Your Vat control account example images are available. Vat control account example are a topic that is being searched for and liked by netizens now. You can Download the Vat control account example files here. Find and Download all royalty-free photos.

If you’re looking for vat control account example images information related to the vat control account example interest, you have visit the right blog. Our website always gives you hints for seeing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Vat Control Account Example. This is available to registered VAT vendors with an active eFiling profile. An opening balance has been entered onto the Purchase Tax Control Account. The VAT control account records all the VAT on both sales outputs and purchases inputs so that the balance on the account shows the amount that should be paid to or claimed from HMRC. Post the CR to vat control of 2133 and DR directors loan.

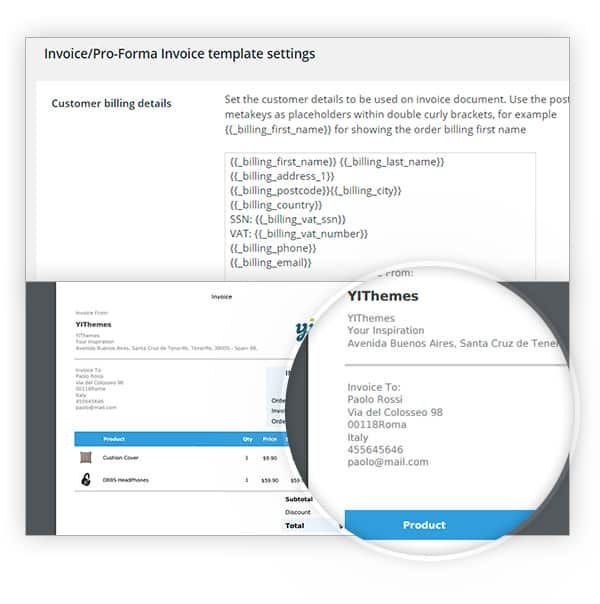

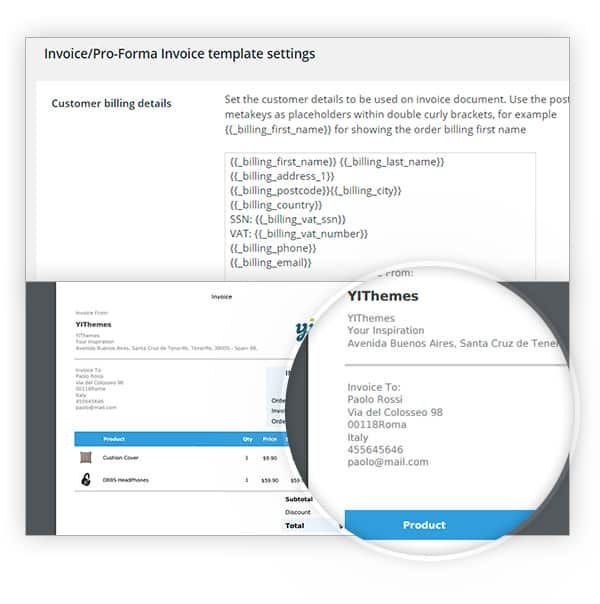

Yith Pdf Invoice And Shipping List Extension For Woocommerce Get Lot Woocommerce Invoice Template Invoicing From fi.pinterest.com

Yith Pdf Invoice And Shipping List Extension For Woocommerce Get Lot Woocommerce Invoice Template Invoicing From fi.pinterest.com

C02 Financial Accounting Fundamentals Control Accounts. This is available to registered VAT vendors with an active eFiling profile. It is here where all the VAT from all the transactions is recorded. AAT Level 4 MAAT ACCA in progress F4- Passed Aug 2020 F5- Passed Dec 2020. However it is also possible to process. Go to Journals then click New Journal.

Lets consider a more detailed example.

At 1 May 2012 the following balances existed in the companys accounting records and the control accounts agreed. It is here where all the VAT from all the transactions is recorded. VAT Journal Entries. Basically the trial balance shows a vat control account of around 7450 at 30042018. - The Debtors Ledger - The Creditors Ledger. The below steps will guide you on how to create a journal.

Source: pinterest.com

Source: pinterest.com

Basically the trial balance shows a vat control account of around 7450 at 30042018. The return submitted to hmrc was around 3200. VAT Control accounts are a nominal account used to track amounts of VAT payable and reclaimable by a business during its normal activities. A new functionality has been enabled on eFiling for a VAT vendor to view the VAT filing control table for a 12 month period. AAT Level 4 MAAT ACCA in progress F4- Passed Aug 2020 F5- Passed Dec 2020.

Source: pinterest.com

Source: pinterest.com

In dealing with the VAT collection and control procedures applied in the Member States this report takes account of a wide range of work and activities which have been carried out by various bodies. A control account often called a controlling account is a general ledger account that summarizes and combines all of the subsidiary accounts for a specific type. Basically the trial balance shows a vat control account of around 7450 at 30042018. Journals have been entered directly to the Purchase Tax Control Account with a tax code that isnt included in the VAT Return for example T9. If required enter a description for the journal.

Source: pinterest.com

Source: pinterest.com

Journals have been entered directly to the Purchase Tax Control Account with a tax code that isnt included in the VAT Return for example T9. AAT Level 4 MAAT ACCA in progress F4- Passed Aug 2020 F5- Passed Dec 2020. In other words its a summary account that equals the sum of the subsidiary account and is used to simplify and organize the general ledger. Enter a reference for the journal. They do not allow for prior period adjustments and processing that does have an effect on the VAT liability.

Source: in.pinterest.com

Source: in.pinterest.com

Basically the trial balance shows a vat control account of around 7450 at 30042018. - The Debtors Ledger - The Creditors Ledger. The VAT control account records all the VAT on both sales outputs and purchases inputs so that the balance on the account shows the amount that should be paid to or claimed from HMRC. Post the CR to vat control of 2133 and DR directors loan. The VAT Filing Control Table and VAT Control Table references in this document are the same and will be used interchangeably.

Source: pinterest.com

Source: pinterest.com

Any more questions about VAT might be better asked under the Indirect Tax section from the level 3 forum as youll be seen by more people covering that topic. This is available to registered VAT vendors with an active eFiling profile. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. Basically the trial balance shows a vat control account of around 7450 at 30042018. By contrast an improved tax risk management model should involve periodic testing of controls to guarantee the effectiveness of VAT-critical processes.

Source: pinterest.com

Source: pinterest.com

C02 Financial Accounting Fundamentals Control Accounts. Control Accounts and Journals LESSON Reconciling the VAT Control Account. An opening balance has been entered onto the Purchase Tax Control Account. Youll do more on VAT and control accounts in Level 3. But the vat reurn for the period is from 01032018 to 31052018.

Source: in.pinterest.com

Source: in.pinterest.com

Lets consider a more detailed example. If required enter a description for the journal. Lets make sure to review your opening and beginning balances to know that they are accurate. For each purchase and sale an amount equal to the VAT. Next check your Ending balance and Ending date.

Source: pinterest.com

Source: pinterest.com

Accounting treatment for VAT paid on purchases The amount of tax paid on purchase of inputs or supplies and available for VAT credit should be debited to a separate account say VAT Credit Receivable Inputs Account. In dealing with the VAT collection and control procedures applied in the Member States this report takes account of a wide range of work and activities which have been carried out by various bodies. They do not allow for prior period adjustments and processing that does have an effect on the VAT liability. In other words its a summary account that equals the sum of the subsidiary account and is used to simplify and organize the general ledger. Journals have been entered directly to the Purchase Tax Control Account with a tax code that isnt included in the VAT Return for example T9.

Source: pinterest.com

Source: pinterest.com

Tyrell proves the accuracy of its sales and purchase ledgers by preparing monthly control accounts. Lets make sure to review your opening and beginning balances to know that they are accurate. When Goods are bought and you have to pay both purchase value and VAT input or pay both following entry will be passed. The below steps will guide you on how to create a journal. - The Debtors Ledger - The Creditors Ledger.

Source: in.pinterest.com

Source: in.pinterest.com

The balance on the account will show how much VAT is owed to or is due from HMRC. However I have a reconciliation that I have been using for the last ten years in Excel this is a very useful tool as most accounting software packages only report on the 2 months or 1 month that you pull for the report. The VAT Return and the VAT Control Account 69 Chapter 5 The VAT Return and the VAT Control Account he main accounting record of any VAT registered business is the VAT control account. When Goods are bought and you have to pay both purchase value and VAT input or pay both following entry will be passed. The balance on the account will show how much VAT is owed to or is due from HMRC.

Source: pinterest.com

Source: pinterest.com

A new functionality has been enabled on eFiling for a VAT vendor to view the VAT filing control table for a 12 month period. The temporary bookkeeper is unsure about the posting to the VAT accounts. Lets consider a more detailed example. Next check your Ending balance and Ending date. A new functionality has been enabled on eFiling for a VAT vendor to view the VAT filing control table for a 12 month period.

Source: pinterest.com

Source: pinterest.com

If required enter a description for the journal. The VAT control account records all the VAT on both sales outputs and purchases inputs so that the balance on the account shows the amount that should be paid to or claimed from HMRC. But the vat reurn for the period is from 01032018 to 31052018. A new functionality has been enabled on eFiling for a VAT vendor to view the VAT filing control table for a 12 month period. The VAT Filing Control Table and VAT Control Table references in this document are the same and will be used interchangeably.

Source: pinterest.com

Source: pinterest.com

My managers solution was to pro rata the 3200 figure 32 giving 2133. C02 Financial Accounting Fundamentals Control Accounts. For each purchase and sale an amount equal to the VAT. The balance on the account will show how much VAT is owed to or is due from HMRC. Ill share some steps to fix the reconciliation difference.

Source: fi.pinterest.com

Source: fi.pinterest.com

But the vat reurn for the period is from 01032018 to 31052018. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. By contrast an improved tax risk management model should involve periodic testing of controls to guarantee the effectiveness of VAT-critical processes. VAT Control accounts are a nominal account used to track amounts of VAT payable and reclaimable by a business during its normal activities. To clear the value on your VAT control account s you will need to create a journal to do this.

Source: pinterest.com

Source: pinterest.com

This is available to registered VAT vendors with an active eFiling profile. Post the CR to vat control of 2133 and DR directors loan. But the vat reurn for the period is from 01032018 to 31052018. If required enter a description for the journal. The VAT control account records all the VAT on both sales outputs and purchases inputs so that the balance on the account shows the amount that should be paid to or claimed from HMRC.

Source: pinterest.com

Source: pinterest.com

VAT Journal Entries. By contrast an improved tax risk management model should involve periodic testing of controls to guarantee the effectiveness of VAT-critical processes. Lets consider a more detailed example. Different date ranges have been specified when calculating the VAT Return and the balance on the Purchase Tax Control Account. VAT Control accounts are a nominal account used to track amounts of VAT payable and reclaimable by a business during its normal activities.

Source: in.pinterest.com

Source: in.pinterest.com

Control Accounts and Journals LESSON Reconciling the VAT Control Account. They do not allow for prior period adjustments and processing that does have an effect on the VAT liability. Go to Journals then click New Journal. - The Debtors Ledger - The Creditors Ledger. VAT Journal Entries.

Source: pinterest.com

Source: pinterest.com

The monthly journals of Frere Stores were added up and verified by the internal auditor. At 1 May 2012 the following balances existed in the companys accounting records and the control accounts agreed. Tyrell proves the accuracy of its sales and purchase ledgers by preparing monthly control accounts. When Goods are bought and you have to pay both purchase value and VAT input or pay both following entry will be passed. Value added tax VAT control accountIn this module we are going to look at the value added tax VAT control accountWe will seewhat it is used forwhere the entries in the account come fromwhat impact the entries in the account have on the VAT liabilityWhat is it used forThe VAT control account is used by businesses that are registered for VATThe account is located inthe.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vat control account example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.