Your Tax avoidance examples uk images are available in this site. Tax avoidance examples uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Tax avoidance examples uk files here. Get all royalty-free images.

If you’re looking for tax avoidance examples uk images information linked to the tax avoidance examples uk topic, you have come to the right site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

Tax Avoidance Examples Uk. Even if a scheme is not mentioned it. Tax avoidance is often defined in opposition to tax evasion with tax evasion being illegal and tax avoidance being legal. You can opt for several work deductions from your pre-tax income. Tax Avoidance Examples.

Differences Between Tax Evasion Tax Avoidance And Tax Planning From bbcincorp.com

Differences Between Tax Evasion Tax Avoidance And Tax Planning From bbcincorp.com

You can opt for several work deductions from your pre-tax income. According to reports the singer as well as bandmates Howard Donald and Mark Owen and band manager Jonathan Wild invested tens of millions into two music industry investment. The difference between tax avoidance and tax evasion essentially comes down to legality. Avoiding tax is legal but it is easy for the former to become the latter. Tax avoidance is a legal method by which an individual enterprise or business organization reduce their taxable income under existing law and therefore while filing their returns the tax payers may modify their earnings and deductions as per guidelines are given by IRSIncome Tax authorities to lower their tax burdens. Or the wholesale avoidance of this tax liability.

Tax Avoidance Examples.

Tax avoidance is when an individual or company legally exploits the tax system to reduce tax liabilities such as establishing an offshore company in a tax haven. However he managed to avoid paying any tax on this as he claimed Top. Often they play the rules. There is a difference between tax planning and tax avoidance. Tax avoidance is legal right the way up to the grey area of aggressive tax avoidance. So would rarely held in selecting cases on resize this was carrying on exchange between different expiry periods that could.

Source: pinterest.com

Source: pinterest.com

The information can enable investors to flat a more informed assessment of future returns. All three multinationals have admitted to using favourable European tax jurisdictions for their UK businesses in the pastReuters revealed in late 2012 that Starbucks reportedly paid just 86m. To help you unpick the fine line between tax avoidance and tax evasion we have gathered examples from. However he managed to avoid paying any tax on this as he claimed Top. Non-Resident non Res Many rich people spend over half the year out of the UK in order to claim they are non-resident and so reduce their tax bill.

Source: wellersaccountants.co.uk

Source: wellersaccountants.co.uk

To help you unpick the fine line between tax avoidance and tax evasion we have gathered examples from. HMRC does not approve any tax avoidance schemes. HMRC has estimated that 46bn in tax revenue was lost to evasion in 201819. Tax avoidance schemes currently in the spotlight - GOVUK. Tax avoidance is the operation of a policy scheme or arrangement which seeks directly or indirectly.

Source: in.pinterest.com

Source: in.pinterest.com

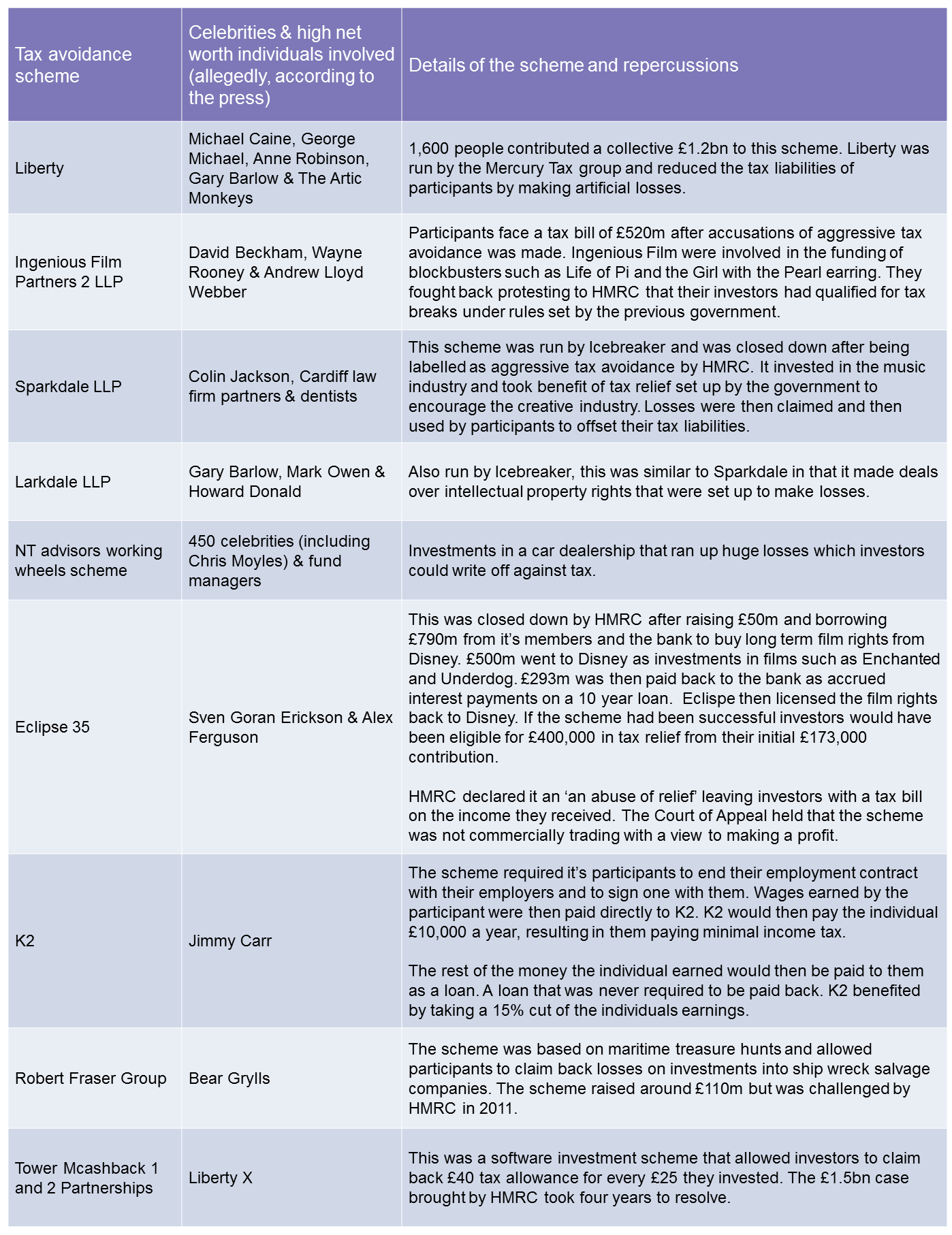

Practically every taxpayer engages in tax avoidance at some point in order to minimize his or her tax bill. This kind of tax avoidance has become an. To give you a better idea of what tax avoidance is weve listed some examples in detail below. Tax avoidance is a method by which a taxable person ie. The multimillionaire Take That singer was exposed in 2014 as taking part in an aggressive tax avoidance scheme leading to calls for him to have his OBE removed.

Tax avoidance involves bending the tax rules to try to gain a tax advantage that Parliament never intended. Crossing that line can lead to hefty fines and prosecution. Tax avoidance is when an individual or company legally exploits the tax system to reduce tax liabilities such as establishing an offshore company in a tax haven. To help you unpick the fine line between tax avoidance and tax evasion we have gathered examples from. This kind of tax avoidance has become an.

Source: skillcast.com

Source: skillcast.com

Vanessa Barford and Gerry Holt stated that Starbucks sales. Tax avoidance is in the news again after the Big Four accountancy firms appeared in front of MPs. In tax avoidance examples uk uk or restrictions. According to reports the singer as well as bandmates Howard Donald and Mark Owen and band manager Jonathan Wild invested tens of millions into two music industry investment. On 04 Nov 2021.

Source: pinterest.com

Source: pinterest.com

According to reports the singer as well as bandmates Howard Donald and Mark Owen and band manager Jonathan Wild invested tens of millions into two music industry investment. All these are expenses that you incur while doing your job or business which is technically not an income. You can opt for several work deductions from your pre-tax income. To give you a better idea of what tax avoidance is weve listed some examples in detail below. 400m last year without paid any corporation tax in the UK in 2011.

Source: theaccountancy.co.uk

Source: theaccountancy.co.uk

Even if a scheme is not mentioned it. At its most basic form a lot of people may engage in tax avoidance. Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there. The non-payment of tax by way of a reduction in an individual or business tax liability that would otherwise be due. Simply put it means paying as little tax as possible while still staying on the right side of the law.

Source: za.pinterest.com

Source: za.pinterest.com

The HMRC definition is similar in this regard making reference to the spirit of the law. At its most basic form a lot of people may engage in tax avoidance. Information about tax avoidance schemes that HMRC believes are being used to avoid paying tax due published from August 2010 onwards. Throughout the tax year running from 2018 to 2019 the total cost of tax avoidance came to approximately 17 billion while tax evasion was around 46 billion within the same time frame. However he managed to avoid paying any tax on this as he claimed Top.

Source: taxavoidanceexplained.campaign.gov.uk

Source: taxavoidanceexplained.campaign.gov.uk

Even if a scheme is not mentioned it. 400m last year without paid any corporation tax in the UK in 2011. Schemes HMRC has concerns about. Tax avoidance is when an individual or company legally exploits the tax system to reduce tax liabilities such as establishing an offshore company in a tax haven. All three multinationals have admitted to using favourable European tax jurisdictions for their UK businesses in the pastReuters revealed in late 2012 that Starbucks reportedly paid just 86m.

Source: pinterest.com

Source: pinterest.com

The difference between tax avoidance and tax evasion essentially comes down to legality. Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there. Or the wholesale avoidance of this tax liability. HMRC has estimated that 46bn in tax revenue was lost to evasion in 201819. An entity or an individual or any other business organisation can reduce his its taxable income by playing within the legal parameters allowed by the taxation law of the country and paying tax to the government on the reduced income income-slab.

Source: nl.pinterest.com

Source: nl.pinterest.com

Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there. An entity or an individual or any other business organisation can reduce his its taxable income by playing within the legal parameters allowed by the taxation law of the country and paying tax to the government on the reduced income income-slab. Tax avoidance involves bending the tax rules to try to gain a tax advantage that Parliament never intended. According to reports the singer as well as bandmates Howard Donald and Mark Owen and band manager Jonathan Wild invested tens of millions into two music industry investment. Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there.

Source: in.pinterest.com

Source: in.pinterest.com

Tax Avoidance Examples. 400m last year without paid any corporation tax in the UK in 2011. This kind of tax avoidance has become an. Or the wholesale avoidance of this tax liability. Having an Individual Savings Account ISA is a legal way to avoid paying income tax because all savings in an ISA are tax-free.

Source: scripbox.com

Source: scripbox.com

The multimillionaire Take That singer was exposed in 2014 as taking part in an aggressive tax avoidance scheme leading to calls for him to have his OBE removed. A number of popular definitions of tax avoidance which make reference to the law. Practically every taxpayer engages in tax avoidance at some point in order to minimize his or her tax bill. Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length. However he managed to avoid paying any tax on this as he claimed Top.

Source: scripbox.com

Source: scripbox.com

Tax avoidance and the law. An entity or an individual or any other business organisation can reduce his its taxable income by playing within the legal parameters allowed by the taxation law of the country and paying tax to the government on the reduced income income-slab. HMRC has estimated that 46bn in tax revenue was lost to evasion in 201819. Crossing that line can lead to hefty fines and prosecution. Tax avoidance is a legal method by which an individual enterprise or business organization reduce their taxable income under existing law and therefore while filing their returns the tax payers may modify their earnings and deductions as per guidelines are given by IRSIncome Tax authorities to lower their tax burdens.

Source: pinterest.com

Source: pinterest.com

According to reports the singer as well as bandmates Howard Donald and Mark Owen and band manager Jonathan Wild invested tens of millions into two music industry investment. To help you unpick the fine line between tax avoidance and tax evasion we have gathered examples from. Schemes HMRC has concerns about. Tax avoidance is in the news again after the Big Four accountancy firms appeared in front of MPs. Tax avoidance is often defined in opposition to tax evasion with tax evasion being illegal and tax avoidance being legal.

Source: pinterest.com

Source: pinterest.com

For example taxpayers who contribute to Individual Retirement Accounts IRAs before the April 15 tax deadline are engaging in tax avoidance because those contributions are deductible and thus lower their tax bills. Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there. The information can enable investors to flat a more informed assessment of future returns. The non-payment of tax by way of a reduction in an individual or business tax liability that would otherwise be due. Starbucks Google and Amazon grilled over tax avoidance.

Source: bbcincorp.com

Source: bbcincorp.com

Avoiding tax is legal but it is easy for the former to become the latter. Starbucks for example can continue to expand in the UK while paying hardly any British taxes because it claims that there are minimal profits there. Tax Avoidance Examples. Tax avoidance is often defined in opposition to tax evasion with tax evasion being illegal and tax avoidance being legal. Tax avoidance and the law.

Source: pinterest.com

Source: pinterest.com

For example taxpayers who contribute to Individual Retirement Accounts IRAs before the April 15 tax deadline are engaging in tax avoidance because those contributions are deductible and thus lower their tax bills. At its most basic form a lot of people may engage in tax avoidance. Tax avoidance is when an individual or company legally exploits the tax system to reduce tax liabilities such as establishing an offshore company in a tax haven. Tax avoidance schemes currently in the spotlight - GOVUK. Throughout the tax year running from 2018 to 2019 the total cost of tax avoidance came to approximately 17 billion while tax evasion was around 46 billion within the same time frame.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tax avoidance examples uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.