Your Frs 105 example accounts images are ready in this website. Frs 105 example accounts are a topic that is being searched for and liked by netizens today. You can Get the Frs 105 example accounts files here. Get all free photos and vectors.

If you’re searching for frs 105 example accounts pictures information linked to the frs 105 example accounts topic, you have visit the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Frs 105 Example Accounts. The financial statements of Smith Limited for the year ended 31 March 2019 contained certain types of expenditure which were believed to be allowable for corporation tax purposes and hence tax relief was claimed in the corporation tax computation for the year then ended. Other comments It is recommended that the first actual FRS 102 accounts are prepared using proprietary model accounts and accounts disclosure checklists. The examples and checklists cover a broad range of entities including small companies charities groups LLPs and micro-companies. 1 FRS 102 and FRS 105 Example small and micro company accounts Presented by John Selwood.

The accounts will be available mid-September and are free to members. Accounts prepared under FRS 105 are also required to present a balance sheet or statement of financial position. It introduced the concept of the Micro Companies Regime which is contained in Section 280D-280E of the Companies Act 2014. The full accounts have a different format to the information filed at Companies House. Are there any restructuring plans. Other comments It is recommended that the first actual FRS 102 accounts are prepared using proprietary model accounts and accounts disclosure checklists.

FRS 105 example accounts 34.

Cross-references to paragraphs are identified by section followed by paragraph number. Ii FRS 105 The Financial Reporting Standard applicable to the Micro-entities Regime is an accounting standard designed to apply to the financial statements of companies LLPs and qualifying partnerships that qualify for and choose to apply the micro-entities regime. Other comments It is recommended that the first actual FRS 102 accounts are prepared using proprietary model accounts and accounts disclosure checklists. All the options above with the exception of EU-adopted IFRSs are Companies Act and UK GAAP accounts. The Irish Accounting Tax Summit Virtual is a fully interactive live virtual event bringing Irelands top CPD speakers directly to your laptop tablet or device. Deferred tax will need to be reversed in the comparatives the following year.

Source: in.pinterest.com

Source: in.pinterest.com

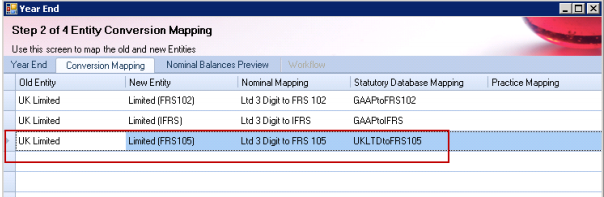

FRS 105 sets of accounts. 35 FRS 105 example accounts Deemed TF view No Directors report Can be filleted Does not prevent accountants from providing high quality accounts to management. This means that development costs cant be capitalised and are taken directly to the PL FRS 105135 and government grants must be accounted for using the accruals method only. R-B8 á November 2017 WWWRELATE-SOFTWARECOM SALESRELATE-SOFTWARECOM 353 1 4597800 Relate Accounts Production FRS 105 Sample Accounts. This is a set of example micro-entity financial statements prepared under FRS 105 early adopted Only the balance sheet with integrated notes is required to be filed at.

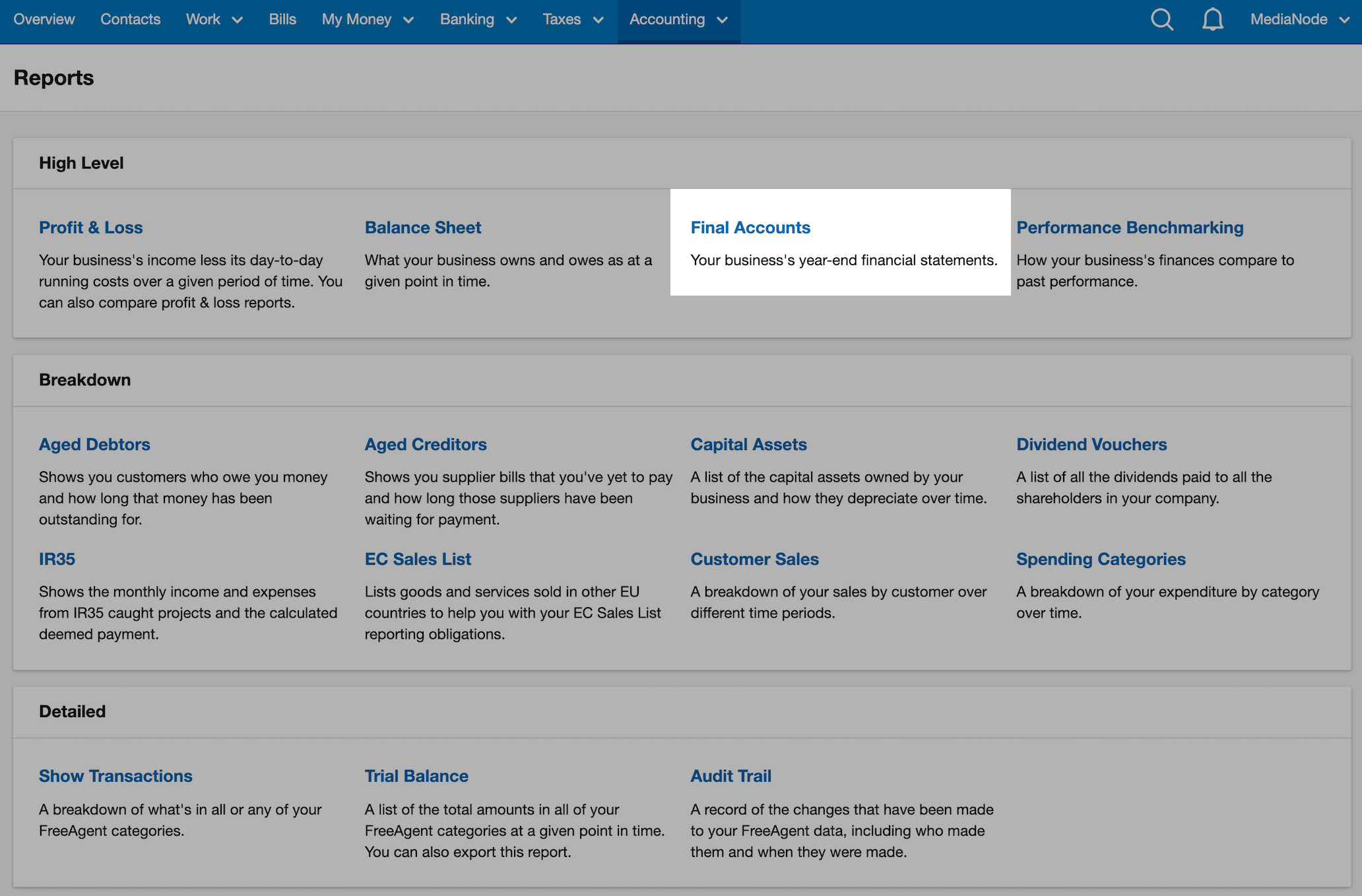

This means that no revaluations or subsequent measurement at fair value is permitted under the micro-entities regime. 15 FRS 105 6B3 A micro entity shall disclose in the notes to its financial statements the accounting policies adopted by the micro-entity in determining the items and amounts in its statement of financial position and its income statement. With Sage Final Accounts you can prepare final accounts for your clients using just your Internet browser. John revisits some things to watch out for when compiling a set of FRS 105 accounts and the main differences from FRS 102. It reduces the content of a set of accounts simplifies the format of those accounts and removes complexity and unnecessary choice from the accounting framework.

Source: help.iris.co.uk

Source: help.iris.co.uk

Deferred tax will need to be reversed in the comparatives the following year. All the options above with the exception of EU-adopted IFRSs are Companies Act and UK GAAP accounts. FRS 105 sections 9-17 The accounting policy options available under FRS 102 are not available under FRS 105. The financial statements of Smith Limited for the year ended 31 March 2019 contained certain types of expenditure which were believed to be allowable for corporation tax purposes and hence tax relief was claimed in the corporation tax computation for the year then ended. Accounts prepared under FRS 105 are also required to present a balance sheet or statement of financial position.

Source: help.iris.co.uk

Source: help.iris.co.uk

FRS 102 for small entities and FRS 105 using the following font like this. The ICAEW Library can provide model accounts and disclosure checklists for FRS 101 FRS 102 FRS 102 Section 1A and FRS 105. The financial statements of Smith Limited for the year ended 31 March 2019 contained certain types of expenditure which were believed to be allowable for corporation tax purposes and hence tax relief was claimed in the corporation tax computation for the year then ended. FRS 105 is designed to replace the FRSSE and provide that simplification. Organisation of FRS 105 xi FRS 105 is organised by topic with each topic presented in a separate numbered section.

Source: help.iris.co.uk

Source: help.iris.co.uk

The original accounting formats are prepared under FRSSE 2008 and are for the year ended 31. Cross-references to paragraphs are identified by section followed by paragraph number. FRS 105 sets of accounts. The Irish Accounting Tax Summit Virtual is a fully interactive live virtual event bringing Irelands top CPD speakers directly to your laptop tablet or device. The financial statements of Smith Limited for the year ended 31 March 2019 contained certain types of expenditure which were believed to be allowable for corporation tax purposes and hence tax relief was claimed in the corporation tax computation for the year then ended.

Source: support.freeagent.com

Source: support.freeagent.com

15 FRS 105 6B3 A micro entity shall disclose in the notes to its financial statements the accounting policies adopted by the micro-entity in determining the items and amounts in its statement of financial position and its income statement. Note that a provision for future operating losses is not permitted FRS 1051614. Model FRS 102 accounts. The financial statements of Smith Limited for the year ended 31 March 2019 contained certain types of expenditure which were believed to be allowable for corporation tax purposes and hence tax relief was claimed in the corporation tax computation for the year then ended. FRS 105 is designed to replace the FRSSE and provide that simplification.

Source: pinterest.com

Source: pinterest.com

So Directors may prefer FRS 105 accounts for that reason. The ICAEW Library can provide model accounts and disclosure checklists for FRS 101 FRS 102 FRS 102 Section 1A and FRS 105. Responsibility to anyone other than Demo Micro-entity FRS 105 Limited and its Board of Directors as a body for my work or for this report. To demonstrate the kind of output you can expect weve included some sample accounts for you to take a look at. 35 FRS 105 example accounts Deemed TF view No Directors report Can be filleted Does not prevent accountants from providing high quality accounts to management.

Source: caseron.co.uk

Source: caseron.co.uk

1 FRS 102 and FRS 105 Example small and micro company accounts Presented by John Selwood. The Act with respect to accounting records and the preparation of financial statements. FRS 105 is therefore based on historic cost accounting and no valuations of property are permitted for both owner. Other comments It is recommended that the first actual FRS 102 accounts are prepared using proprietary model accounts and accounts disclosure checklists. This means that no revaluations or subsequent measurement at fair value is permitted under the micro-entities regime.

Source: userdocs.wolterskluwer.co.uk

Source: userdocs.wolterskluwer.co.uk

There is a difference in this accounting under FRS 102 than. So Directors may prefer FRS 105 accounts for that reason. It introduced the concept of the Micro Companies Regime which is contained in Section 280D-280E of the Companies Act 2014. In most cases youll disclose less information in a set of FRS 105 accounts versus Abbreviated Accounts. The original accounting formats are prepared under FRSSE 2008 and are for the year ended 31.

Source: pinterest.com

Source: pinterest.com

Examples might include operating leases for office space restaurants or retail space. FRS 105 takes into account any relevant changes made to FRS 102 in this regard. Ii FRS 105 The Financial Reporting Standard applicable to the Micro-entities Regime is an accounting standard designed to apply to the financial statements of companies LLPs and qualifying partnerships that qualify for and choose to apply the micro-entities regime. FRS 10519 Borrowing costs must be expensed FRS. FRS 105 sections 9-17 The accounting policy options available under FRS 102 are not available under FRS 105.

Source: userdocs.wolterskluwer.co.uk

Source: userdocs.wolterskluwer.co.uk

In most cases youll disclose less information in a set of FRS 105 accounts versus Abbreviated Accounts. FRS 102 accounts for a small company opting to prepare full FRS 102 financial statements for example when approaching the small company thresholds or a group requirement. The full accounts are for the members and these have to comply with the complete accounts format as laid out in FRS 105. 35 FRS 105 example accounts Deemed TF view No Directors report Can be filleted Does not prevent accountants from providing high quality accounts to management. Accounts prepared under FRS 105 are also required to present a balance sheet or statement of financial position.

Source: pinterest.com

Source: pinterest.com

FRS 100 does not extend the mandatory application of EU-adopted IFRSs beyond the current requirement of the IAS Regulation or market rules. A provision will be required for any present obligation at the balance sheet date FRS 1051613 and Example 2 in the Appendix to Section 16. Accounts prepared under FRS 105 are also required to present a balance sheet or statement of financial position. This is a set of example micro-entity financial statements prepared under FRS 105 early adopted Only the balance sheet with integrated notes is required to be filed at. John revisits some things to watch out for when compiling a set of FRS 105 accounts and the main differences from FRS 102.

This allows companies to prepare financial statements under FRS 105 by applying the requirements of the micro companies regime in the Companies Act. FRS 105 is therefore based on historic cost accounting and no valuations of property are permitted for both owner. FRS 105 is designed to replace the FRSSE and provide that simplification. 1 FRS 102 and FRS 105 Example small and micro company accounts Presented by John Selwood. This allows companies to prepare financial statements under FRS 105 by applying the requirements of the micro companies regime in the Companies Act.

Source: pinterest.com

Source: pinterest.com

A provision will be required for any present obligation at the balance sheet date FRS 1051613 and Example 2 in the Appendix to Section 16. The fair value accounting and alternative accounting rules cannot be applied in micro-entity accounts. Other comments It is recommended that the first actual FRS 102 accounts are prepared using proprietary model accounts and accounts disclosure checklists. If FRS 105 specifically addresses a transaction other event or condition a micro-entity. Responsibility to anyone other than Demo Micro-entity FRS 105 Limited and its Board of Directors as a body for my work or for this report.

Source: help.iris.co.uk

Source: help.iris.co.uk

It is your duty to ensure that Demo Micro-entity FRS 105 Limited has kept adequate accounting records and to prepare statutory financial statements that give a true and fair view of the assets. FRS 105 is therefore based on historic cost accounting and no valuations of property are permitted for both owner. This allows companies to prepare financial statements under FRS 105 by applying the requirements of the micro companies regime in the Companies Act. It introduced the concept of the Micro Companies Regime which is contained in Section 280D-280E of the Companies Act 2014. The accounts will be available mid-September and are free to members.

Source: ar.pinterest.com

Source: ar.pinterest.com

102 FRS 102 1a FRS 105 small self-administered pension schemes charitable incorporated organisations charity company accounts using FRS 102 and LLPs using FRS 102. This is a set of example micro-entity financial statements prepared under FRS 105 early adopted Only the balance sheet with integrated notes is required to be filed at. FRS 105 sections 9-17 The accounting policy options available under FRS 102 are not available under FRS 105. There is also a summary to guide users to complete the correct disclosure checklist. The Companies Accounting Act 2017 commenced on 9th June 2017.

Source: help.iris.co.uk

Source: help.iris.co.uk

With Sage Final Accounts you can prepare final accounts for your clients using just your Internet browser. Ii FRS 105 The Financial Reporting Standard applicable to the Micro-entities Regime is an accounting standard designed to apply to the financial statements of companies LLPs and qualifying partnerships that qualify for and choose to apply the micro-entities regime. Deferred tax will need to be reversed in the comparatives the following year. The full accounts are for the members and these have to comply with the complete accounts format as laid out in FRS 105. FRS 105 financial statements.

Source: help.iris.co.uk

Source: help.iris.co.uk

It introduced the concept of the Micro Companies Regime which is contained in Section 280D-280E of the Companies Act 2014. There is a difference in this accounting under FRS 102 than. FRS 10519 Borrowing costs must be expensed FRS. This means that no revaluations or subsequent measurement at fair value is permitted under the micro-entities regime. Examples might include operating leases for office space restaurants or retail space.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title frs 105 example accounts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.