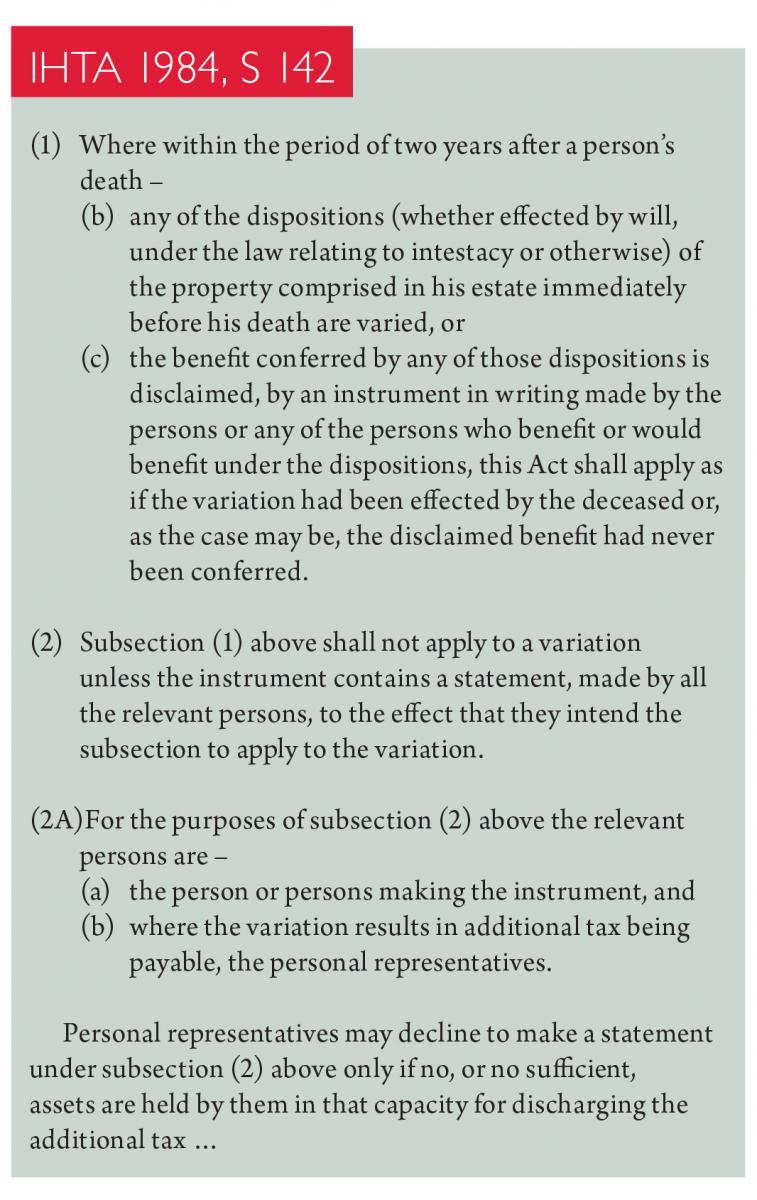

Deed Of Variation Example. To take advantage of the IHT reduced rate of 36 where at least 10 of the deceaseds net estate is left to charity. An example would if the inheritance were to have an effect on income taxes that would need to be paid as a result of inheriting an asset or property. Example 1 The last surviving parent of four children passes away. Potential problems may arise with a variation of intestacy provisions where the make believe drafting is adopted ie.

Law Tax Date 11 Octobvr 2ots Deed Of Var I Ation Of A Lease Law Insider From lawinsider.com

Law Tax Date 11 Octobvr 2ots Deed Of Var I Ation Of A Lease Law Insider From lawinsider.com

My mother recently passed away. This means that for example where the deceaseds estate passing to their widowwidower has significantly increased in value from the time of death a deed of variation can be used to pass the. A clause in the Initial Agreement. 3 Variations not to affect accrued rights and obligations 31 Subject only to the Variations the Agreement shall remain in full force and effect and shall be read and construed and be enforceable as if the terms of this Deed were. The variation must be made within 2. How to make changes.

The deed of variation would in such a case would treat the would-be heir as if they had died before the will or.

Potential problems may arise with a variation of intestacy provisions where the make believe drafting is adopted ie. The deed of variation operates to change who inherits where someone has left a will. DAY OF TWO THOUSAND AND ELEVEN BETWEEN xxxxxxx. An example would if the inheritance were to have an effect on income taxes that would need to be paid as a result of inheriting an asset or property. The reason for a the need for a deed for certain transactions is actually quite simple. Clause 4 of the Initial Agreement is deleted.

Source: pdffiller.com

Source: pdffiller.com

A deed of variation purports to incorporate an entire will rather than simply a redirection of legacies. Here are three possible examples of when a deed of variation may be used. There are several reasons why beneficiaries may wish to vary or redirect an inheritance such as. Hereinafter called the Testator having duly. Deed of variation wording.

Source: whatdotheyknow.com

Source: whatdotheyknow.com

Use this deed where a person has died and has left a will. Of in the County of Surrey. Some examples when a Deed of Variation may be appropriate are the following. Example variation This variation alters the loan conditions. The variation must be made within 2.

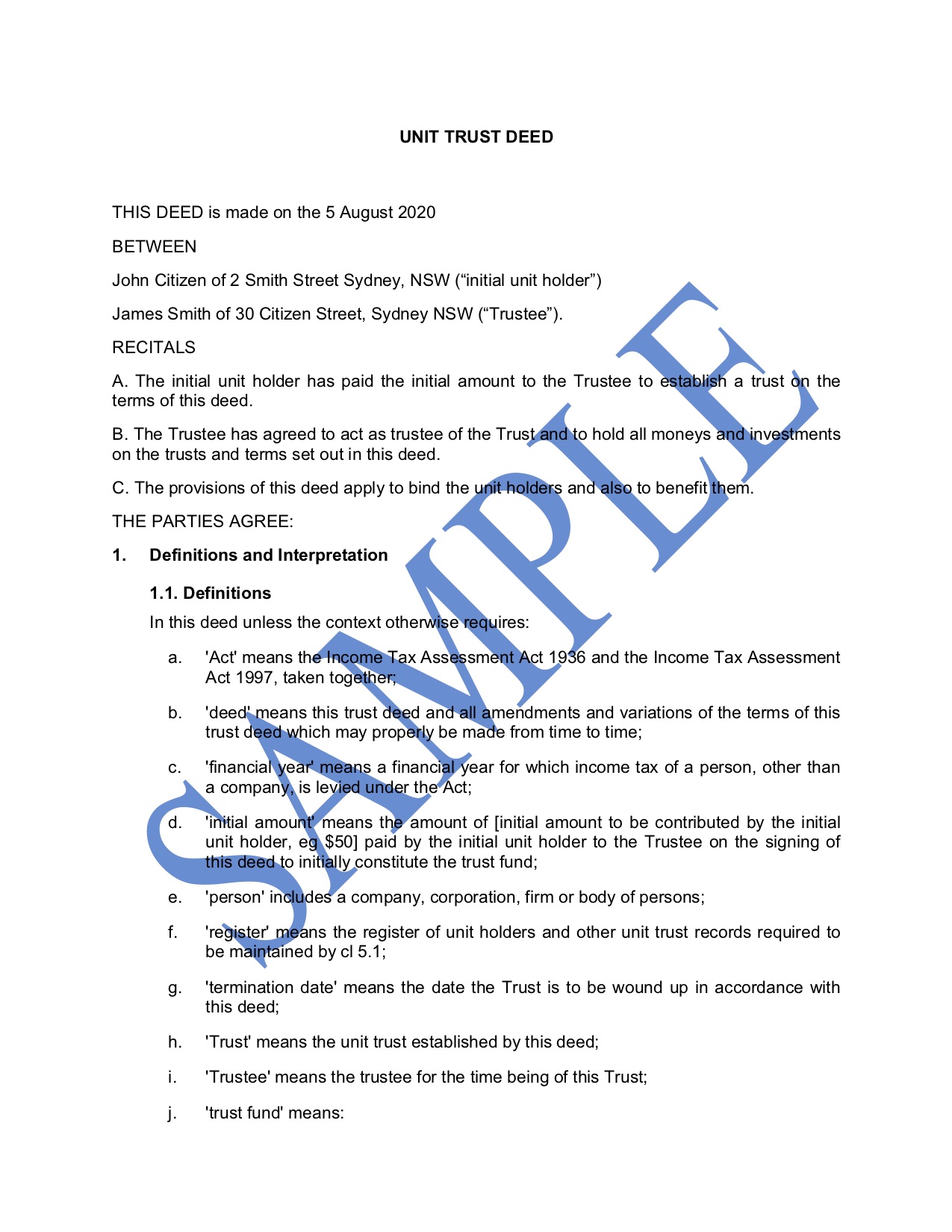

2 The trustee is the trustee of the fund the members are the members of the fund and prior to the date of this deed the fund was governed by the funds current deed. Where beneficiaries under a Will are already wealthy a Deed of Variation allows them to pass on their entitlement to their children or further issue generation skipping. This means that for example where the deceaseds estate passing to their widowwidower has significantly increased in value from the time of death a deed of variation can be used to pass the. THIS DEED OF VARIATION AND FAMILY ARRANGEMENT IS MADE THE. A deed of variation does not avoid tax.

Source: lawpath.com.au

Source: lawpath.com.au

An example of a deed would be the quit claim deed that is often used as a means of formally relinquishing a persons rights or claims over a certain piece of property. There are many strict conditions to be met for a Deed of Variation to be valid. To reduce the amount of Inheritance or Capital. Deeds of Variation can even be used where an asset passes outside of the estate. The variation must be made within 2.

Source: netlawman.ie

Source: netlawman.ie

You would use a different document to vary the entitlements of the beneficiaries of an intestate estate. A clause in the Initial Agreement may be deleted. For example you may want to use a variation to a will to reduce IHT liability by skipping a generation. To take advantage of the IHT reduced rate of 36 where at least 10 of the deceaseds net estate is left to charity. 2 The trustee is the trustee of the fund the members are the members of the fund and prior to the date of this deed the fund was governed by the funds current deed.

Source: lawpath.com.au

Source: lawpath.com.au

As a firm believer in tradition this parent left their entire estate totalling 800000 to the eldest child. A Deed of Variation allows a beneficiary of an estate to change or re-arrange a disposition made by will. 2 The trustee is the trustee of the fund the members are the members of the fund and prior to the date of this deed the fund was governed by the funds current deed. For example you may want to use a variation to a will to reduce IHT liability by skipping a generation. Example 1 The last surviving parent of four children passes away.

Source: legalo.co.uk

Source: legalo.co.uk

3 Variations not to affect accrued rights and obligations 31 Subject only to the Variations the Agreement shall remain in full force and effect and shall be read and construed and be enforceable as if the terms of this Deed were. Donations to charity in a will can also help reduce the amount of IHT which is due. For example where the deceased died without making a will. Bear in mind that you. The variation must be in writing and although HM Revenue Customs suggest a letter would suffice a formal deed is usually prepared.

Source: lawinsider.com

Source: lawinsider.com

A Deed of Variation allows a beneficiary of an estate to change or re-arrange a disposition made by will. There are circumstances in which all of the Beneficiaries would need to agree to a Deed of Variation. For example where the deceased died without making a will. Where a property is held as joint tenants and has passed automatically to the surviving co-owner then the co-owner can choose to vary this effect by carrying out a retrospective severance. A Deed of Variation allows a beneficiary of an estate to change or re-arrange a disposition made by will.

Source: lawinsider.com

Source: lawinsider.com

For example you may want to use a variation to a will to reduce IHT liability by skipping a generation. Potential problems may arise with a variation of intestacy provisions where the make believe drafting is adopted ie. Historically a deed of variation could have been executed which for example could have left a sum to the value of mr frenchs nrb to a discretionary trust for the children and the rest of the estate to his spouse making use of his available nrb this would still mean no iht was due on mr frenchs death but less tax should now be payable on. The reason for a the need for a deed for certain transactions is actually quite simple. This Deed of Variation of Agreement is designed for use in such situations and sets out the agreed changes that are to be made to the contract in question.

Source: yumpu.com

Source: yumpu.com

Same meaning in this Deed. How to make changes. 3 The variation clause in Part N of the funds current deed entitled Variation provides that. Child or grandchild Change the balance of distribution perhaps giving less wealthy beneficiaries a larger share. THIS DEED OF VARIATION AND FAMILY ARRANGEMENT IS MADE THE.

Source: docplayer.net

Source: docplayer.net

The deed of variation operates to change who inherits where someone has left a will. Hereinafter called the Testator having duly. Here are three possible examples of when a deed of variation may be used. A Deed of Variation allows a beneficiary of an estate to change or re-arrange a disposition made by will. What is a deed of variation.

Source: netlawman.co.uk

Source: netlawman.co.uk

A clause in the Initial Agreement may be deleted. An example of a deed would be the quit claim deed that is often used as a means of formally relinquishing a persons rights or claims over a certain piece of property. To reduce the amount of Inheritance or Capital. Potential problems may arise with a variation of intestacy provisions where the make believe drafting is adopted ie. Possibly the borrower has renegotiated the borrowing terms 1.

Source: taxation.co.uk

Source: taxation.co.uk

Use this deed where a person has died and has left a will. There are several reasons why beneficiaries may wish to vary or redirect an inheritance such as. Of in the County of Surrey. A Deed of Variation allows a beneficiary of an estate to change or re-arrange a disposition made by will. In the County of Surrey of the second part.

Source: whatdotheyknow.com

Source: whatdotheyknow.com

This may be due for example to a change in business circumstances or to a renegotiation of the original agreement. Hereinafter called the Testator having duly. THIS DEED OF VARIATION AND FAMILY ARRANGEMENT IS MADE THE. As such the children may wish to divide the entire Estate between the four of them. As a firm believer in tradition this parent left their entire estate totalling 800000 to the eldest child.

Source: lawpath.com.au

Source: lawpath.com.au

Where a property is held as joint tenants and has passed automatically to the surviving co-owner then the co-owner can choose to vary this effect by carrying out a retrospective severance. Same meaning in this Deed. 2 Variation of the Agreement With effect from the Variation Date theAgreement is varied by adopting the Variations. To reduce the amount of Inheritance or Capital. There are several reasons why beneficiaries may wish to vary or redirect an inheritance such as.

For as long as I can remember she told me and my brother she would leave her estate her property and a small amount of savings to myself and my brother to be split 5050. The reason for a the need for a deed for certain transactions is actually quite simple. A clause in the Initial Agreement may be deleted. Possibly the borrower has renegotiated the borrowing terms 1. There are many strict conditions to be met for a Deed of Variation to be valid.

Source: sampledocuments.ru

Source: sampledocuments.ru

My mother recently passed away. To reduce the amount of Inheritance or Capital. 3 Variations to the Initial Agreement ADDITIONAL TERMS This section can be used to add to or vary the Initial Agreement. Historically a deed of variation could have been executed which for example could have left a sum to the value of mr frenchs nrb to a discretionary trust for the children and the rest of the estate to his spouse making use of his available nrb this would still mean no iht was due on mr frenchs death but less tax should now be payable on. As such the children may wish to divide the entire Estate between the four of them.

Reduce or avoid inheritance tax or capital gains tax Provide for someone left out of a will eg. This means that for example where the deceaseds estate passing to their widowwidower has significantly increased in value from the time of death a deed of variation can be used to pass the. WHEN THE VARIATIONS WILL TAKE EFFECT On signing of this Deed. The reason for a the need for a deed for certain transactions is actually quite simple. Example 1 The last surviving parent of four children passes away.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title deed of variation example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.