Your Reverse charge vat return example images are ready. Reverse charge vat return example are a topic that is being searched for and liked by netizens now. You can Find and Download the Reverse charge vat return example files here. Get all free photos.

If you’re looking for reverse charge vat return example pictures information connected with to the reverse charge vat return example keyword, you have pay a visit to the ideal site. Our website always gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

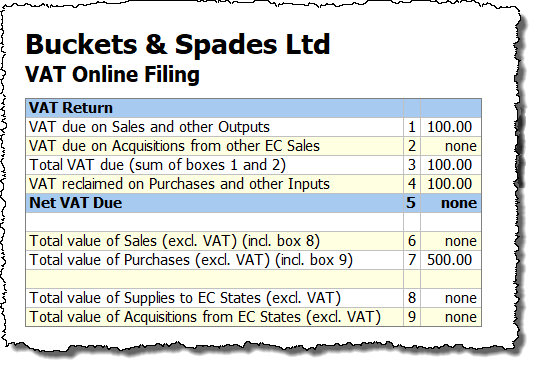

Reverse Charge Vat Return Example. So theyve charged you 800 without the VAT. Make sure you do not enter the net value of. Therefore for companies trading with the UK excluding trade in goods with Northern Ireland the rules of trade with a non-EU country apply. This is then reported on their VAT return in both Box 1 sales and Box 4 purchases.

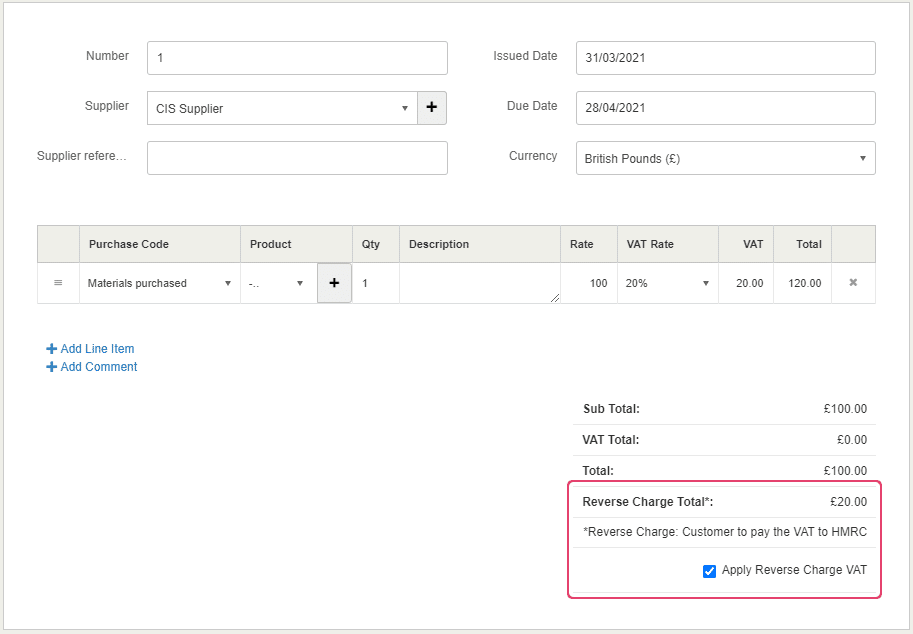

Domestic Reverse Charge For Cis Vat Quickfile From community.quickfile.co.uk

Domestic Reverse Charge For Cis Vat Quickfile From community.quickfile.co.uk

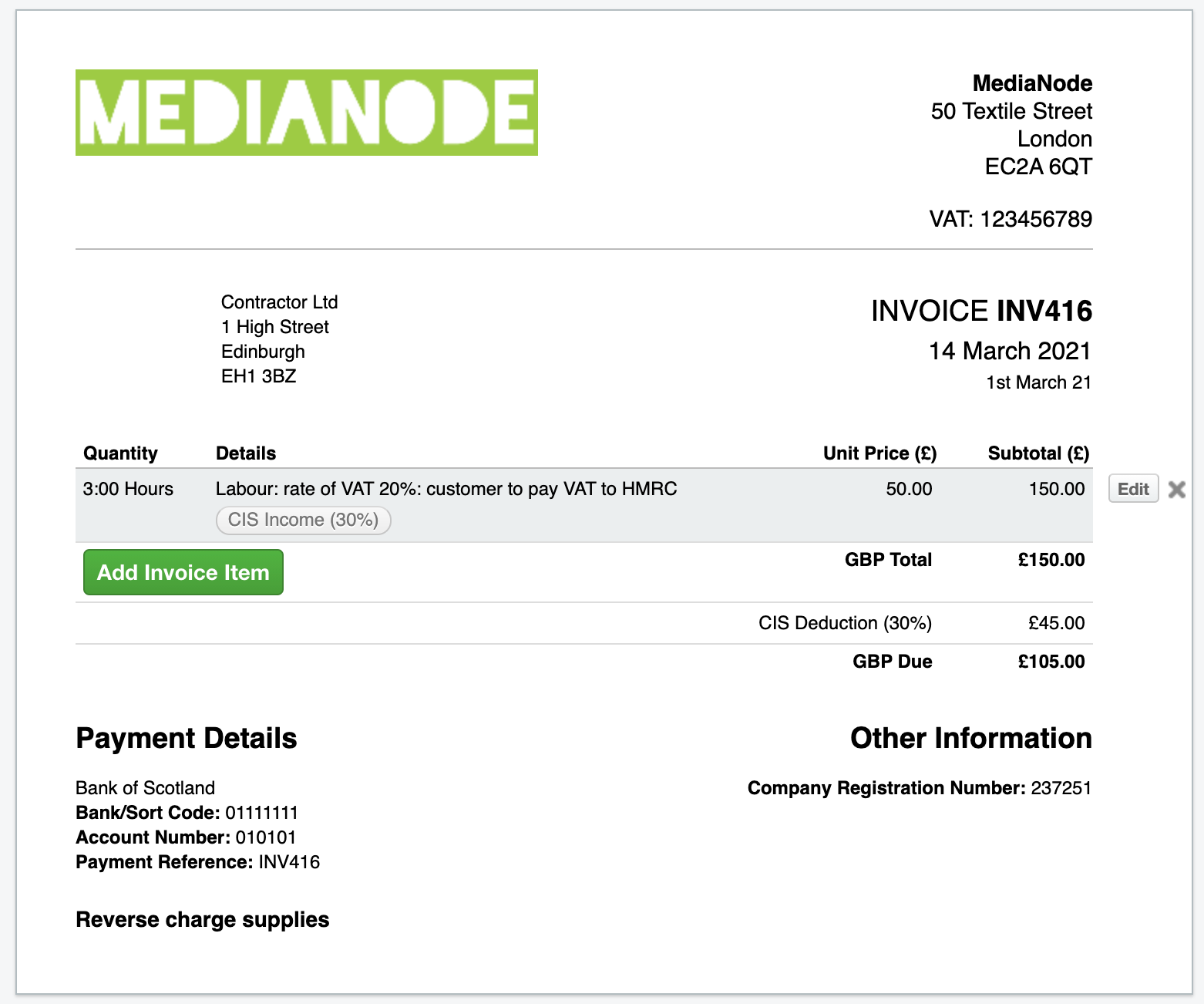

Abdul has acquired services from a non-UAE-based supplier he will have to record the reverse charge on his relevant VAT return. Although VAT isnt charged on the invoice they report the 1200 VAT and apply the reverse charge rules. Make sure you do not enter the net value of. Let us consider a couple of simple working examples to understand how the reverse charge VAT mechanism works. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. The subcontractor would invoice 1000 but state reverse charge VAT rules apply.

List the net value of invoices issued in box 6.

Reverse charge applies. 9250 1850 VAT. Plumber Pete is doing work for Contractor Ltd which is subject to the new reverse charge rules. EU Reverse Charge Procedure. You are also required to recover the VAT charged to yourself on these invoices in Box 4 of the VAT return. Reverse charge bookkeeping services from India.

Source: help.brightpearl.com

Source: help.brightpearl.com

In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is. Reverse charge applies. Brian the subcontractor is hired by Gary the contractor for building work that costs 2400 including VAT. In this example because the recipient accounts for the VAT under the reverse charge mechanism the place of supply for VAT purposes is the UAE. According to this regulation it is the service recipient customer and not the service provider who must pay the VAT.

Abdul has acquired services from a non-UAE-based supplier he will have to record the reverse charge on his relevant VAT return. The contractor would pay 1000 to the subcontractor ignoring CIS tax. This means that instead of paying VAT at the border and deducting it later in the VAT return the importer will pay and deduct the VAT at the same time in the VAT return with the corresponding nil cash flow impact unless partial exemption applies. This is made up of 2000 costs. It should be noted that Northern Ireland is treated as a Member.

Services that fall under VAT reverse charge. EU Reverse Charge Procedure. If you closely observe the illustration the net result of reverse charge mechanism is same as that of forward charge basis. They would still declare the net sale of 1000 in Box 6 of the VAT return. The VAT at the UK rate of 20 would be 160.

Source: dolibarr.org

Source: dolibarr.org

VAT 3 Return Example for Reverse Charge VAT 3 Return Headings Example Explanation Amount T1 VAT on Sale In its JanuaryFebruary 2019 VAT return A Ltd includes VAT of 181000 as VAT on Sales ie. They would still declare the net sale of 1000 in Box 6 of the VAT return. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. So theyve charged you 800 without the VAT. If you closely observe the illustration the net result of reverse charge mechanism is same as that of forward charge basis.

Source: eque2.co.uk

Source: eque2.co.uk

Lets make the comparative analysis of VAT on forward charge and reverse charge with an example of domestic supplies of goods at 5 versus the import of similar goods. Services that fall under VAT reverse charge. It should be noted that Northern Ireland is treated as a Member. The HMRC provides a list of those services where VAT reverse charge doesnt and doesnt apply. An example of how the reverse charge would work in practice is.

Source: theconstructionindex.co.uk

Source: theconstructionindex.co.uk

It should be noted that Northern Ireland is treated as a Member. From 1 October 2019 a domestic reverse charge rule is being introduced which will change the person responsible for accounting for VAT in relation to certain supplies of construction services. Reverse charge means the reverse of the tax liability between supplier and recipient. A note against the services provided where Reverse VAT applies and that the customer is required to account for the VAT. TOTAL GBP 40000 Less CIS Deduction 20.

Source: joblogic.com

Source: joblogic.com

EU Reverse Charge Procedure. An example of suitable wordingis. As I understand it based on HMRCs website for the French transport company the entries should be. This means that instead of paying VAT at the border and deducting it later in the VAT return the importer will pay and deduct the VAT at the same time in the VAT return with the corresponding nil cash flow impact unless partial exemption applies. Similarly contractors would not pay VAT to the subcontractors and therefore would not claim this money as a cost through their VAT return.

Services that fall under VAT reverse charge. Let us consider a couple of simple working examples to understand how the reverse charge VAT mechanism works. A note against the services provided where Reverse VAT applies and that the customer is required to account for the VAT. An example of how the reverse charge would work in practice is. In less than two months significant changes are being introduced to the VAT treatment of supplies in the construction industry.

Source: forum.manager.io

Source: forum.manager.io

The reverse charge procedure is the reversal of the tax liability and has VAT consequences especially for online sellers. Customers need to account for VAT on these items to HMRC at the rate shown. Make sure you do not enter the net value of. It should be noted that Northern Ireland is treated as a Member. If the VAT incurred relates to a taxable supply there is a full entitlement to recover the VAT in Box 4.

Source: youtube.com

Source: youtube.com

If you closely observe the illustration the net result of reverse charge mechanism is same as that of forward charge basis. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. If you closely observe the illustration the net result of reverse charge mechanism is same as that of forward charge basis. Reverse charge bookkeeping services from India. List the net value of invoices issued in box 6.

Source: kashflow.com

Source: kashflow.com

On 31 December 2020 the United Kingdom left the EU and as a result became a third country for VAT purposes. From 1 October 2019 a domestic reverse charge rule is being introduced which will change the person responsible for accounting for VAT in relation to certain supplies of construction services. They would still declare the net sale of 1000 in Box 6 of the VAT return. You work out the VAT you would have paid at the prevailing UK rate. Make sure you do not enter the net value of.

The contractor would pay 1000 to the subcontractor ignoring CIS tax. A note against the services provided where Reverse VAT applies and that the customer is required to account for the VAT. Customers need to account for VAT on these items to HMRC at the rate shown. 9250 1850 VAT. The subcontractor would therefore include in Box 1 a VAT amount of Nil.

Source: ordeconta.com

Source: ordeconta.com

Example of a reverse charge invoice for one contract with different VAT rates. 9250 1850 VAT. An example of how the reverse charge would work in practice is. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above.

Source: docs.pegasus.co.uk

Source: docs.pegasus.co.uk

List the net value of invoices issued in box 6. When the Reverse Charge is applied the recipient of the goods or services makes the declaration of both their purchase input VAT and the suppliers sale output VAT in their VAT return. VAT on its own sales of 100000 plus reverse charge VAT of 81000 on services received from B. Box 1 and 4 160 and boxes 6 and 7 800. Where services provided are subject to the VAT reverse charge.

Source: support.freeagent.com

Source: support.freeagent.com

The value of the work is 10000 plus 20 VAT. This is then reported on their VAT return in both Box 1 sales and Box 4 purchases. Abdul has acquired services from a non-UAE-based supplier he will have to record the reverse charge on his relevant VAT return. Working on housing 2000 2000 Domestic Reverse Charge 20 VAT on Income 40000 Subtotal 40000 TOTAL DOMESTIC REVERSE CHARGE 20 VAT ON INCOME 000 Reverse charge applies to items marked with Domestic reverse charge. The logical way to look at the figures in this example is to consider what VAT return entries would have been made if the legislation required the Indian bookkeeper to get a UK VAT number.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

If the work on the contractors client would have been say 200 in the example above then the value of reverse charge work would have been only 200200 9000 X 100 217 and the subcontractor would have charged VAT on the total invoice as it falls outside of DRC ie. On 31 December 2020 the United Kingdom left the EU and as a result became a third country for VAT purposes. 9250 1850 VAT. VAT on its own sales of 100000 plus reverse charge VAT of 81000 on services received from B. VAT 3 Return Example for Reverse Charge VAT 3 Return Headings Example Explanation Amount T1 VAT on Sale In its JanuaryFebruary 2019 VAT return A Ltd includes VAT of 181000 as VAT on Sales ie.

Source: moneysoft.co.uk

Source: moneysoft.co.uk

You work out the VAT you would have paid at the prevailing UK rate. Box 1 and 4 160 and boxes 6 and 7 800. Working on housing 2000 2000 Domestic Reverse Charge 20 VAT on Income 40000 Subtotal 40000 TOTAL DOMESTIC REVERSE CHARGE 20 VAT ON INCOME 000 Reverse charge applies to items marked with Domestic reverse charge. You are also required to recover the VAT charged to yourself on these invoices in Box 4 of the VAT return. Reverse charge applies.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

Customer to pay the VAT to HMRC If a credit note is issued for construction services subject to Reverse VAT it must include a note showing the VAT element. On 31 December 2020 the United Kingdom left the EU and as a result became a third country for VAT purposes. EU Reverse Charge VAT. In this way the two entries cancel each other from a cash payment perspective in the same returnFrom the authorities. Customer to pay the VAT to HMRC If a credit note is issued for construction services subject to Reverse VAT it must include a note showing the VAT element.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title reverse charge vat return example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.