Your Sole trader tax return example images are available in this site. Sole trader tax return example are a topic that is being searched for and liked by netizens today. You can Download the Sole trader tax return example files here. Find and Download all royalty-free images.

If you’re looking for sole trader tax return example pictures information connected with to the sole trader tax return example interest, you have visit the ideal site. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that fit your interests.

Sole Trader Tax Return Example. When you have decided to go for it take the plunge and drive towards the success and rewards of setting up a business as a sole trader there are. If you are self-employed your profits are subject to income tax and National Insurance Contributions. Register for Self. A self-assessment tax return is used to inform HMRC of a sole trader or partner in a business partnerships annual income tax and National Insurance liabilities.

Example Case Study 2 Australian Taxation Office From ato.gov.au

Example Case Study 2 Australian Taxation Office From ato.gov.au

Register for Self. To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. Sole Trader Tax Return -Getting Prepared For Tax Time. For sole traders tax is paid on their profits through the annual self-assessment scheme run by HMRC. Ad Filing your taxes just became easier. Tax Guide for Self-Employed Sole Traders.

Youll also need to complete a tax return if you have significant.

A sole proprietor is someone who owns an unincorporated business by himself or herself. Buy unlocked bookkeeping spreadsheet file you will be able to amend all the cells in. A self-assessment tax return is used to inform HMRC of a sole trader or partner in a business partnerships annual income tax and National Insurance liabilities. Download free simple bookkeeping spreadsheet in Excel format here. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders. Tax Guide for Self-Employed Sole Traders.

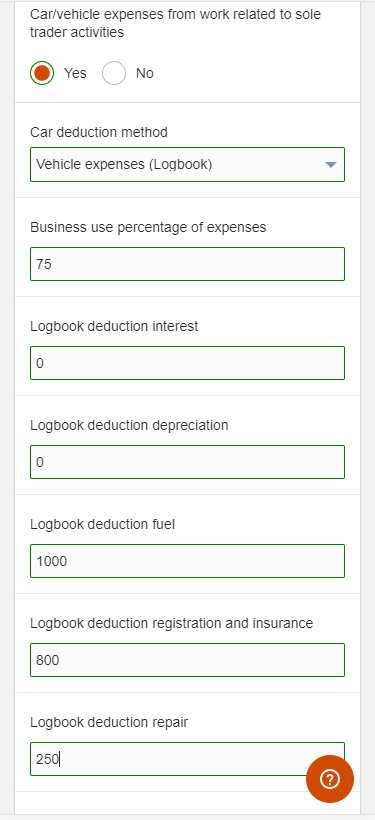

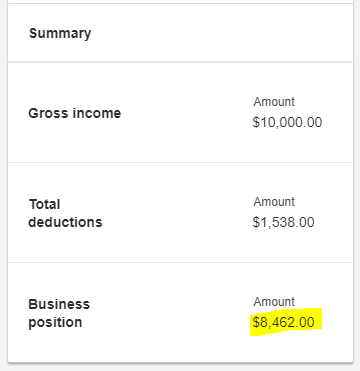

Source: help.airtax.com.au

Source: help.airtax.com.au

Sole trader tax return tips are given below in this article. Income Tax in 20212. You will pay income. Buy unlocked bookkeeping spreadsheet file you will be able to amend all the cells in. Register for Self.

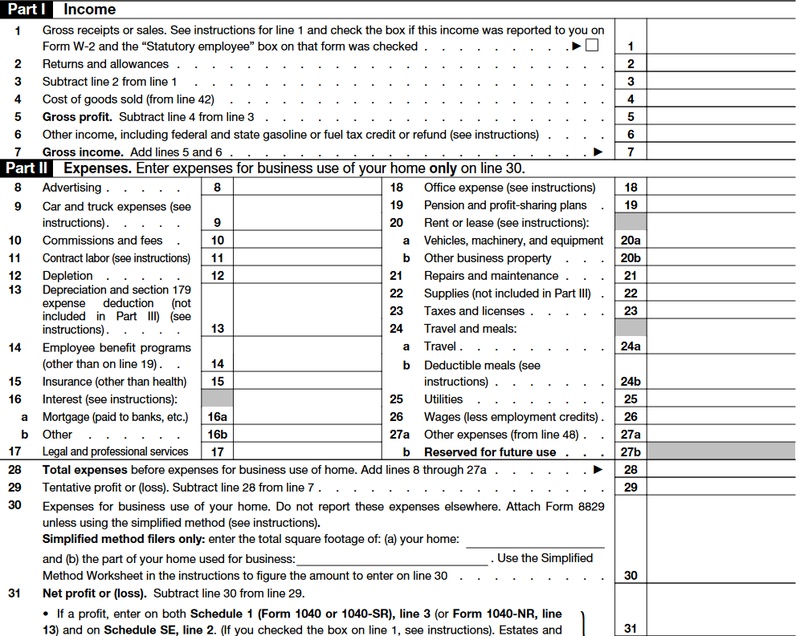

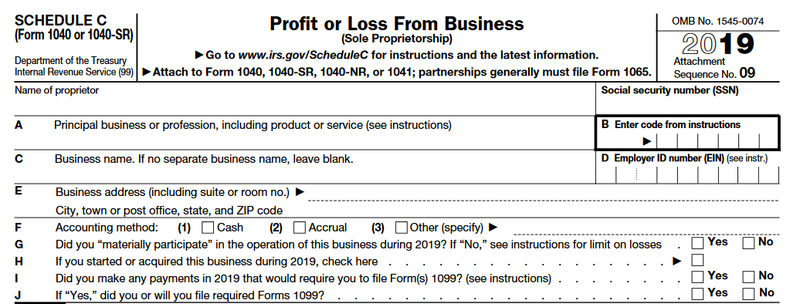

Source: fool.com

Source: fool.com

You will pay income. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders. How are sole traders taxed. File your taxes at your own pace. Now that you have started your own business for example.

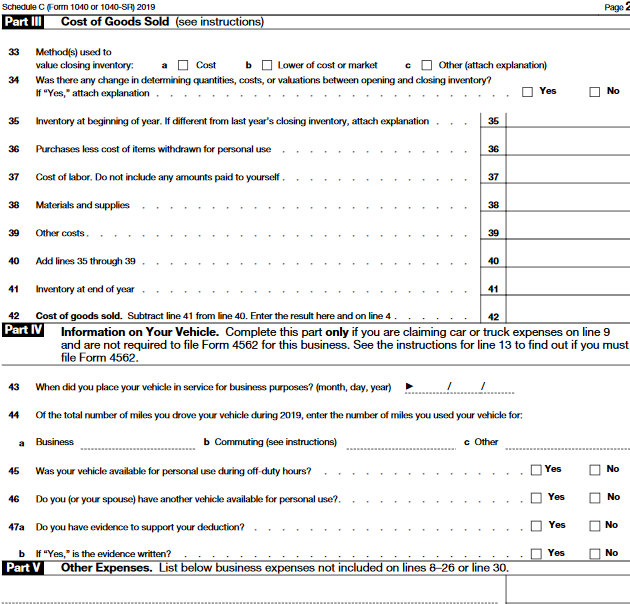

Source: waveapps.com

Source: waveapps.com

Register for Self. Sole traders submit individual tax returns along with a schedule of business income and deductions for expenses. Sole trader tax return tips are given below in this article. File your taxes at your own pace. Sole Trader Tax Return -Getting Prepared For Tax Time.

Source: diyaccounting.co.uk

Source: diyaccounting.co.uk

Tax Guide for Self-Employed Sole Traders. If you are self-employed your profits are subject to income tax and National Insurance Contributions. To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. Sole trader tax return tips are given below in this article. If youre already a sole trader or just thinking of starting out as one its important that you have a firm idea of the tax that youre required to pay on your.

How to set up as a sole trader. To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. If youre already a sole trader or just thinking of starting out as one its important that you have a firm idea of the tax that youre required to pay on your. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders. A self-assessment tax return is used to inform HMRC of a sole trader or partner in a business partnerships annual income tax and National Insurance liabilities.

Source: ato.gov.au

Source: ato.gov.au

Sole trader tax return tips are given below in this article. When you have decided to go for it take the plunge and drive towards the success and rewards of setting up a business as a sole trader there are. Register for Self. Youll need to file a tax return every year. A sole proprietor is someone who owns an unincorporated business by himself or herself.

Source: fool.com

Source: fool.com

Now that you have started your own business for example. Dont let your taxes become a hassle. However if you are the sole member of a domestic limited. Now that you have started your own business for example. Download free simple bookkeeping spreadsheet in Excel format here.

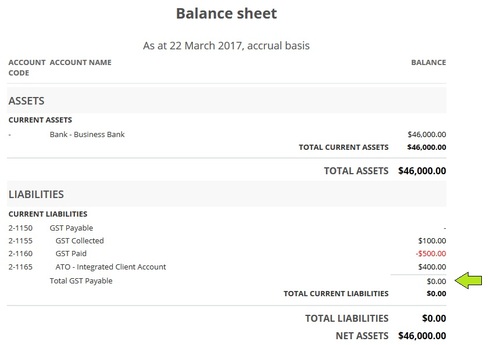

Source: community.reckon.com

Source: community.reckon.com

How to calculate income tax for sole traders There are a few different types of taxes sole traders need to understand but lets cover the easy one first. For example if you earn money from renting out a property read our guide to Self Assessment for landlords. For sole traders tax is paid on their profits through the annual self-assessment scheme run by HMRC. Now that you have started your own business for example. Download free simple bookkeeping spreadsheet in Excel format here.

Source: ato.gov.au

Source: ato.gov.au

Youll need to file a tax return every year. Sole Trader Tax Return -Getting Prepared For Tax Time. Income Tax in 20212. How Much Tax Does a Sole Trader Pay. When you have decided to go for it take the plunge and drive towards the success and rewards of setting up a business as a sole trader there are.

Source: ato.gov.au

Source: ato.gov.au

Download free simple bookkeeping spreadsheet in Excel format here. It must be completed and. Sole Trader Tax Return -Getting Prepared For Tax Time. For example if you earn money from renting out a property read our guide to Self Assessment for landlords. Income Tax in 20212.

Source: axa.co.uk

Source: axa.co.uk

However if you are the sole member of a domestic limited. If you are self-employed your profits are subject to income tax and National Insurance Contributions. Youll also need to complete a tax return if you have significant. Dont let your taxes become a hassle. How to calculate income tax for sole traders There are a few different types of taxes sole traders need to understand but lets cover the easy one first.

Source: sars.gov.za

Source: sars.gov.za

Youll also need to complete a tax return if you have significant. How to set up as a sole trader. How Much Tax Does a Sole Trader Pay. How are sole traders taxed. Income Tax in 20212.

Source: watsonwatt.com.au

Source: watsonwatt.com.au

Now that you have started your own business for example. Sole traders are given a personal allowance tax-free amount that they. When you have decided to go for it take the plunge and drive towards the success and rewards of setting up a business as a sole trader there are. Some s ole trader tax deductions include. How Much Tax Does a Sole Trader Pay.

Source: investopedia.com

Source: investopedia.com

Dont let your taxes become a hassle. How to set up as a sole trader. Sole traders are given a personal allowance tax-free amount that they. Youll need to file a tax return every year. If you are self-employed your profits are subject to income tax and National Insurance Contributions.

Source: ato.gov.au

Source: ato.gov.au

To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. Buy unlocked bookkeeping spreadsheet file you will be able to amend all the cells in. Register for Self. How to set up as a sole trader. Ad Filing your taxes just became easier.

Source: help.airtax.com.au

Source: help.airtax.com.au

For sole traders tax is paid on their profits through the annual self-assessment scheme run by HMRC. Youll also need to complete a tax return if you have significant. Dont let your taxes become a hassle. Ad Filing your taxes just became easier. File your taxes at your own pace.

Source: fool.com

Source: fool.com

For sole traders tax is paid on their profits through the annual self-assessment scheme run by HMRC. Some s ole trader tax deductions include. When you have decided to go for it take the plunge and drive towards the success and rewards of setting up a business as a sole trader there are. Youll also need to complete a tax return if you have significant. Download free simple bookkeeping spreadsheet in Excel format here.

Source: ato.gov.au

Source: ato.gov.au

To set up as a sole trader you need to tell HMRC that you pay tax through Self Assessment. How to calculate income tax for sole traders There are a few different types of taxes sole traders need to understand but lets cover the easy one first. Buy unlocked bookkeeping spreadsheet file you will be able to amend all the cells in. Ad Filing your taxes just became easier. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax return for sole traders.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sole trader tax return example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.