Your First home super saver scheme example images are available. First home super saver scheme example are a topic that is being searched for and liked by netizens now. You can Find and Download the First home super saver scheme example files here. Find and Download all free photos and vectors.

If you’re looking for first home super saver scheme example images information linked to the first home super saver scheme example topic, you have come to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

First Home Super Saver Scheme Example. The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. You want to put 10000 of that salary pre-tax towards your home deposit. What is the First Home Super Saver FHSS Scheme. The government is proposing to boost the First Home Super Saver scheme for first home buyers.

First Home Super Saver Scheme Fhsss The Only Guide You Need From etax.com.au

First Home Super Saver Scheme Fhsss The Only Guide You Need From etax.com.au

The Australian Governments First Home Super Saver FHSS scheme helps Australians save for their first home. Under the scheme you could withdraw up to 30000 from super to help purchase. Under this scheme first home savers can. 2 Fact Sheet Understanding the First Home Super Saver Scheme continued Example Monica is saving towards a deposit and wants to buy a new home in 2 years time. What is the First Home Super Saver FHSS Scheme. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality.

These initiatives target first home buyers attempting to enter the housing market and retirees.

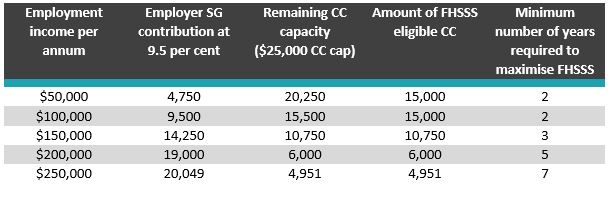

If eligible the First Home Super Saver Scheme allows you to make extra voluntary contributions of up to 30000 maximum of 15000 per. The scheme lets you make voluntary contributions to your super which you then can withdraw to buy a house. The Federal Government has introduced the FHSSS to help Australians buy their first home. The government is proposing to boost the First Home Super Saver scheme for first home buyers. First Home Super Saver Scheme FHSSS. The first home super saver scheme FHSS enables first-time home-buyers to save for a deposit in super.

The Australian Governments First Home Super Saver FHSS scheme helps Australians save for their first home. The FHSS Scheme allows you to boost your. First Home Super Saver Scheme FHSSS. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve. If you pay tax on that as normal and then.

Source: aware.com.au

Source: aware.com.au

This is achieved through allowing voluntary contributions to be made to superannuation. How it works To use the FHSS scheme you need to make voluntary super. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve. First Home Super Saver Scheme also known as FHSSS is a government scheme made to assist you with speeding up the time it takes to save and buy your first home. First Home Super Saver Scheme FHSSS.

Source: cbussuper.com.au

Source: cbussuper.com.au

The First Home Super Saver Scheme FHSSS was first introduced in the 2017-18 Federal Budget by then-Treasurer Scott Morrison. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. The First Home Super Saver FHSS Scheme allows first home buyers to make contributions to their super then withdraw those contributions for a deposit to buy or build a home to live in. The Federal Government has introduced the FHSSS to help Australians buy their first home. First Home Super Saver Scheme Example.

Source: northbrisbanehomeloans.com.au

Source: northbrisbanehomeloans.com.au

First Home Super Saver Scheme explained. If you pay tax on that as normal and then. What is the First Home Super Saver FHSS Scheme. Under this scheme first home savers can. The FHSS scheme allows you to make voluntary.

Source: smsfwarehouse.com.au

Source: smsfwarehouse.com.au

Under this scheme first home savers can. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. Say you are earning 60000. Saver Scheme The First Home Super Saver Scheme FHSSS helps Australians boost their savings for a first home by allowing them to build a deposit inside superannuation giving them. If you pay tax on that as normal and then.

Source: mozo.com.au

Source: mozo.com.au

The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability. The first home super saver scheme FHSS enables first-time home-buyers to save for a deposit in super. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve. You want to put 10000 of that salary pre-tax towards your home deposit.

![]() Source: mlc.com.au

Source: mlc.com.au

Under the scheme you could withdraw up to 30000 from super to help purchase. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve. First Home Super Saver Scheme Example. Under the scheme you can make eligible voluntary. The FHSS Scheme is designed to let first home buyers save a deposit faster by making additional contributions into their super in order.

Source: taxstore.com.au

Source: taxstore.com.au

First Home Super Saver Scheme Example. This is achieved through allowing voluntary contributions to be made to superannuation. Crucially you can use. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. The First Home Super Saver Scheme FHSSS was first introduced in the 2017-18 Federal Budget by then-Treasurer Scott Morrison.

Source: mozo.com.au

Source: mozo.com.au

First Home Super Saver Scheme Example. The FHSS Scheme is designed to let first home buyers save a deposit faster by making additional contributions into their super in order. From 1 July 2017 you. The Federal Government has introduced the FHSSS to help Australians buy their first home. Under the scheme you can make eligible voluntary.

Source: finpeak.com.au

Source: finpeak.com.au

These are known as the First Home Super Saver Scheme FHSSS and downsizer contributions. The First Home Super Saver FHSS Scheme allows first home buyers to make contributions to their super then withdraw those contributions for a deposit to buy or build a home to live in. From 1 July 2017 you. Ad With Our 3 Down Payment Option Buying A New Home Could Be A Reality. The power of the First Home Super Saver scheme.

Additionally the scheme applies a deemed earning rate to your contribution and this rate may be higher than other forms of investment for example interest on a cash savings account. The First Home Super Saver FHSS scheme is aimed at assisting you to purchase your first home. Get ready while I perform a feat of magic. First Home Super Saver Scheme also known as FHSSS is a government scheme made to assist you with speeding up the time it takes to save and buy your first home. The FHSS Scheme is designed to let first home buyers save a deposit faster by making additional contributions into their super in order.

Source: vicsuper.com.au

Source: vicsuper.com.au

To help reduce some of this strain the Australian Government introduced the First Home Super Saver FHSS Scheme in the 2017 Federal Budget. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve. The first home super saver scheme FHSS enables first-time home-buyers to save for a deposit in super. Additionally the scheme applies a deemed earning rate to your contribution and this rate may be higher than other forms of investment for example interest on a cash savings account. The FHSS Scheme allows you to boost your.

Source: etax.com.au

Source: etax.com.au

From 1 July 2017 you. So what is the. Say you are earning 60000. The FHSS scheme allows you to make voluntary. The current scheme allows you to withdraw up to 30000 of the voluntary contributions youve.

The First Home Super Saver FHSS scheme is aimed at assisting you to purchase your first home. The FHSS scheme allows you to make voluntary. Under the scheme you can make eligible voluntary. The FHSS Scheme allows you to boost your. The first home super saver FHSS scheme was introduced by the Australian Government in the Federal Budget 201718 to reduce pressure on housing affordability.

Source: huntergalloway.com.au

Source: huntergalloway.com.au

First Home Super Saver Scheme also known as FHSSS is a government scheme made to assist you with speeding up the time it takes to save and buy your first home. To help more first home buyers get into the property market the Government has introduced a First Home Super Saver FHSS scheme. The First Home Super Saver FHSS Scheme allows first home buyers to make contributions to their super then withdraw those contributions for a deposit to buy or build a home to live in. The First Home Super Saver FHSS scheme is aimed at assisting you to purchase your first home. Say you are earning 60000.

Source: skilledsmart.com.au

Source: skilledsmart.com.au

To help reduce some of this strain the Australian Government introduced the First Home Super Saver FHSS Scheme in the 2017 Federal Budget. Say you are earning 60000. To help reduce some of this strain the Australian Government introduced the First Home Super Saver FHSS Scheme in the 2017 Federal Budget. What is the First Home Super Saver FHSS Scheme. So what is the.

Source: fhba.com.au

Source: fhba.com.au

Under this scheme first home savers can. Get ready while I perform a feat of magic. The Australian Governments First Home Super Saver FHSS scheme helps Australians save for their first home. From 1 July 2017 you. The government is proposing to boost the First Home Super Saver scheme for first home buyers.

Source: huntergalloway.com.au

Source: huntergalloway.com.au

This is achieved through allowing voluntary contributions to be made to superannuation. The first home super saver scheme FHSS enables first-time home-buyers to save for a deposit in super. The Federal Government has introduced the FHSSS to help Australians buy their first home. So what is the. Under the scheme you can make eligible voluntary.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first home super saver scheme example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.