Your Equipment breakdown coverage examples images are ready in this website. Equipment breakdown coverage examples are a topic that is being searched for and liked by netizens today. You can Get the Equipment breakdown coverage examples files here. Get all free photos.

If you’re looking for equipment breakdown coverage examples pictures information connected with to the equipment breakdown coverage examples interest, you have come to the ideal blog. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Equipment Breakdown Coverage Examples. Chubb offers comprehensive equipment breakdown coverage on both a monoline and package basis. Equipment Breakdown coverage can be obtained through. The property or Bis-Pak coverage you have is expanded to include loss due to equipment breakdown and your business income coverage is extended to include breakdown losses. Home warranties can cost 50 or.

Equipment Breakdown Coverage Heritage Property Casualty Company From heritagepci.com

Equipment Breakdown Coverage Heritage Property Casualty Company From heritagepci.com

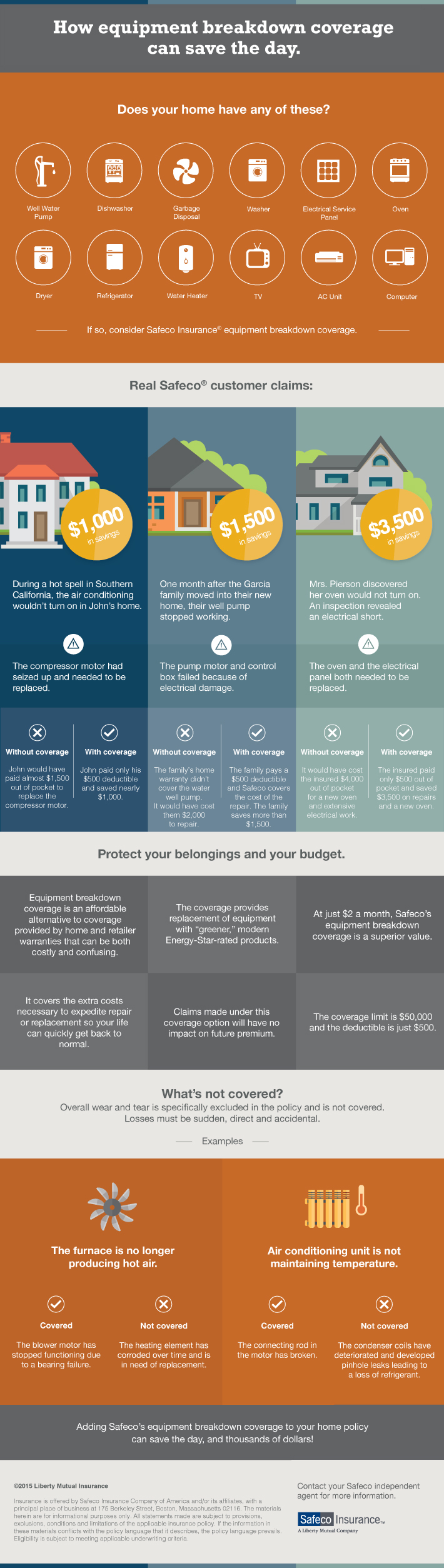

Examples are shown for illustrative purposes only and do not represent predicted or expected outcomes. Examining some examples of losses that occur offers insight into why equipment breakdown insurance is important coverage for todays equipment-intensive. Other expenses incurred to limit the loss or. While Equipment Breakdown is not intended to cover wear and tear issues that occur on older equipment over time it can provide coverage for out of the blue sudden and accidental breakdown. For example any business that uses electricity may have a need for this coverage. Equipment breakdown coverage protects most equipment and built-in systems in your home including your HVAC water heater and personal computers.

Equipment Breakdown Coverage is insurance that pays the cost to repair or replace equipment or machinery that breaks down suddenly and accidentally.

Equipment is exposed to unique risks that other property is not. TV computer stereo air conditioner furnace water heater swimming pool equipment appliances and other electrical home systems. An insurance carrier that understands equipment breakdowns can help keep your business operating. It does not pay for normal wear and tear. Equipment is exposed to unique risks that other property is not. Equipment Breakdown coverage can be obtained through.

Source: securityfirstflorida.com

Source: securityfirstflorida.com

Electrical short circuits mechanical forces overload control failures are just a few of the causes of equipment breakdowns. A sudden surge from the local power plant damages multiple appliances. For example any business that uses electricity may have a need for this coverage. It does not pay for normal wear and tear. Equipment breakdown insurance is a named perils policy as the perils insured are specified to dovetail with certain coverage exclusions in property policies.

Source: paisabazaar.com

Source: paisabazaar.com

They pay the cost of repairing or replacing major appliances or equipment. Acuitys equipment breakdown coverage endorsement attaches to a property or Bis-Pak policy. Equipment is exposed to unique risks that other property is not. The most we pay for any one dwelling. While Equipment Breakdown is not intended to cover wear and tear issues that occur on older equipment over time it can provide coverage for out of the blue sudden and accidental breakdown.

Source: thig.com

Source: thig.com

The motor inside your commercial refrigerator burns out and needs to be repaired. Chubb offers comprehensive equipment breakdown coverage on both a monoline and package basis. Having equipment breakdown coverage with your homeowners insurance is smart. Every business likely has exposure. The cost to repair the motor burnoutincluding laboras well as food spoilage and product loss is covered with equipment breakdown insurance.

Source: thig.com

Source: thig.com

Equipment Breakdown Coverage Examples. Also included are 5 additional coverages including extra costs to make. The cost to repair the motor burnoutincluding laboras well as food spoilage and product loss is covered with equipment breakdown insurance. Electrical short circuits mechanical forces overload control failures are just a few of the causes of equipment breakdowns. Its a key add-on coverage that protects against mechanical failure or electrical breakdown.

Source: thig.com

Source: thig.com

Equipment breakdown coverage is a homeowners insurance policy endorsement that covers electrical and mechanical breakdown. Primary causes of loss include power surges short circuits and mechanical breakdown. Furthermore Equipment Breakdown insurance provides protection from the costs associated with insured losses to a business equipment such as. An example would be where rust and corrosion led to the demise of a gas fired heating blower. What Equipment Breakdown coverage is not is a maintenance policy.

Source: paisabazaar.com

Source: paisabazaar.com

The property or Bis-Pak coverage you have is expanded to include loss due to equipment breakdown and your business income coverage is extended to include breakdown losses. Rust and corrosion are specifically excluded from coverage in the policy. Furthermore Equipment Breakdown insurance provides protection from the costs associated with insured losses to a business equipment such as. Do I really need Equipment Breakdown coverage. Equipment breakdown coverage protects most equipment and built-in systems in your home including your HVAC water heater and personal computers.

Source: securityfirstflorida.com

Source: securityfirstflorida.com

Rust and corrosion are specifically excluded from coverage in the policy. Chubb offers comprehensive equipment breakdown coverage on both a monoline and package basis. It provides additional protection for common home appliances furnaces and HVAC systems in case of electrical or mechanical breakdown. Equipment Breakdown Coverage a. Equipment breakdown coverage is a homeowners insurance policy endorsement that covers electrical and mechanical breakdown.

Source: munichre.com

Source: munichre.com

Acuitys equipment breakdown coverage endorsement attaches to a property or Bis-Pak policy. Acuitys equipment breakdown coverage endorsement attaches to a property or Bis-Pak policy. Examining some examples of losses that occur offers insight into why equipment breakdown insurance is important coverage for todays equipment-intensive. An example would be where rust and corrosion led to the demise of a gas fired heating blower. These are all examples of seemingly small problems that can lead to huge losses.

Source: thig.com

Source: thig.com

Unlike Equipment Breakdown insurance home warranties usually pay even for wear tear. Property that breaks down due to normal wear and tear typically isnt. Furthermore Equipment Breakdown insurance provides protection from the costs associated with insured losses to a business equipment such as. It provides additional protection for common home appliances furnaces and HVAC systems in case of electrical or mechanical breakdown. Equipment breakdown coverage includes just about everything that uses energy.

Home warranties can cost 50 or. Electrical short circuits mechanical forces overload control failures are just a few of the causes of equipment breakdowns. Equipment is exposed to unique risks that other property is not. Having equipment breakdown coverage with your homeowners insurance is smart. This Equipment Breakdown Coverage provides insurance for a Covered Cause of Loss as defined in A1.

Source: irmi.com

Source: irmi.com

Equipment breakdown coverage is a form of property insurance and is based on the happening of an accident from which the perils insured are identified. Electrical short circuits mechanical forces overload control failures are just a few of the causes of equipment breakdowns. They pay the cost of repairing or replacing major appliances or equipment. What Equipment Breakdown coverage is not is a maintenance policy. These are all examples of seemingly small problems that can lead to huge losses.

Source: thig.com

Source: thig.com

Equipment is exposed to unique risks that other property is not. While Equipment Breakdown is not intended to cover wear and tear issues that occur on older equipment over time it can provide coverage for out of the blue sudden and accidental breakdown. The cost to repair the motor burnoutincluding laboras well as food spoilage and product loss is covered with equipment breakdown insurance. Equipment is exposed to unique risks that other property is not. Thats why home warranty coverage is much more expensive than equipment breakdown coverage.

Source: munichre.com

Source: munichre.com

It provides additional protection for common home appliances furnaces and HVAC systems in case of electrical or mechanical breakdown. Equipment breakdown insurance comes in handy in these scenarios. Equipment Breakdown Coverage a. Equipment Breakdown coverage can be obtained through. Rust and corrosion are specifically excluded from coverage in the policy.

Source: munichre.com

Source: munichre.com

It provides additional protection for common home appliances furnaces and HVAC systems in case of electrical or mechanical breakdown. The unit had not been serviced in 10 years and thus no one knew that the unit was rusting away. For example if the above refrigerator continues to run and its motor burns out then it would be covered. An example would be where rust and corrosion led to the demise of a gas fired heating blower. For example any business that uses electricity may have a need for this coverage.

Source: munichre.com

Source: munichre.com

These are all examples of seemingly small problems that can lead to huge losses. The Equipment Breakdown policy covers damage to insured equipment and resulting loss of revenue Business Income while the equipment is being repaired or replaced. Its a key add-on coverage that protects against mechanical failure or electrical breakdown. Furthermore Equipment Breakdown insurance provides protection from the costs associated with insured losses to a business equipment such as. Equipment breakdown insurance is a named perils policy as the perils insured are specified to dovetail with certain coverage exclusions in property policies.

Source: munichre.com

Source: munichre.com

Property that breaks down due to normal wear and tear typically isnt. Having equipment breakdown coverage with your homeowners insurance is smart. The unit had not been serviced in 10 years and thus no one knew that the unit was rusting away. Equipment breakdown often costs less than 50 a year. Rust and corrosion are specifically excluded from coverage in the policy.

Source: investopedia.com

Source: investopedia.com

The cost to repair the motor burnoutincluding laboras well as food spoilage and product loss is covered with equipment breakdown insurance. The property or Bis-Pak coverage you have is expanded to include loss due to equipment breakdown and your business income coverage is extended to include breakdown losses. The unit had not been serviced in 10 years and thus no one knew that the unit was rusting away. What Equipment Breakdown coverage is not is a maintenance policy. Electrical short circuits mechanical forces overload control failures are just a few of the causes of equipment breakdowns.

Source: ekagency.com

Source: ekagency.com

Equipment breakdown coverage is a form of property insurance and is based on the happening of an accident from which the perils insured are identified. Equipment Breakdown Coverage is insurance that pays the cost to repair or replace equipment or machinery that breaks down suddenly and accidentally. Examining some examples of losses that occur offers insight into why equipment breakdown insurance is important coverage for todays equipment-intensive. Chubb offers comprehensive equipment breakdown coverage on both a monoline and package basis. Equipment breakdown coverage protects most equipment and built-in systems in your home including your HVAC water heater and personal computers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title equipment breakdown coverage examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.