Your Preferential origin declaration example images are ready. Preferential origin declaration example are a topic that is being searched for and liked by netizens today. You can Find and Download the Preferential origin declaration example files here. Download all royalty-free images.

If you’re looking for preferential origin declaration example pictures information related to the preferential origin declaration example keyword, you have visit the ideal site. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

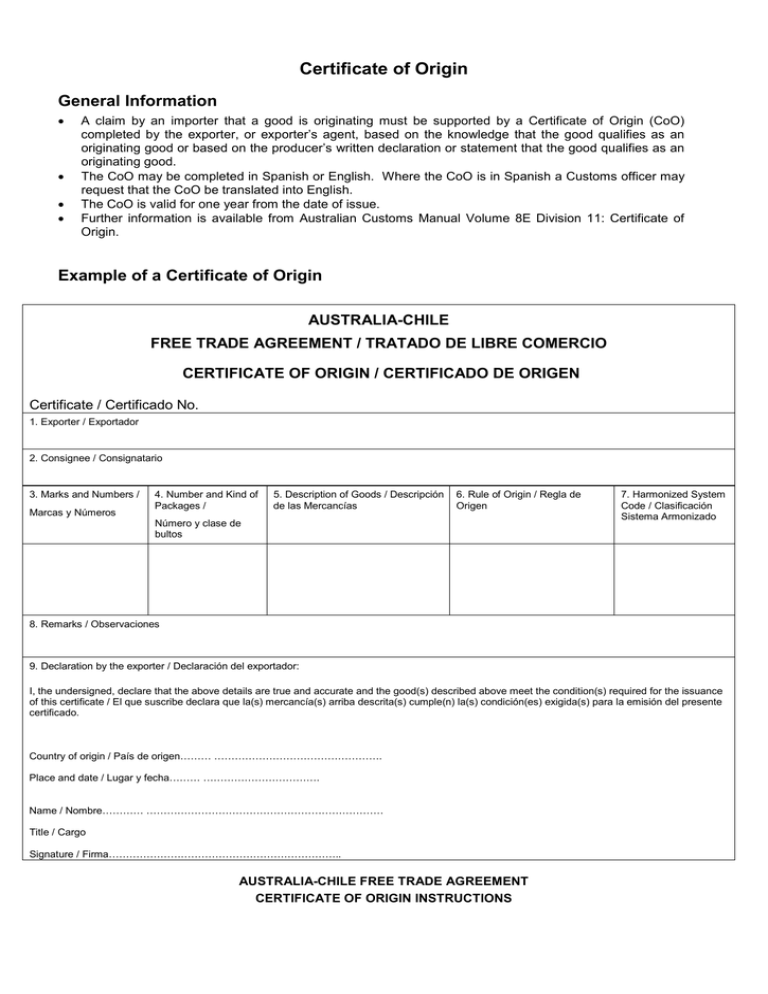

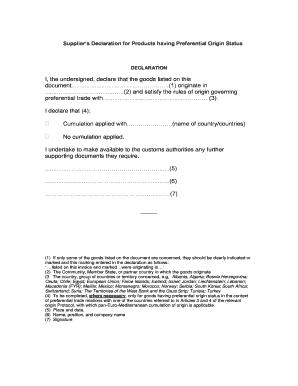

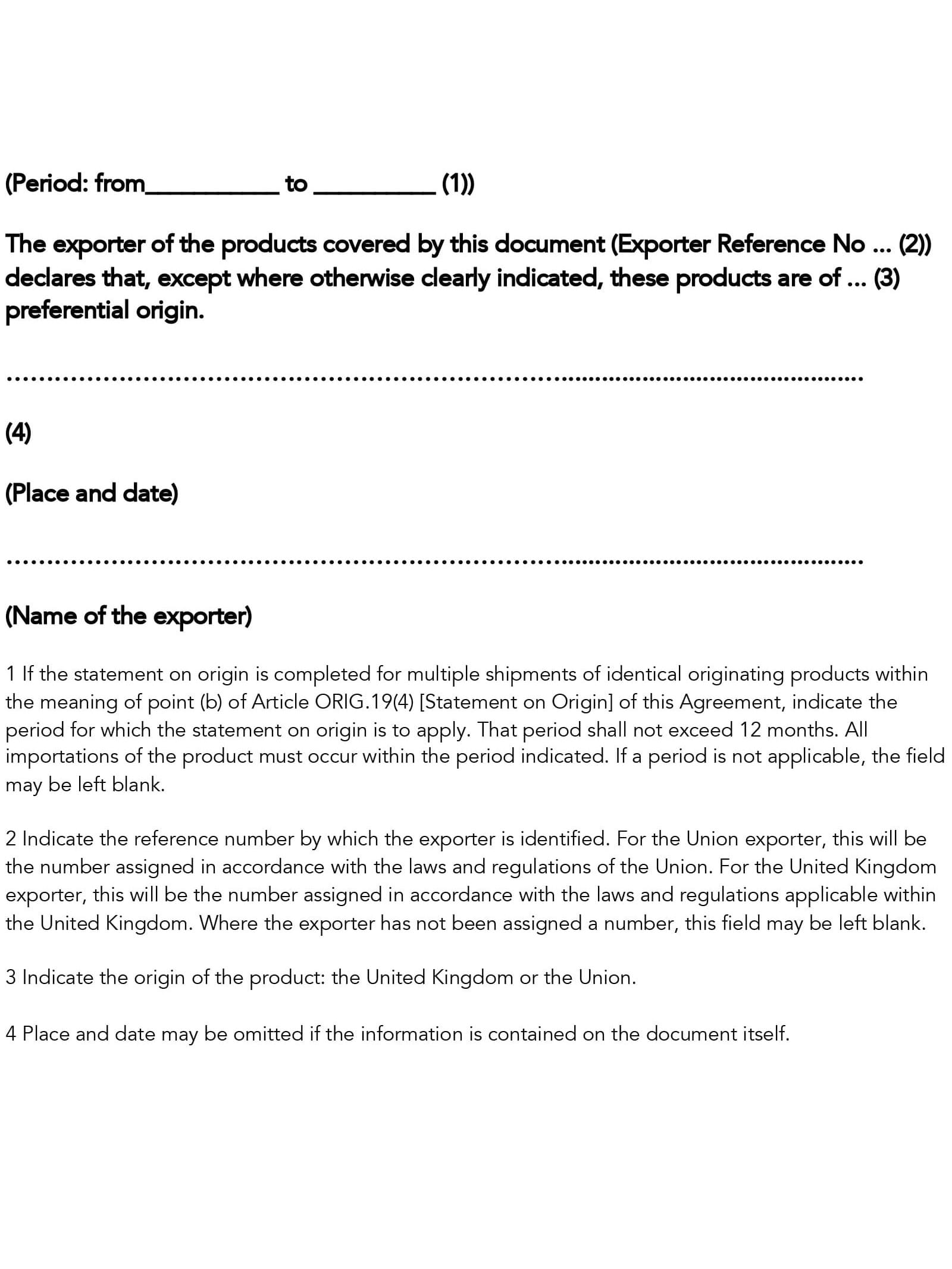

Preferential Origin Declaration Example. Template of a long-term supplier declaration within the EU with origins PDF. 4 To be completed where necessary only for goods having preferential origin status in the context of preferential trade relations with one of the countries referred to in Articles 3 and 4 of the relevant origin Protocol with which pan-Euro-Mediterranean cumulation of origin is applicable. The type of certificate to produce is determined by each preferential agreement. Preferential origin 2 according to rules of origin of the Generalised System of Preferences of the European Union and.

L 2019339en 01000101 Xml From eur-lex.europa.eu

L 2019339en 01000101 Xml From eur-lex.europa.eu

You or your agent must lodge an import declaration for the gym equipment. Declaration of origin allows the consignee to benefit from a reduction or waiver of customs duty and makes the customs process easier. In effect it means that goods must either 1 be manufactured from raw materials or components which have been grown or produced. The content of the origin declaration follows from the preferential arrangement itself. Of the Royal Decree lay down the rules of the Generalized System of Preferences GSP. 5 Place and date.

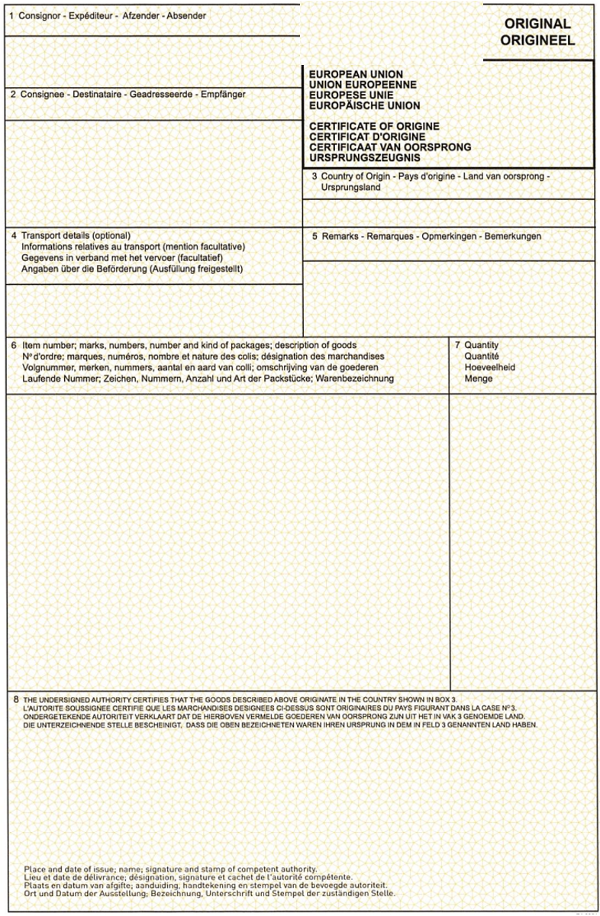

This certificate is normally requested by the customs authority of the importing country for assessing whether the.

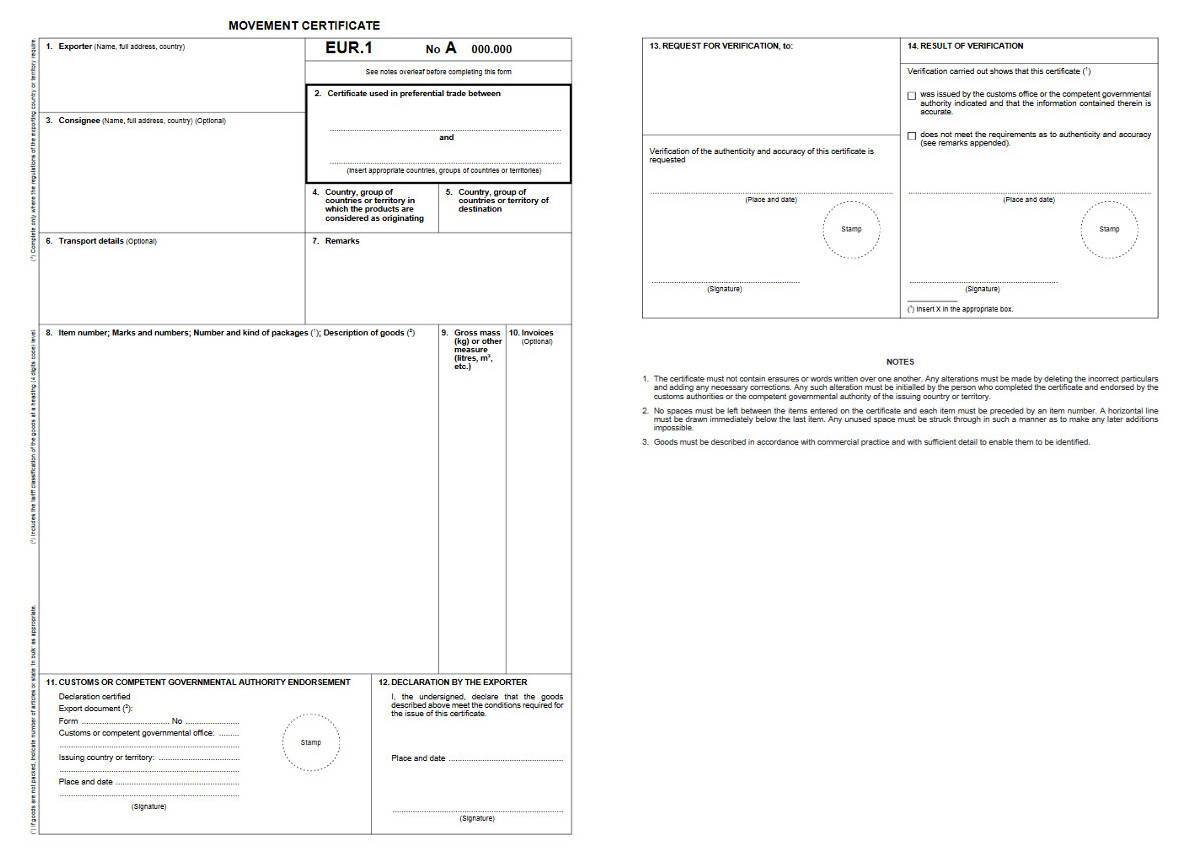

Long-term supplier declaration for goods without origins. Internal and External SUBJECT. Preferential origin of goods Preferential origin of goods. A suppliers declaration may never be used as a proof of origin for claiming preferential treatment at importation. The EUR1 movement certificate used for example in exchanges with Switzerland. The Netherlands Chamber of Commerce offers an example of an origin declaration for export to the UK.

Source: logistics.public.lu

Source: logistics.public.lu

Articles 37 et seq. Guidance on the Rules of Preferential Origin. The supplier certifying to the buying company the preferential originating status of their goods for a limited period of time max. In its most common form the suppliers declaration is a declaration of the preferential originating status of a product that has already been achieved. Articles 37 et seq.

Source: studylib.es

Source: studylib.es

The European Commission provides the following detailed information on the rules of origin. The invoice declaration the text of which is given below must be made out in accordance with the footnotes. Template of a long-term supplier declaration within the EU with origins PDF. Example 3 - Importing gym equipment from the UK. CanadaEU CETA Origin Declaration The origin declaration the text of which is given below must be completed in accordance with the footnotes.

The non-preferential origin of the goods is a mandatory element of the declaration for release for free circulation. A declaration of origin on invoice can be used for goods under u20ac6000 destined for certain countries see country information sheets. The European Commission provides the following detailed information on the rules of origin. Tax and Duty Manual Preferential Origin Appendix 2 10 Annex VII. Preferential Rules of Origin 2 THIS INSTRUCTION AND GUIDELINE REFERS TO.

Source: pdfprof.com

Source: pdfprof.com

The non-preferential origin of the goods is a mandatory element of the declaration for release for free circulation. In effect it means that goods must either 1 be manufactured from raw materials or components which have been grown or produced. 4 MARCH 2009 AVAILABILITY. Long-term supplier declaration for goods without origins. Suppliers provide these declarations to exporters stating the origin of their products.

Source: wikiwand.com

Source: wikiwand.com

This declaration is not valid for goods having preferential origin status and which qualify for movement certificates EUR1 EUR-MED or invoice declarations. Rules of origin. In effect it means that goods must either 1 be manufactured from raw materials or components which have been grown or produced. You or your agent must lodge an import declaration for the gym equipment. Suppliers provide these declarations to exporters stating the origin of their products.

Source: publications.europa.eu

Source: publications.europa.eu

In its most common form the suppliers declaration is a declaration of the preferential originating status of a product that has already been achieved. The invoice declaration the text of which is given below must be made out in accordance with the footnotes. 4 MARCH 2009 AVAILABILITY. Preferential Rules of Origin 2 THIS INSTRUCTION AND GUIDELINE REFERS TO. 6 Name position and company.

A suppliers declaration is supporting evidence for an application for origin certification. 5 Place and date. Non-preferential origin rules apply for purposes other than preferential duty. CanadaEU CETA Origin Declaration The origin declaration the text of which is given below must be completed in accordance with the footnotes. Template of a long-term supplier declaration within the EU with origins PDF.

Source: logistics.public.lu

Source: logistics.public.lu

A suppliers declaration is supporting evidence for an application for origin certification. 6 Name position and company. 4 To be completed where necessary only for goods having preferential origin status in the context of preferential trade relations with one of the countries referred to in Articles 3 and 4 of the relevant origin Protocol with which pan-Euro-Mediterranean cumulation of origin is applicable. 4 MARCH 2009 AVAILABILITY. Non-preferential origin rules apply for purposes other than preferential duty.

Source: publications.europa.eu

Source: publications.europa.eu

The invoice declaration the text of which is given below must be made out in accordance with the footnotes. The type of certificate to produce is determined by each preferential agreement. Non-preferential origin rules apply for purposes other than preferential duty. The declarant is responsible for the correct origin determination and should hold the information on the processing that has taken place in the last country of production of the goods declared for release for free circulation in. An origin declaration.

Source: long-term-supplier-declaration.pdffiller.com

Source: long-term-supplier-declaration.pdffiller.com

To claim preferential rates of duty your product must originate in the EU or UK as the exporting country as set out in Chapter 2 of the Trade and Cooperation Agreement rules. The invoice declaration the text of which is given below must be made out in accordance with the footnotes. 62 annex 22-16 PB L 343 of 29122015 is applicable. Declaration of origin allows the consignee to benefit from a reduction or waiver of customs duty and makes the customs process easier. Long-term suppliers declarations LTVD for goods without preferential origin.

Source: publications.europa.eu

Source: publications.europa.eu

An origin declaration. 64 CDU sets out the rules for the acquisition of preferential origin of goods in EU agreements or in the provisions granted unilaterally and for temporary derogation. Declaration of origin allows the consignee to benefit from a reduction or waiver of customs duty and makes the customs process easier. The Netherlands Chamber of Commerce offers an example of an origin declaration for export to the UK. From_____ to _____ 1.

The type of certificate to produce is determined by each preferential agreement. You or your agent must lodge an import declaration for the gym equipment. The invoice declaration the text of which is given below must be made out in accordance with the footnotes. Suppliers declaration for goods having preferential origin status. A suppliers declaration may never be used as a proof of origin for claiming preferential treatment at importation.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

Internal and External SUBJECT. Articles 37 et seq. The declarant is responsible for the correct origin determination and should hold the information on the processing that has taken place in the last country of production of the goods declared for release for free circulation in. Suppliers declaration for goods having preferential origin status. You must do the following to avail of the preferential tariff treatment under the EU-UK Trade and Cooperation Agreement.

Source: pdffiller.com

Source: pdffiller.com

Preferential Rules of Origin 2 THIS INSTRUCTION AND GUIDELINE REFERS TO. Non-preferential origin rules apply for purposes other than preferential duty. To claim preferential rates of duty your product must originate in the EU or UK as the exporting country as set out in Chapter 2 of the Trade and Cooperation Agreement rules. Preferential origin 2 according to rules of origin of the Generalised System of Preferences of the European Union and. All importations of the product must occur within the period indicated.

You must have proof that the goods which you are importing have UK origin. A suppliers declaration may never be used as a proof of origin for claiming preferential treatment at importation. A declaration of origin on invoice can be used for goods under u20ac6000 destined for certain countries see country information sheets. From_____ to _____ 1. Suppliers provide these declarations to exporters stating the origin of their products.

Source: brexit2020.intertradeireland.com

Source: brexit2020.intertradeireland.com

In order to have preferential origin goods must fulfil the relevant conditions laid down in the origin protocol to the agreement of whichever country is concerned or in the origin rules of the autonomous arrangements. A suppliers declaration may never be used as a proof of origin for claiming preferential treatment at importation. Suppliers declaration for products not having preferential origin. Preferential Certificate of Origin. Suppliers declaration within the European Union The types of suppliers declarations are dependent on whether the products have preferential origin.

In its most common form the suppliers declaration is a declaration of the preferential originating status of a product that has already been achieved. A suppliers declaration may never be used as a proof of origin for claiming preferential treatment at importation. Internal and External SUBJECT. To claim preferential rates of duty your product must originate in the EU or UK as the exporting country as set out in Chapter 2 of the Trade and Cooperation Agreement rules. Long-term suppliers declarations LTVD for goods without preferential origin.

Source: slidetodoc.com

Source: slidetodoc.com

These are used to determine for example if trade embargoes or Anti-Dumping Duties apply or for compiling statistics. 4 To be completed where necessary only for goods having preferential origin status in the context of preferential trade relations with one of the countries referred to in Articles 3 and 4 of the relevant origin Protocol with which pan-Euro-Mediterranean cumulation of origin is applicable. Rules of origin. The European Commission provides the following detailed information on the rules of origin. Internal and External SUBJECT.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title preferential origin declaration example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.