Your Salary sacrifice car example images are ready in this website. Salary sacrifice car example are a topic that is being searched for and liked by netizens now. You can Get the Salary sacrifice car example files here. Download all royalty-free photos and vectors.

If you’re looking for salary sacrifice car example pictures information connected with to the salary sacrifice car example keyword, you have visit the ideal blog. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

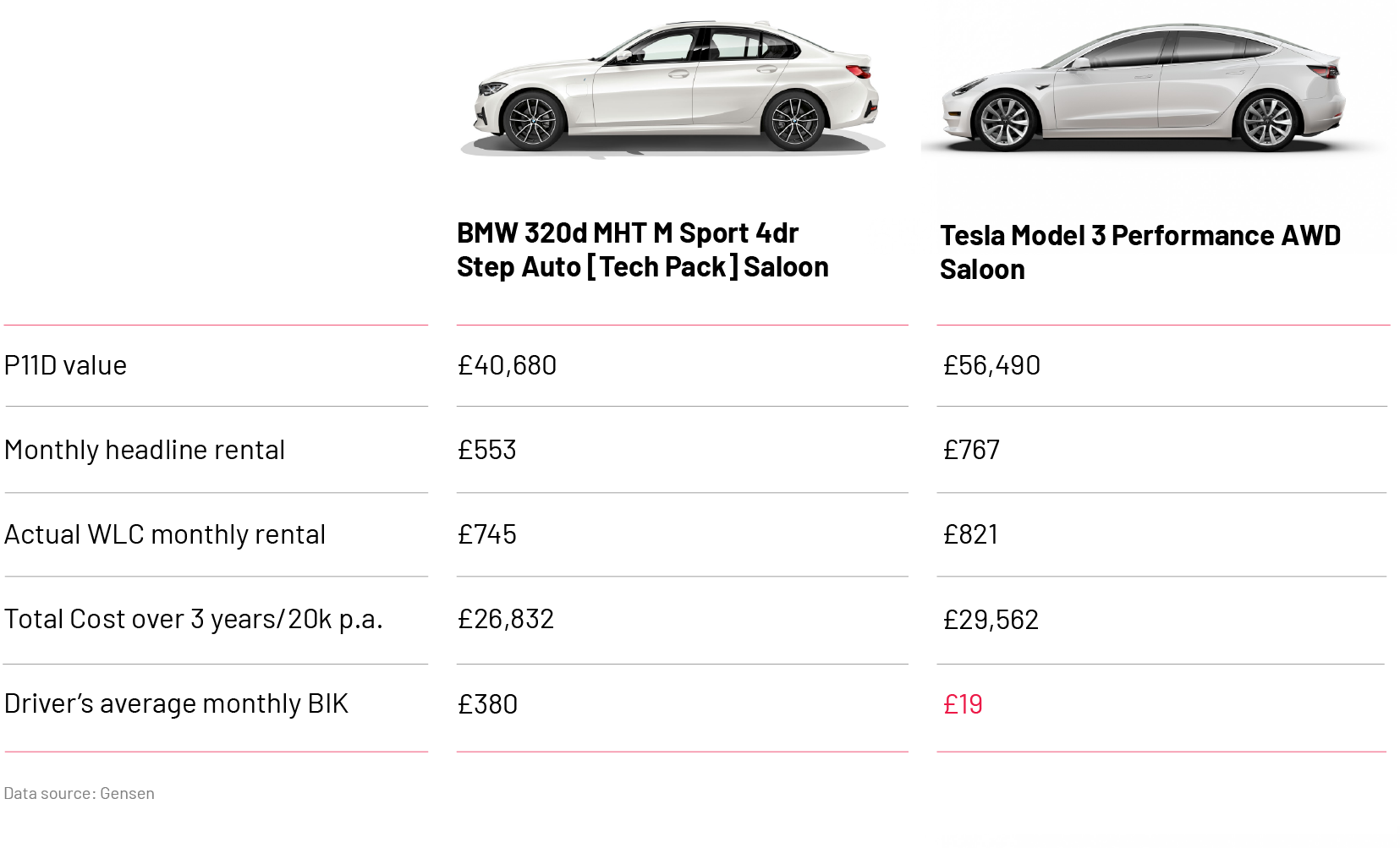

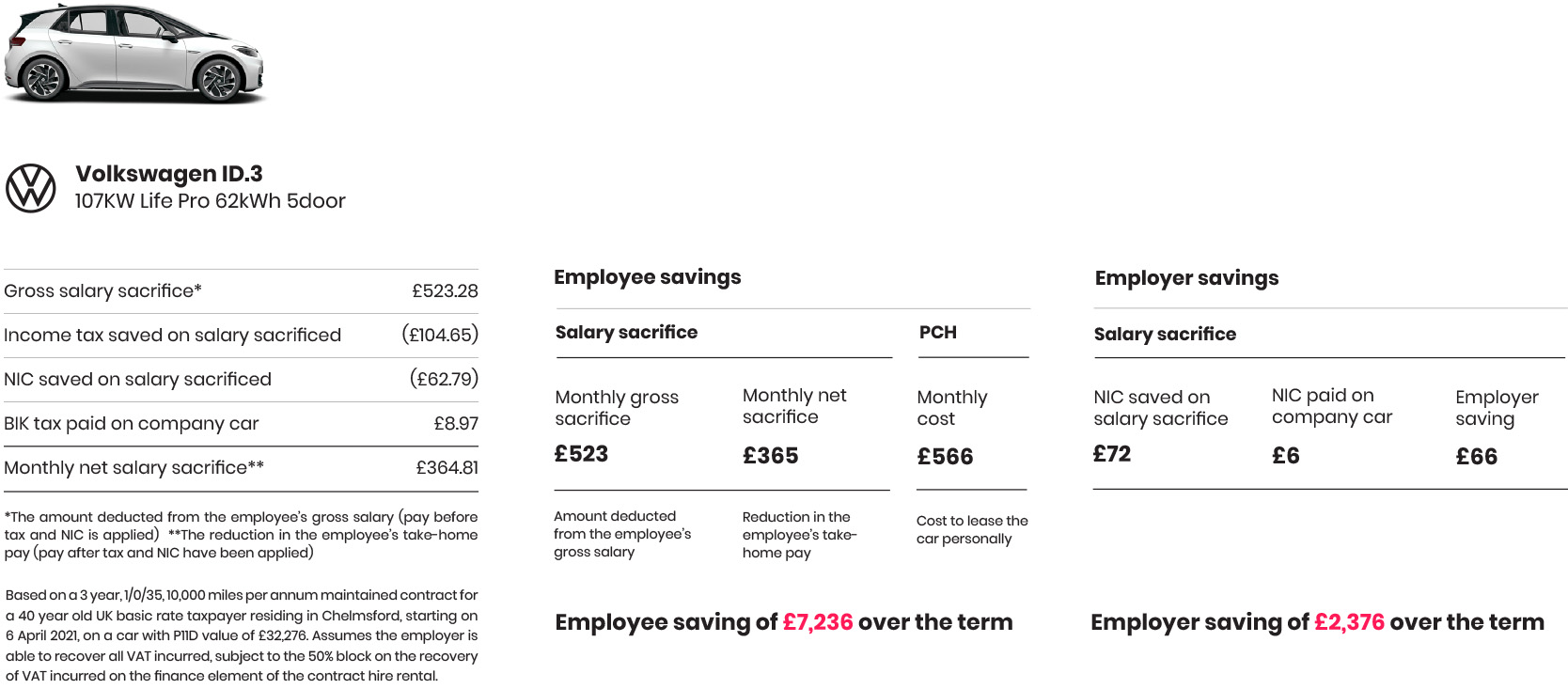

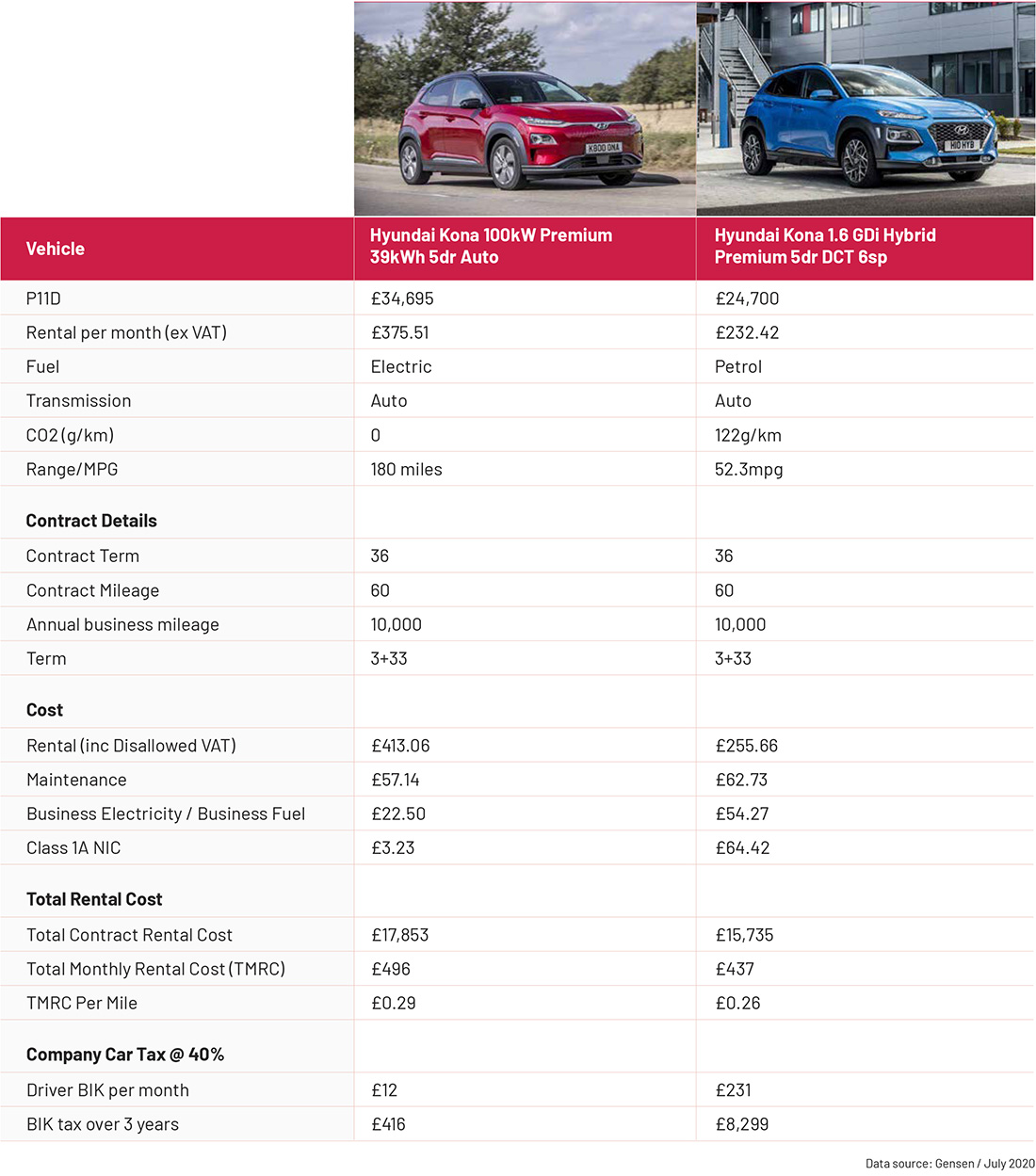

Salary Sacrifice Car Example. An electric car is eco-friendly and requires less maintenance than a petrol or diesel car but the up-front cost is a lot. The actual amount will depend on which costs the employer wishes to take in to account. - P11D value of the car list price plus delivery and VAT - CO2 emissions - Benefit in Kind BiK rate - employees income tax rate These figures are used in the following calculations. For electric cars the BiK rate is 0 for the 202021 financial year.

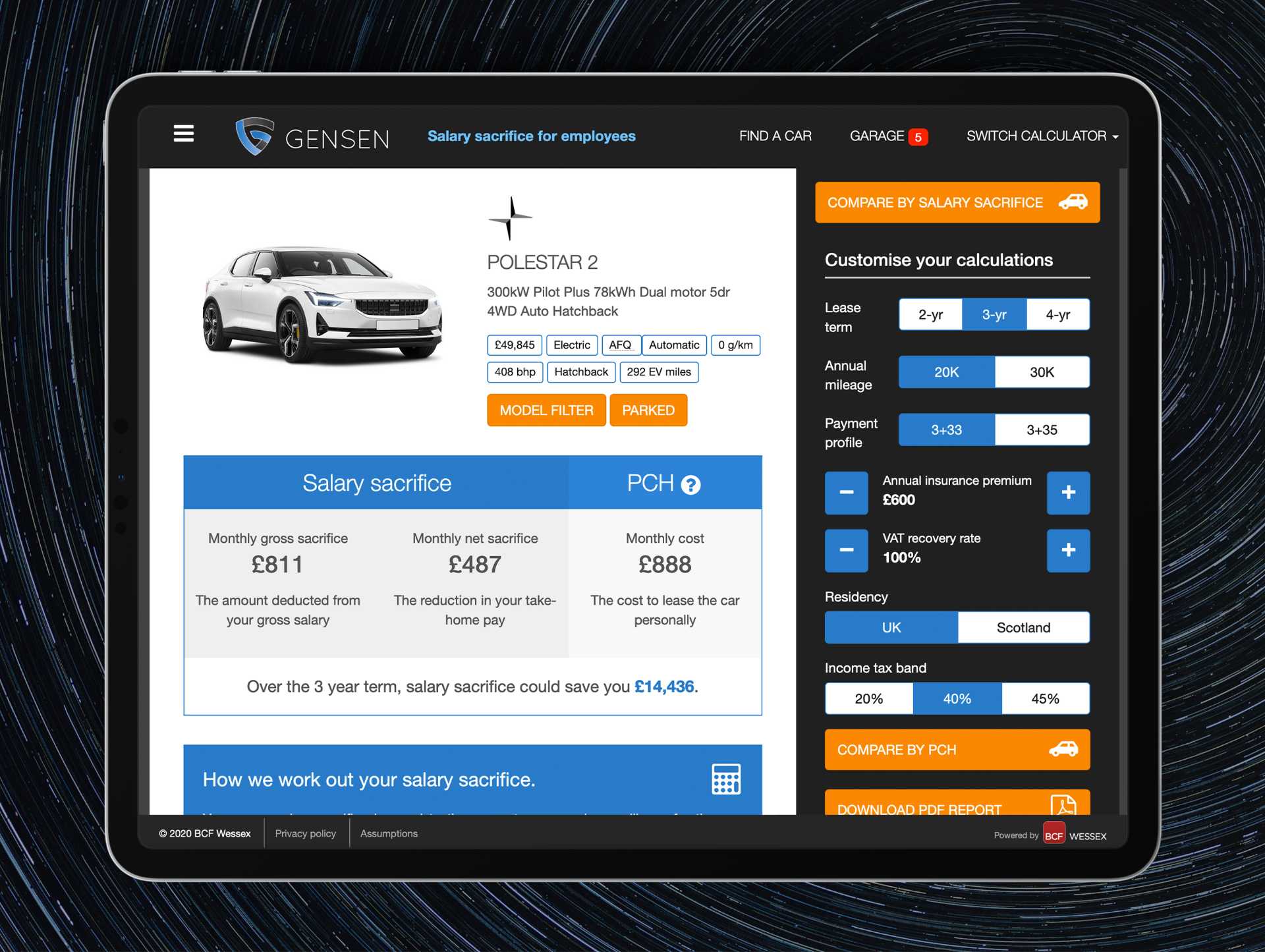

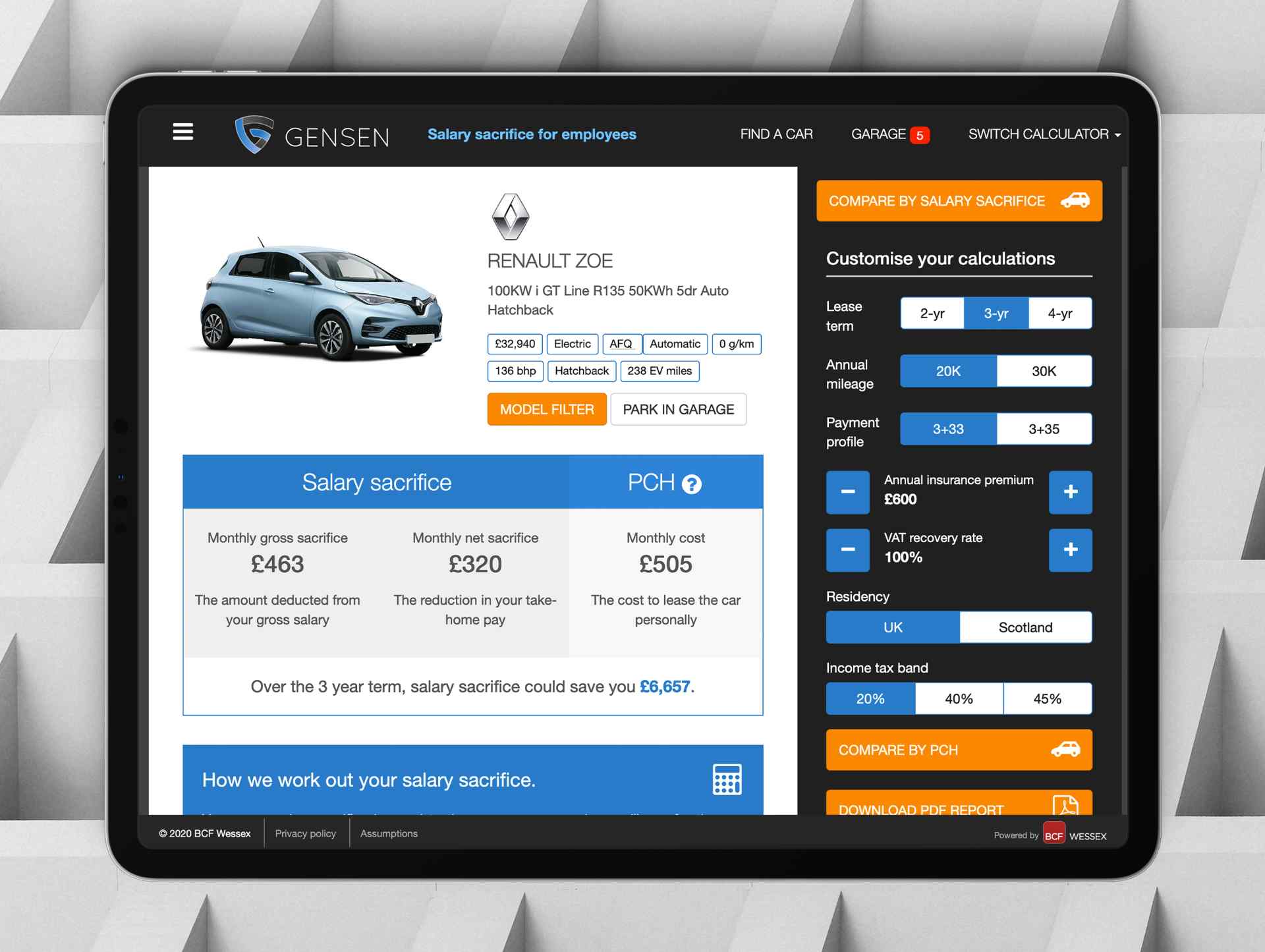

This car would be your benefit in exchange for reducing your salary. To explore the benefits for your employees and your business in more detail take a look at our guide - in it youll discover. This year you may agree to receive only 75000 as your salary in return for a 25000 car. Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says. How legislation changes from April 2020 have made EVs even more attractive. However now you can find some amazing schemes to help make them affordable.

Electric car salary sacrifice example The salary sacrificed by the employee and the amount contributed by the employer are calculated based on.

The 11500 running expenses includes registration which is GST-free. Salary sacrifice of a motor vehicle. Any salary sacrifice car agreement which precedes the change in tax rules remains exempt from. The actual amount will depend on which costs the employer wishes to take in to account. We work with hundreds of organisations from large utilities to the National Health Service to offer employees a benefit-rich salary sacrifice car scheme. Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says.

The rate will rise to just 1 in 2021-22 and 2 in 2022-23. Why salary sacrifice for cars schemes still remain part of a compelling employee motivation and reward package. It is simple to follow and shows how you can benefit from doing this. This year you may agree to receive only 75000 as your salary in return for a 25000 car. The second entry in the table Examples of salary sacrifice has been amended to correct the explanation of how much of the salary is subject to tax and National Insurance contributions.

The net pay and net delivered value of the employees pay packet. Here is an example based on how i think this works and on what I want to do. Its a totally simple idea your employees can choose to use some of their salary before its taxed in exchange for the use of a brand new car. So if your salary was 30000 before a car salary sacrifice or any other salary sacrifice your employer will use 30000 as a reference when calculating other benefits like pension contributions. - P11D value of the car list price plus delivery and VAT - CO2 emissions - Benefit in Kind BiK rate - employees income tax rate These figures are used in the following calculations.

Source: vincents.com.au

Source: vincents.com.au

799840 - is the effective additional salary that Im to be taxed on Total cost of vehicle X BiK rate 762000 - is the salary im sacrificing company has to pay. For example if an employees net monthly pay is 1850 before salary sacrifice they would take home 1650 after salary sacrifice the EV is costing them 200 per month which would otherwise have cost them around 400 a month. The Employee Salary Sacrifice calculator estimates the net cost of Salary Sacrifice to the employee including. 4999000 Cost of vehicle. 16 - BiK rate for electric vehicles in 2019 799840.

Source: easifleet.com.au

Source: easifleet.com.au

Salary sacrifice of a motor vehicle. Can a salary sacrifice scheme work for any car. 4999000 Cost of vehicle. For example Fleet Evolution has a salary sacrifice car scheme that saves you more money if you choose a greener car. This has been updated for the current tax year of 202122.

Say that you earn 100000 before-tax every year. Prior to 2017 a salary sacrifice car scheme carried the same tax advantages as other salary sacrifice schemes however since April 2017 the employee is now required to pay income tax on either the value of the car or the amount of salary sacrificed. Can a salary sacrifice scheme work for any car. This notional salary is your pay rate before any salary sacrifice arrangements. The electric vehicle is leased by the employees company with the cost being deducted from the employees gross salary.

Source: vincents.com.au

Source: vincents.com.au

Can a salary sacrifice scheme work for any car. For example Fleet Evolution has a salary sacrifice car scheme that saves you more money if you choose a greener car. Under this arrangement his employer will provide the use of a 35000 car and pay all the associated running expenses of 11500. So if your salary was 30000 before a car salary sacrifice or any other salary sacrifice your employer will use 30000 as a reference when calculating other benefits like pension contributions. The net pay and net delivered value of the employees pay packet.

Source: fleetalliance.co.uk

Source: fleetalliance.co.uk

This has been updated for the current tax year of 202122. For example Fleet Evolution has a salary sacrifice car scheme that saves you more money if you choose a greener car. The concept of salary sacrifice is best understood with some examples so lets look at a good one. The electric vehicle is leased by the employees company with the cost being deducted from the employees gross salary. How legislation changes from April 2020 have made EVs even more attractive.

Source: employeebenefits.co.uk

Source: employeebenefits.co.uk

799840 - is the effective additional salary that Im to be taxed on Total cost of vehicle X BiK rate 762000 - is the salary im sacrificing company has to pay. Assuming you have been in the 1995 pension scheme you can find this out from your TRS or annual benefit statement for 24 years this would equate to 2480th x 8253 2476 of pension growth. For example if an employees net monthly pay is 1850 before salary sacrifice they would take home 1650 after salary sacrifice the EV is costing them 200 per month which would otherwise have cost them around 400 a month. For electric cars the BiK rate is 0 for the 202021 financial year. The gross salary sacrifice in this example is 8253 when you give the car back your salary will go back up by 8253.

Source: employeebenefits.co.uk

Source: employeebenefits.co.uk

Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says. Assuming you have been in the 1995 pension scheme you can find this out from your TRS or annual benefit statement for 24 years this would equate to 2480th x 8253 2476 of pension growth. 26 May 2015. The electric vehicle is leased by the employees company with the cost being deducted from the employees gross salary. Sam earns 65000 a year and is considering entering into an effective salary sacrifice arrangement.

Source: worldevday.org

Source: worldevday.org

The salary sacrifice car is a company car leased by the employer for 2 to 3 years. As part of a payroll sacrifice system you can make an. 26 May 2015. You can calculate results based on either a fixed cash value or a certain proportion of your salary. This year you may agree to receive only 75000 as your salary in return for a 25000 car.

Source: brokernews.co.uk

Source: brokernews.co.uk

However now you can find some amazing schemes to help make them affordable. 16 - BiK rate for electric vehicles in 2019 799840. This car would be your benefit in exchange for reducing your salary. Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says. To explore the benefits for your employees and your business in more detail take a look at our guide - in it youll discover.

Here is an example based on how i think this works and on what I want to do. This year you may agree to receive only 75000 as your salary in return for a 25000 car. 4999000 Cost of vehicle. How legislation changes from April 2020 have made EVs even more attractive. Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says.

Source: fleetnetwork.com.au

Source: fleetnetwork.com.au

Its a totally simple idea your employees can choose to use some of their salary before its taxed in exchange for the use of a brand new car. The second entry in the table Examples of salary sacrifice has been amended to correct the explanation of how much of the salary is subject to tax and National Insurance contributions. It is simple to follow and shows how you can benefit from doing this. This year you may agree to receive only 75000 as your salary in return for a 25000 car. So if your salary was 30000 before a car salary sacrifice or any other salary sacrifice your employer will use 30000 as a reference when calculating other benefits like pension contributions.

The Employee Salary Sacrifice calculator estimates the net cost of Salary Sacrifice to the employee including. Meaning this tax break could make salary sacrifice an effectively perfect perk for drivers who want electric cars. The second entry in the table Examples of salary sacrifice has been amended to correct the explanation of how much of the salary is subject to tax and National Insurance contributions. It is simple to follow and shows how you can benefit from doing this. Salary sacrifice of a motor vehicle.

Source: brokernews.co.uk

Source: brokernews.co.uk

The net pay and net delivered value of the employees pay packet. Here is an example based on how i think this works and on what I want to do. Can a salary sacrifice scheme work for any car. The electric vehicle is leased by the employees company with the cost being deducted from the employees gross salary. The adjustment to pay required to get a car under Salary Sacrifice.

Source: fleetalliance.co.uk

Source: fleetalliance.co.uk

The Employee Salary Sacrifice calculator estimates the net cost of Salary Sacrifice to the employee including. Its a totally simple idea your employees can choose to use some of their salary before its taxed in exchange for the use of a brand new car. Here is an example based on how i think this works and on what I want to do. To explore the benefits for your employees and your business in more detail take a look at our guide - in it youll discover. Meaning this tax break could make salary sacrifice an effectively perfect perk for drivers who want electric cars.

Source: schoolminibuscompany.co.uk

Source: schoolminibuscompany.co.uk

Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says. The adjustment to pay required to get a car under Salary Sacrifice. An electric car is eco-friendly and requires less maintenance than a petrol or diesel car but the up-front cost is a lot. Any salary sacrifice car agreement which precedes the change in tax rules remains exempt from. However salary sacrifice is most effective when an employee chooses an electric vehicle EV because the BIK rate is just 1 in 202122 and is then capped at 2 until the end of the 202425 tax year.

Source: fleetalliance.co.uk

Source: fleetalliance.co.uk

For example Fleet Evolution has a salary sacrifice car scheme that saves you more money if you choose a greener car. The Employee Salary Sacrifice calculator estimates the net cost of Salary Sacrifice to the employee including. However salary sacrifice is most effective when an employee chooses an electric vehicle EV because the BIK rate is just 1 in 202122 and is then capped at 2 until the end of the 202425 tax year. This notional salary is your pay rate before any salary sacrifice arrangements. It is simple to follow and shows how you can benefit from doing this.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title salary sacrifice car example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.