Your Depreciation journal entry example images are ready in this website. Depreciation journal entry example are a topic that is being searched for and liked by netizens today. You can Get the Depreciation journal entry example files here. Get all royalty-free photos.

If you’re looking for depreciation journal entry example pictures information linked to the depreciation journal entry example keyword, you have pay a visit to the right blog. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Depreciation Journal Entry Example. Depreciation is not charged on land. There are two main accounts created to record the journal entry for the depreciation charge. Alternatively you can divide 10000 by 5 to arrive at 2000. Introduction to Accounting Gain a solid foundation in accounting to ensure you are prepared for future business courses and the real world with WarrenReeveDuchacs market-leading ACCOUNTING 27E.

Depreciation Nonprofit Accounting Basics From nonprofitaccountingbasics.org

Depreciation Nonprofit Accounting Basics From nonprofitaccountingbasics.org

Here Amount Rs Af Nu Rf ර Currency of your country. To Transfer it to the Income Statement. At the end of the tax year we will depreciate one-fifth or 20 of the assets value. Big John the owner estimates that this oven will last about 10 years and probably wont be worth anything after 10 years. To calculate the depreciation by using the straight-line method we simply divide its cost less scrap value by the total number of year as per the formula below. Introduction to Accounting Gain a solid foundation in accounting to ensure you are prepared for future business courses and the real world with WarrenReeveDuchacs market-leading ACCOUNTING 27E.

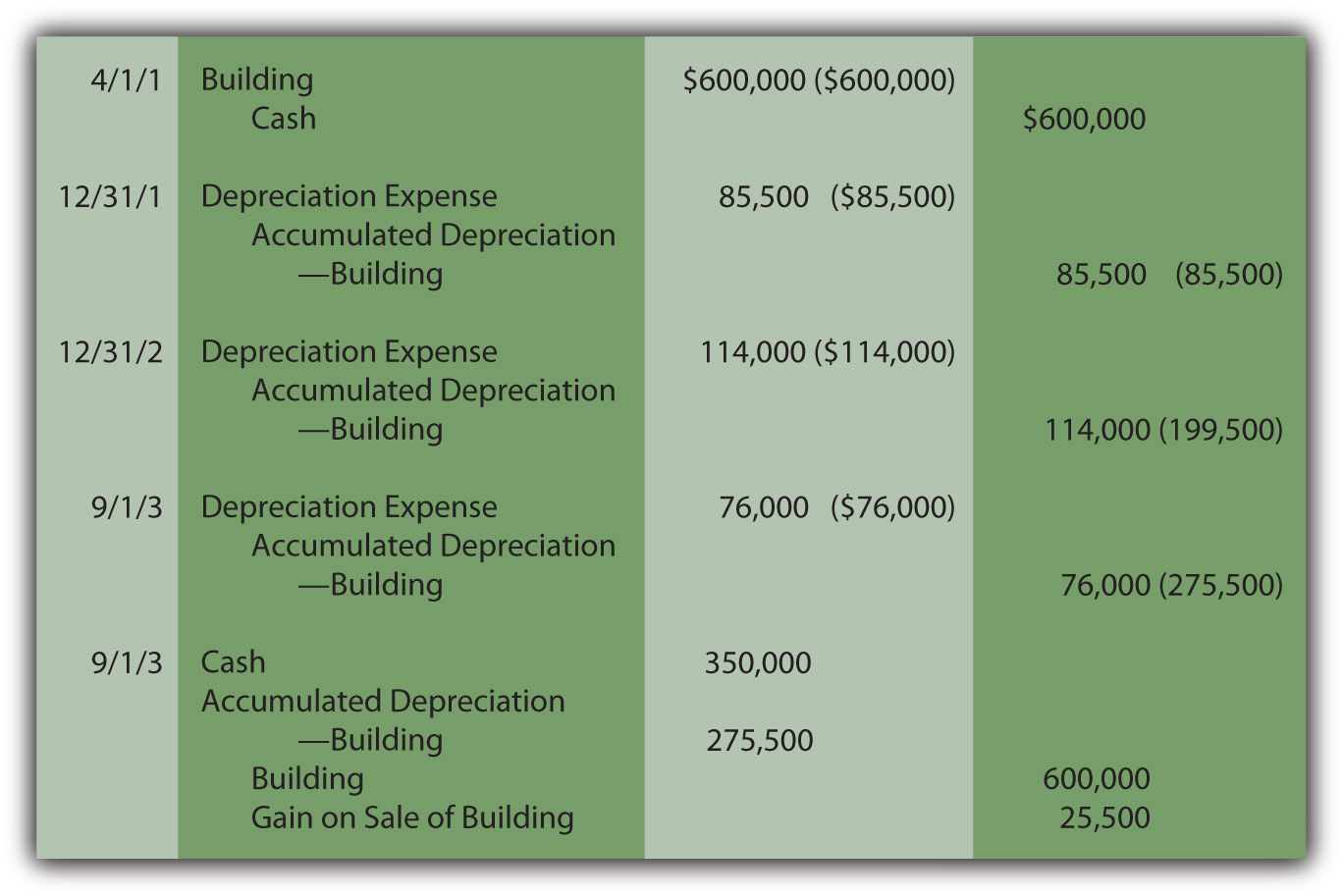

Whole-period depreciation in the period of purchase On 1 July 20X1 Company A purchased a vehicle at a cost of 20000.

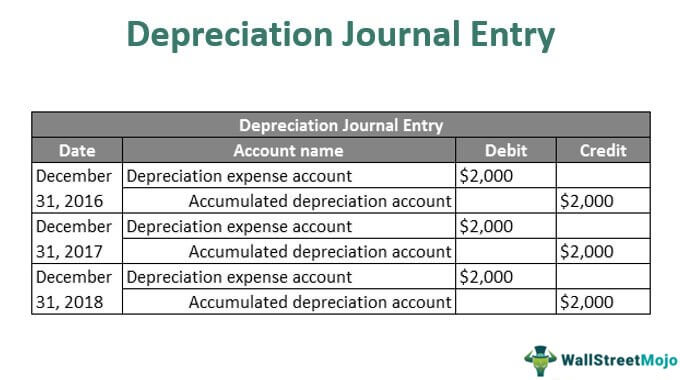

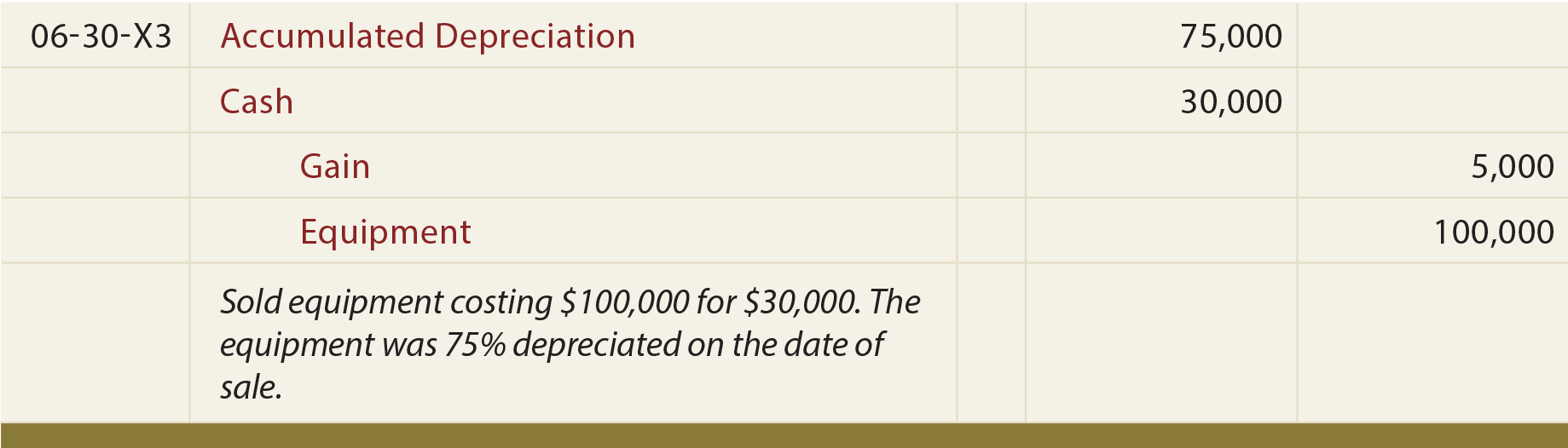

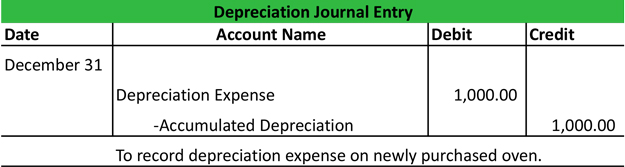

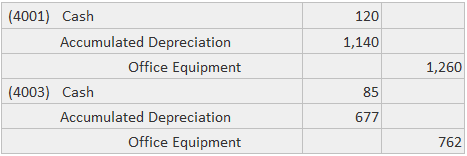

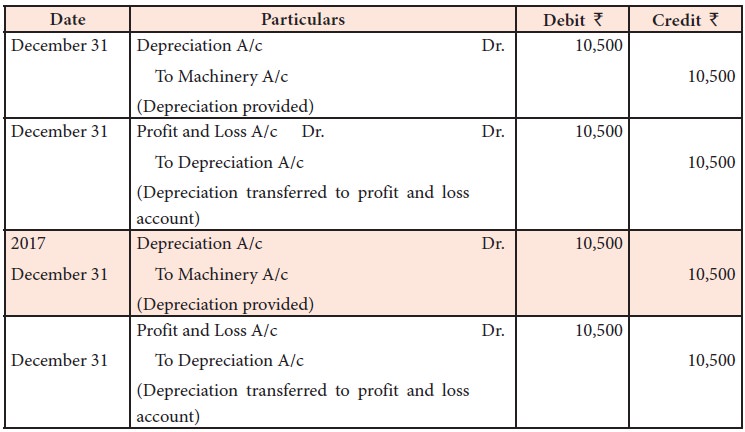

The basic journal entries under this approach are. The journal entry to record retirement credits the group account for the items original cost debits cash for the proceeds and debits accumulated depreciation for the difference. The journal entry will be. The basic journal entry for depreciation is to debit the Depreciation Expense account which appears in the income statement and credit the Accumulated Depreciation account which appears in the balance sheet as a contra account that reduces the amount of fixed assets. The scrape value is around 10000. To record depreciation using the straight-line example above you need to make the following journal entries.

Source: investopedia.com

Source: investopedia.com

First we need to calculate the monthly depreciation expense. The basic journal entry for depreciation is to debit the Depreciation Expense account which appears in the income statement and credit the Accumulated Depreciation account which appears in the balance sheet as a contra account that reduces the amount of fixed assets. The scrape value is around 10000. A company buys a piece of equipment worth 10000 with an expected usage of 5 years. Company ABC purchase a new vehicle that cost 50000 on 01 Jan 202X.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Company ABC purchases a car cost 120000 on 01 Jan 202X. This edition helps you connect. So the amount could be lower or higher based on the decision that the company makes in the revision of. At the end of the second year company decides to sell the car for 50000. There are two main accounts created to record the journal entry for the depreciation charge.

Source: open.lib.umn.edu

Source: open.lib.umn.edu

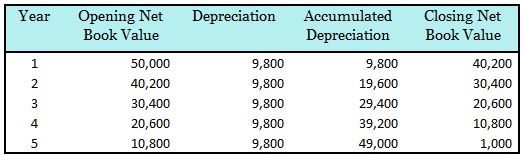

On January 1st we purchase equipment for 10000 and its useful life is 5 years. Management has estimated that the car will be able to use for 3 years without any residual value. At the end of this year Bob will record this accumulated depreciation journal entry. Depreciation Cost Scrap ValueUseful Life From the example the total cost of the machinery is 50000 the scrap value is 1000 and the useful life is 5 years. Introduction to Accounting Gain a solid foundation in accounting to ensure you are prepared for future business courses and the real world with WarrenReeveDuchacs market-leading ACCOUNTING 27E.

Source: youtube.com

Source: youtube.com

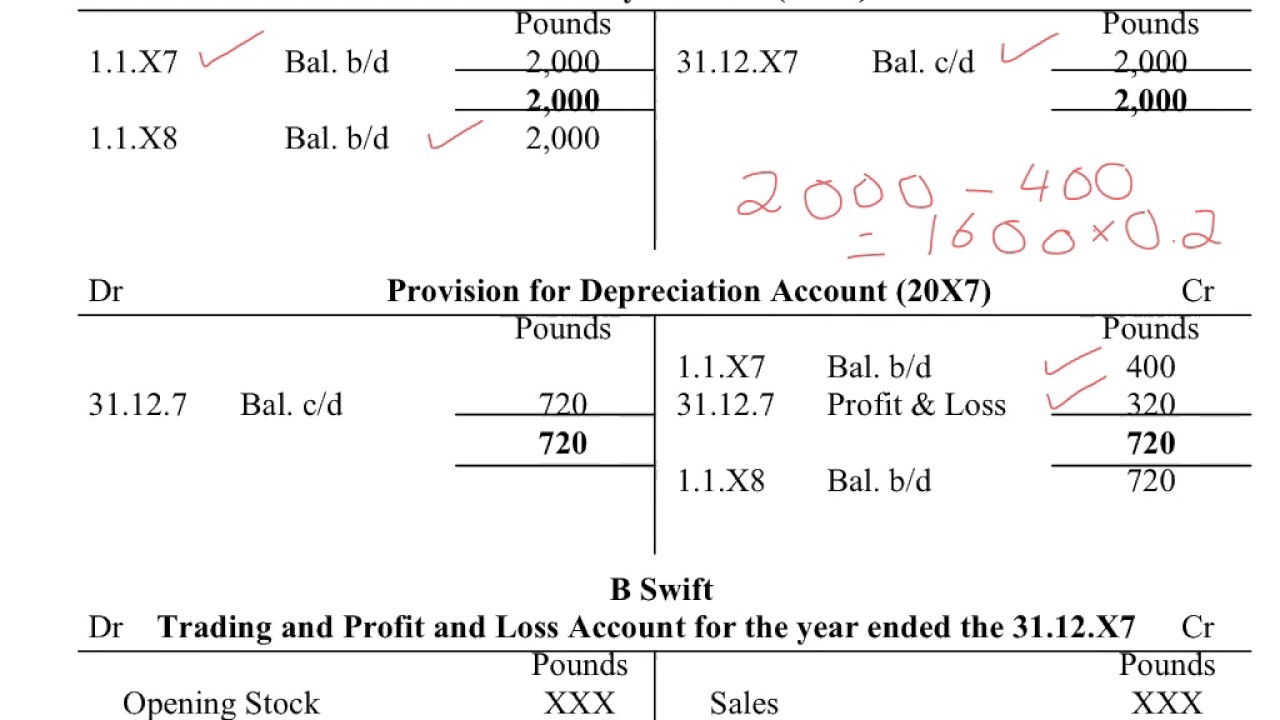

Over time the accumulated depreciation balance will continue to increase as. To calculate the depreciation by using the straight-line method we simply divide its cost less scrap value by the total number of year as per the formula below. Whole-period depreciation in the period of purchase On 1 July 20X1 Company A purchased a vehicle at a cost of 20000. Read Free Depreciation Journal Entry Examples invoices pay bills manage payroll generate reports and determine job costs. On January 1st we purchase equipment for 10000 and its useful life is 5 years.

Source: docs.oracle.com

Source: docs.oracle.com

Example A truck costing 40000 has a useful life of 10 years and a salvage value of 5000 at the end of its useful life. Today we are trying to solve this problem by writing some journal entries examples of depreciation. On January 1st we purchase equipment for 10000 and its useful life is 5 years. This cars useful life is 5 years and Bob expects the salvage value to be zero. At the end of the tax year we will depreciate one-fifth or 20 of the assets value.

Source: accountinghub-online.com

Source: accountinghub-online.com

Introduction to Accounting Gain a solid foundation in accounting to ensure you are prepared for future business courses and the real world with WarrenReeveDuchacs market-leading ACCOUNTING 27E. Big John the owner estimates that this oven will last about 10 years and probably wont be worth anything after 10 years. Depreciation Cost Scrap ValueUseful Life From the example the total cost of the machinery is 50000 the scrap value is 1000 and the useful life is 5 years. Recording of the depreciation cost in the account books begins with an estimation of the depreciation cost. Also calculate the net carrying value of the asset at the end of 7th year.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Whole-period depreciation in the period of purchase On 1 July 20X1 Company A purchased a vehicle at a cost of 20000. Using accounting software If youre lucky enough to use an accounting software. At the end of this year Bob will record this accumulated depreciation journal entry. Lets look at an example of depreciation using the simple Straight-line method of depreciation. Plant and machinery land and building furniture and fitting vehicles equipment.

Source: dkgoelsolutions.com

Source: dkgoelsolutions.com

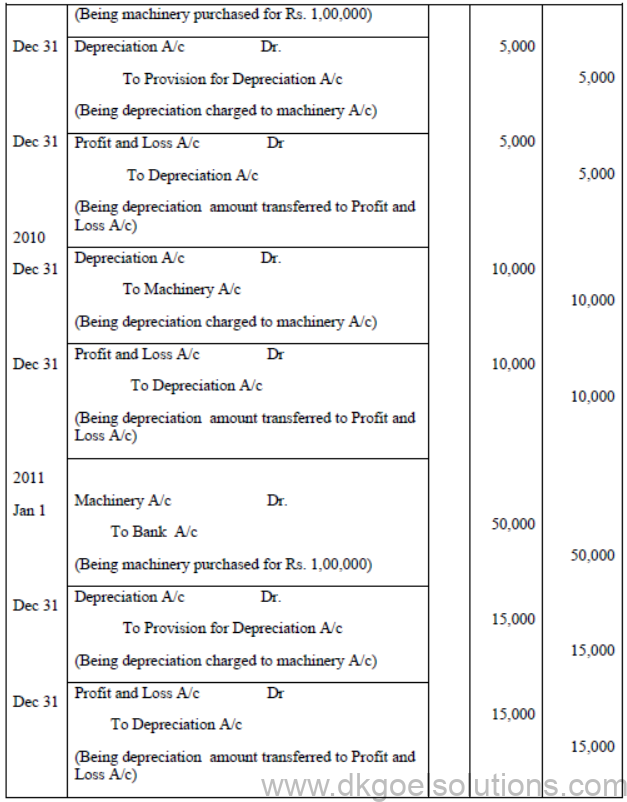

Journal Entry In the book of Keep in Mind KIM Depreciation is non-cash expenses. All these journal entries have been passed on the basis of double entry system. Please prepare journal entries related to accumulated depreciation. Journal Entry In the book of Keep in Mind KIM Depreciation is non-cash expenses. Its short form is Depn Some fixed assets are.

Source: youtube.com

Source: youtube.com

Please prepare journal entries related to accumulated depreciation. To record depreciation using the straight-line example above you need to make the following journal entries. Depreciation Journal Entry Example Big Johns Pizza LLC bought a new pizza oven at the beginning of this year for 10000. All these journal entries have been passed on the basis of double entry system. Please prepare the straight-line depreciation journal entry.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

There are two main accounts created to record the journal entry for the depreciation charge. Read Free Depreciation Journal Entry Examples invoices pay bills manage payroll generate reports and determine job costs. To Transfer Depreciation into PL After the assets useful life when all depreciation is charged throughout the years the asset approaches it scrap or residual value. This is due to the revised depreciation only apply to the current period onward and the previous depreciation journal entry will not be revised. So the amount could be lower or higher based on the decision that the company makes in the revision of.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

This is due to the revised depreciation only apply to the current period onward and the previous depreciation journal entry will not be revised. So the amount could be lower or higher based on the decision that the company makes in the revision of. Introduction to Accounting Gain a solid foundation in accounting to ensure you are prepared for future business courses and the real world with WarrenReeveDuchacs market-leading ACCOUNTING 27E. To Transfer Depreciation into PL After the assets useful life when all depreciation is charged throughout the years the asset approaches it scrap or residual value. Also calculate the net carrying value of the asset at the end of 7th year.

Source: personal-accounting.org

Source: personal-accounting.org

Straight-line depreciation can also be calculated using Microsoft Excel SLN function. Its short form is Depn Some fixed assets are. The car is depreciated at a rate of 1000 a year. The basic journal entry for depreciation is to debit the Depreciation Expense account which appears in the income statement and credit the Accumulated Depreciation account which appears in the balance sheet as a contra account that reduces the amount of fixed assets. Please prepare journal entries related to accumulated depreciation.

Source: nonprofitaccountingbasics.org

Source: nonprofitaccountingbasics.org

Using accounting software If youre lucky enough to use an accounting software. Please prepare journal entries related to accumulated depreciation. Also calculate the net carrying value of the asset at the end of 7th year. 10000 and depreciation rate is 10. Plant and machinery land and building furniture and fitting vehicles equipment.

Source: brainkart.com

Source: brainkart.com

Journal Entry for Depreciation with Examples. Here Amount Rs Af Nu Rf ර Currency of your country. Depreciation journal Entry-Example-Depreciation journal Entry when depreciation is charged to asset account-2Depreciation journal Entry when Depreciation is credited to Provision for depreciation AccountAccumulated Depreciation Account. Please prepare journal entries related to accumulated depreciation. Please prepare the straight-line depreciation journal entry.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Alternatively you can divide 10000 by 5 to arrive at 2000. The owner of the company estimates that the useful life of this oven is about ten. All these journal entries have been passed on the basis of double entry system. Lets look at an example of depreciation using the simple Straight-line method of depreciation. At the end of the tax year we will depreciate one-fifth or 20 of the assets value.

Source: nonprofitaccountingbasics.org

Source: nonprofitaccountingbasics.org

The lessee makes the following entry in Year 1 to recognize the 100000 payment and annual depreciation of 84353. 10000 x 2 2000. This will also be recorded as accumulated depreciation on the balance sheet. Alternatively you can divide 10000 by 5 to arrive at 2000. Then the enterprise is likely to depreciate it under the depreciation expense of 2000 every year over the 5 years of its use.

Source: docs.oracle.com

Source: docs.oracle.com

The company expects the vehicle to be equally useful for 4 years after which it can be sold for 5000. Lets look at an example of depreciation using the simple Straight-line method of depreciation. Journal Entry for Depreciation with Examples. On January 1st we purchase equipment for 10000 and its useful life is 5 years. So the amount could be lower or higher based on the decision that the company makes in the revision of.

Source: accountingcoach.com

Source: accountingcoach.com

Recording of the depreciation cost in the account books begins with an estimation of the depreciation cost. At the end of this year Bob will record this accumulated depreciation journal entry. Depreciation Cost Scrap ValueUseful Life From the example the total cost of the machinery is 50000 the scrap value is 1000 and the useful life is 5 years. The lessee makes the following entry in Year 1 to recognize the 100000 payment and annual depreciation of 84353. Based on the experience company will depreciate it using a straight line with a useful life of 4 years.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title depreciation journal entry example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.