Your Vat reverse charge example uk images are available. Vat reverse charge example uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Vat reverse charge example uk files here. Download all free vectors.

If you’re searching for vat reverse charge example uk images information related to the vat reverse charge example uk keyword, you have come to the ideal site. Our website always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Vat Reverse Charge Example Uk. Suppose a company ABC is a manufacturer of sports goods in the UK. The logic in other reverse charge situations is simple. The reverse charge system offers advantages for taxable persons in terms of simplification thanks to the partial filling in of VAT returns but also in terms of cash flow. Heres a summary of the changes.

Reverse Charge Vat What You Need To Know From theconstructionindex.co.uk

Reverse Charge Vat What You Need To Know From theconstructionindex.co.uk

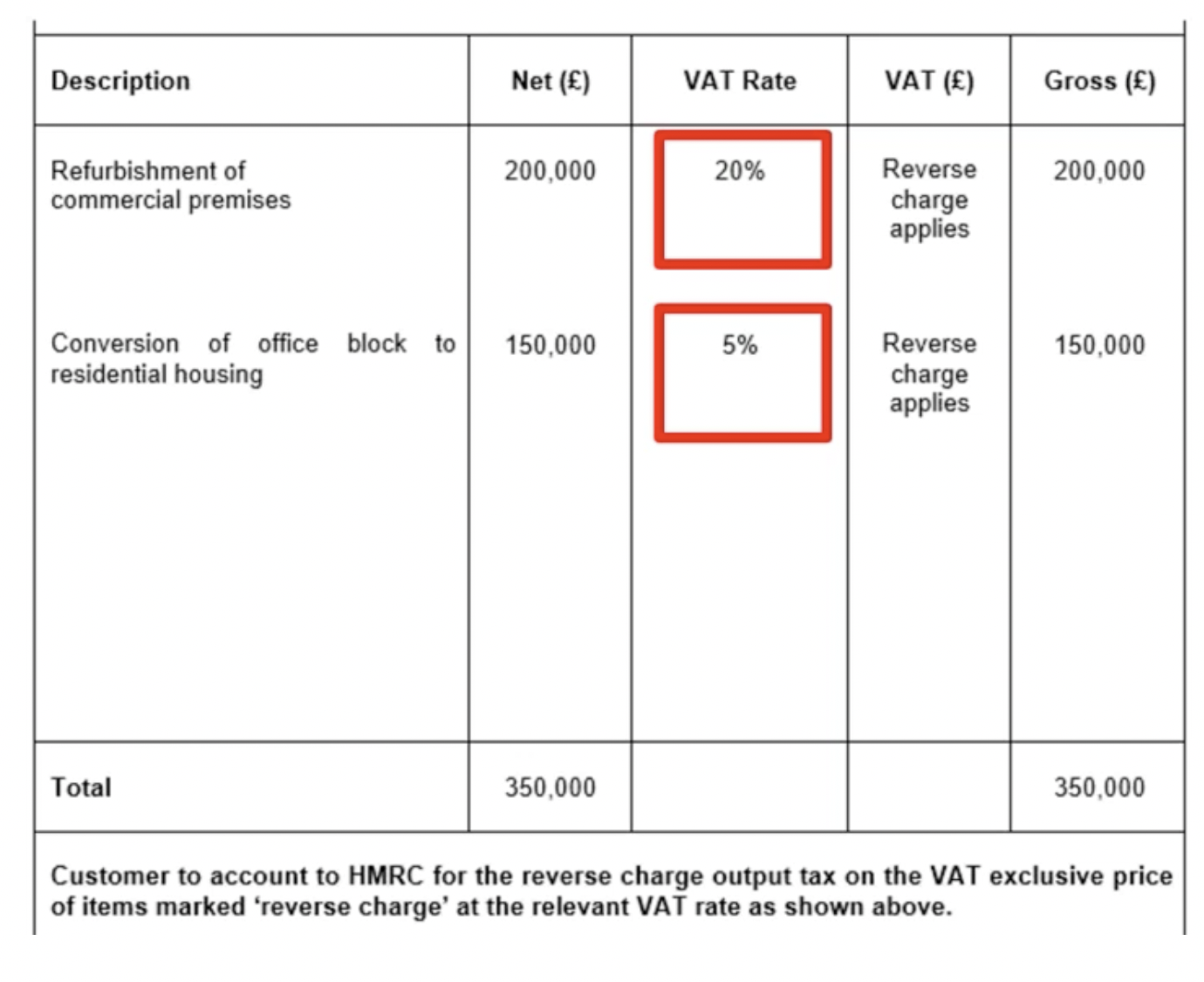

The HMRC example is as follows. If a UK supplier is not paid 5 or 20 VAT in the first place by his customer and the customer declares the output tax on his own VAT return instead the supplier cannot disappear into the wilderness without declaring and paying output tax to HMRC on a VAT return. Reverse charge means the reverse of the tax liability between supplier and recipient. EU Reverse Charge VAT. For further information about reverse charge VAT check with the HMRC. Hi ZM6 yes the 20 RC SG code would be applicable in this case.

How will domestic reverse.

The invoice must now state that reverse charge applies. Reverse charge means the reverse of the tax liability between supplier and recipient. VAT reverse charge. The reverse charge is how you must account for VAT on services that you buy from businesses who are based outside the UK. On 31 December 2020 the United Kingdom left the EU and as a result became a third country for VAT purposes. Convert the value of the services into sterling.

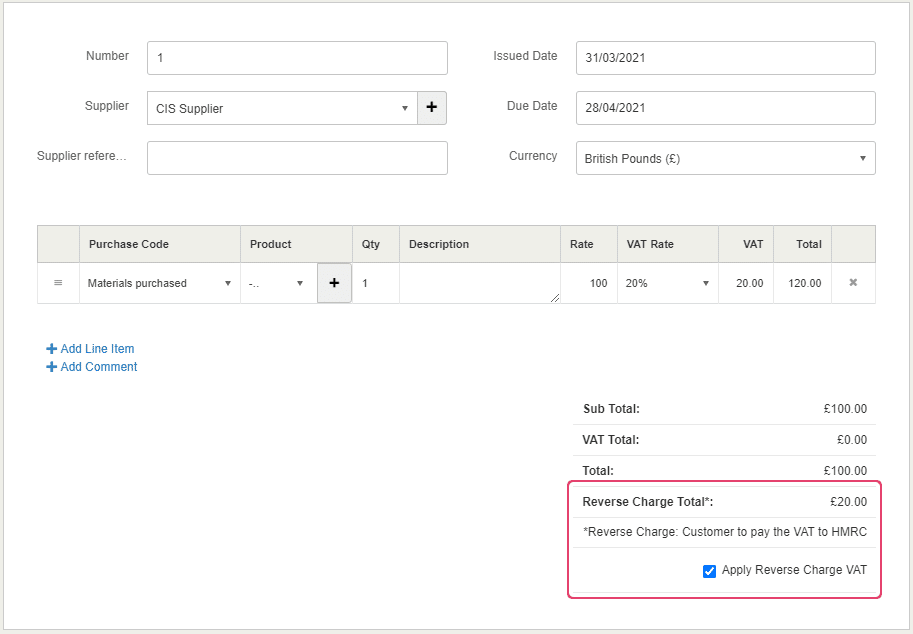

Source: kashflow.com

Source: kashflow.com

If you are not registered for VAT the reverse charge will not apply to you. For further information about reverse charge VAT check with the HMRC. VAT on services from abroad. In January 2021 at the end of the Brexit transitional period the UK introduced an option for UK VAT registered businesses to defer paying Import VAT when goods are imported into the UK and instead apply a reverse charge a self-assessment with a simultaneous input tax deduction in the UK VAT return. The HMRC example is as follows.

Source: jttaccounts.co.uk

Source: jttaccounts.co.uk

An example of how the reverse charge would work in practice is. You can check the information on invoicing rules of the EU Commission. If your business buys services from outside the UK a rule called the reverse charge applies. It should be noted that Northern Ireland is treated as a Member. The invoice must now state that reverse charge applies.

Source: theconstructionindex.co.uk

Source: theconstructionindex.co.uk

In January 2021 at the end of the Brexit transitional period the UK introduced an option for UK VAT registered businesses to defer paying Import VAT when goods are imported into the UK and instead apply a reverse charge a self-assessment with a simultaneous input tax deduction in the UK VAT return. The VAT reverse charge effective dates have been updated to 2020 within the guidance. An example of how the reverse charge would work in practice is. The logic in other reverse charge situations is simple. How will domestic reverse.

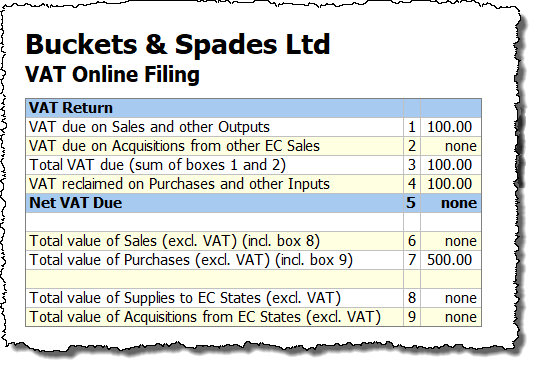

If a UK supplier is not paid 5 or 20 VAT in the first place by his customer and the customer declares the output tax on his own VAT return instead the supplier cannot disappear into the wilderness without declaring and paying output tax to HMRC on a VAT return. For example article 194 of the VAT Directive is used for Domestic reverse charge and article 138 of the VAT Directive is used for intra-Community supplies of goods. Purchasing services from a business based outside the UK such as buying marketing or advertising from a businesses like Google or Facebook who are based in Ireland. This is made up of 2000 costs plus VAT at 20 400. Therefore for companies trading with the UK excluding trade in goods with Northern Ireland the rules of trade with a non-EU country apply.

Source: eque2.co.uk

Source: eque2.co.uk

VAT reverse charge. The logic in other reverse charge situations is simple. In January 2021 at the end of the Brexit transitional period the UK introduced an option for UK VAT registered businesses to defer paying Import VAT when goods are imported into the UK and instead apply a reverse charge a self-assessment with a simultaneous input tax deduction in the UK VAT return. Reverse charge VAT can be used in the following situations. Supply and fix works will be subject to the reverse charge because the services and goods are part of one supply for VAT purposes.

Source: brightpay.co.uk

Source: brightpay.co.uk

Reverse charge VAT can be used in the following situations. Sorry GeorgiaC but thats wrong. In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is. VAT reverse charge. Heres a summary of the changes.

Source: help.accounting.sage.com

Source: help.accounting.sage.com

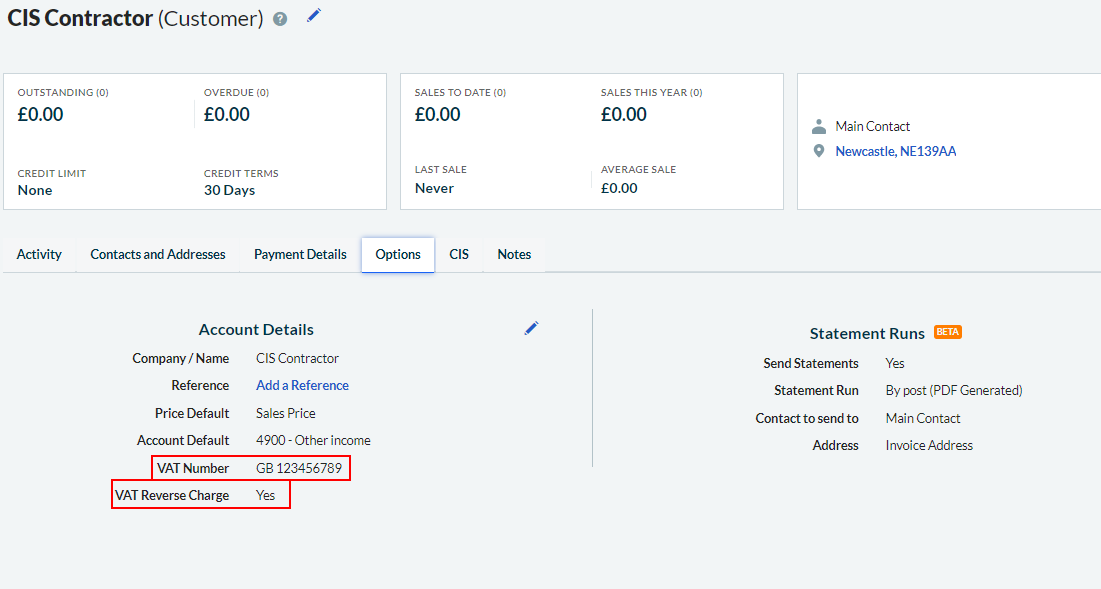

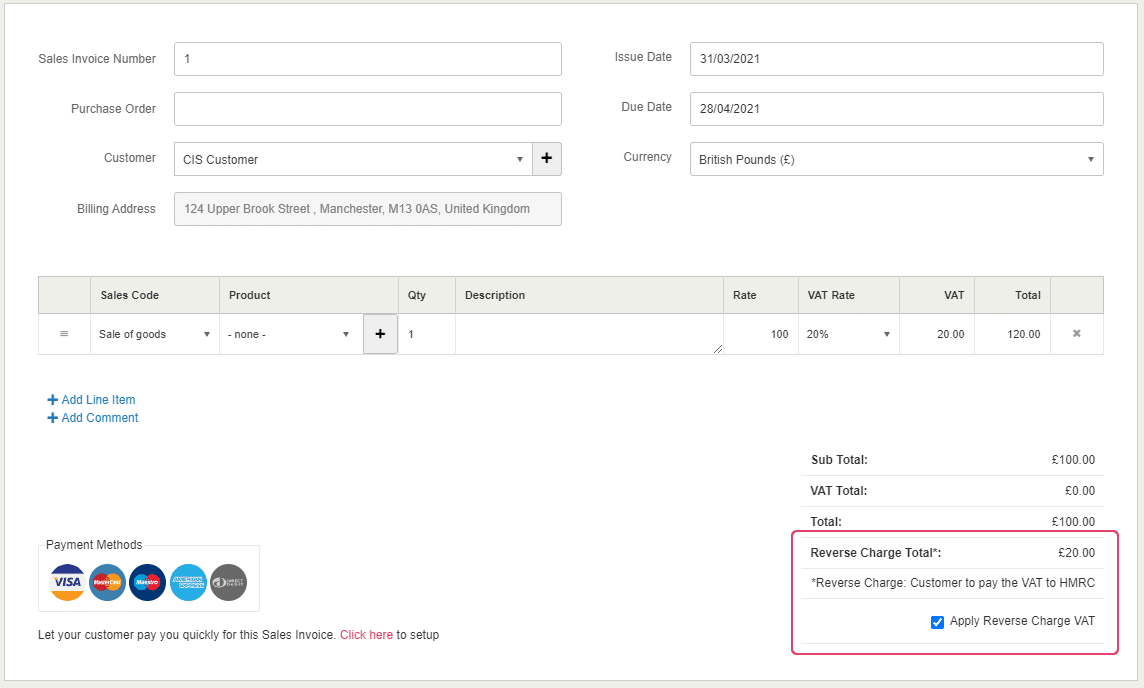

The VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure. If you are a VAT-registered contractor customer you will instead account for both input and output tax on invoices you receive from your VAT-registered subcontractors. VAT reverse charge. The reverse charge is the amount of VAT you would have paid on that service if you had bought it in the UK. Reverse charge applies.

VAT on services from abroad. Supply and fix works will be subject to the reverse charge because the services and goods are part of one supply for VAT purposes. The VAT reverse charge effective dates have been updated to 2020 within the guidance. On 31 December 2020 the United Kingdom left the EU and as a result became a third country for VAT purposes. If your business buys services from outside the UK a rule called the reverse charge applies.

Source: moneysoft.co.uk

Source: moneysoft.co.uk

Heres a summary of the changes. It should be noted that Northern Ireland is treated as a Member. Let us consider a couple of simple working examples to understand how the reverse charge VAT mechanism works. VAT Act 1994 Section 55A applies The second problem is a cashflow problem. You can check the information on invoicing rules of the EU Commission.

Supply and fix works will be subject to the reverse charge because the services and goods are part of one supply for VAT purposes. When to use reverse charge VAT. If you are not registered for VAT the reverse charge will not apply to you. The reverse charge is how you must account for VAT on services that you buy from businesses who are based outside the UK. The VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

UK Postponed Import VAT Accounting. Hi ZM6 yes the 20 RC SG code would be applicable in this case. VAT on services from abroad. In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is. Brian the subcontractor is hired by Gary the contractor for building work that costs 2400 including VAT.

Source: help.brightpearl.com

Source: help.brightpearl.com

If you are not registered for VAT the reverse charge will not apply to you. VAT on services from abroad. VAT Act 1994 Section 55A applies The second problem is a cashflow problem. For further information about reverse charge VAT check with the HMRC. When to use reverse charge VAT.

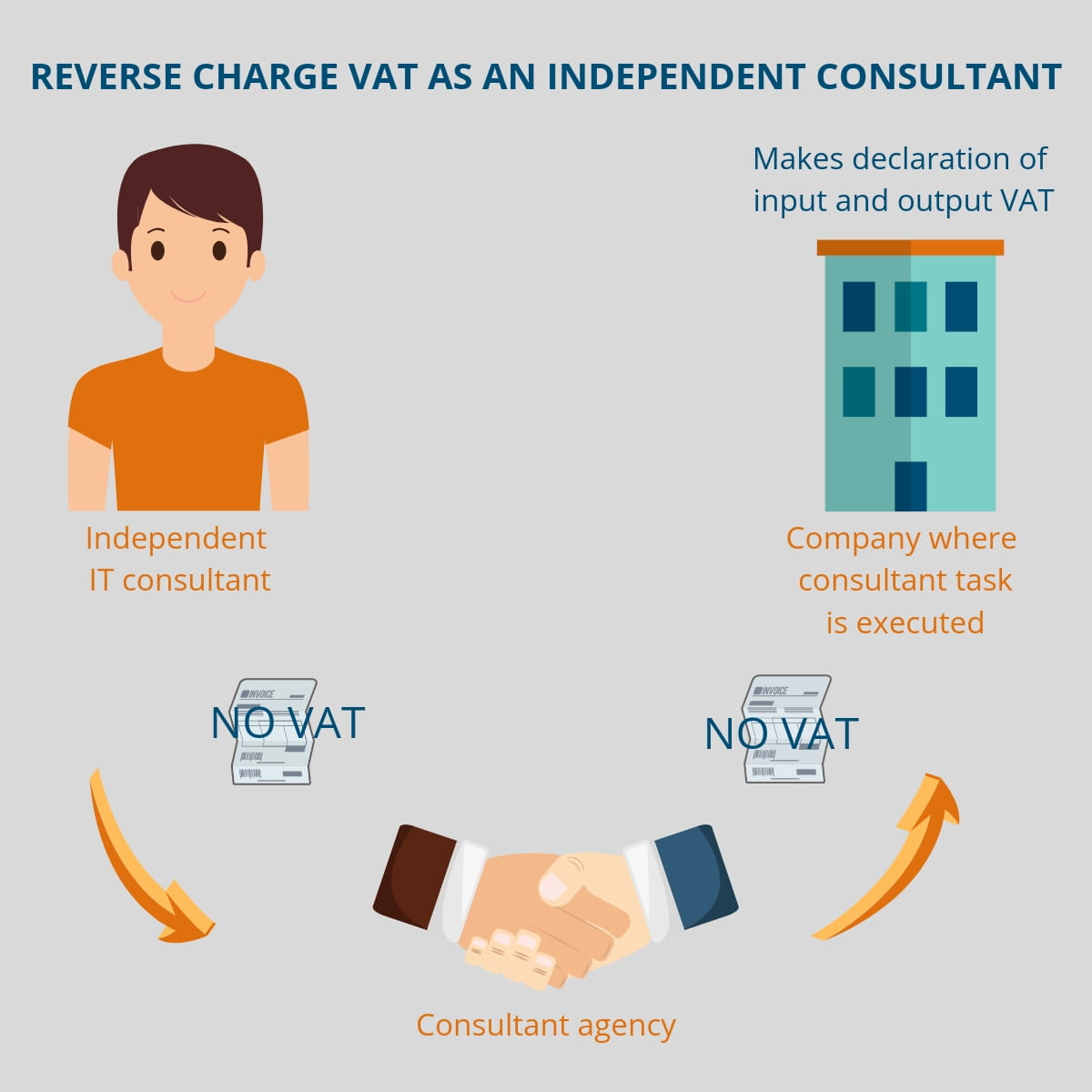

Source: rightpeoplegroup.com

Source: rightpeoplegroup.com

The HMRC example is as follows. Sorry GeorgiaC but thats wrong. If you are a VAT-registered contractor customer you will instead account for both input and output tax on invoices you receive from your VAT-registered subcontractors. Supply and fix works will be subject to the reverse charge because the services and goods are part of one supply for VAT purposes. VAT Act 1994 Section 55A applies The second problem is a cashflow problem.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

Purchasing services from a business based outside the UK such as buying marketing or advertising from a businesses like Google or Facebook who are based in Ireland. The VAT reverse charge effective dates have been updated to 2020 within the guidance. This is made up of 2000 costs plus VAT at 20 400. Brian the subcontractor is hired by Gary the contractor for building work that costs 2400 including VAT. Purchasing services from a business based outside the UK such as buying marketing or advertising from a businesses like Google or Facebook who are based in Ireland.

Source: rightpeoplegroup.com

Source: rightpeoplegroup.com

If a UK supplier is not paid 5 or 20 VAT in the first place by his customer and the customer declares the output tax on his own VAT return instead the supplier cannot disappear into the wilderness without declaring and paying output tax to HMRC on a VAT return. UK Postponed Import VAT Accounting. Let us consider a couple of simple working examples to understand how the reverse charge VAT mechanism works. For further information about reverse charge VAT check with the HMRC. The reverse charge is the amount of VAT you would have paid on that service if you had bought it in the UK.

Source: kashflow.com

Source: kashflow.com

Supply and fix works will be subject to the reverse charge because the services and goods are part of one supply for VAT purposes. You can check the information on invoicing rules of the EU Commission. In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is. If your business buys services from outside the UK a rule called the reverse charge applies. The VAT reverse charge effective dates have been updated to 2020 within the guidance.

Source: astonshaw.co.uk

Source: astonshaw.co.uk

VAT Act 1994 Section 55A applies The second problem is a cashflow problem. Reverse charge VAT can be used in the following situations. If a UK supplier is not paid 5 or 20 VAT in the first place by his customer and the customer declares the output tax on his own VAT return instead the supplier cannot disappear into the wilderness without declaring and paying output tax to HMRC on a VAT return. The VAT reverse charge effective dates have been updated to 2020 within the guidance. In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Convert the value of the services into sterling. In short the supplier issues an invoice that does not include any tax rates and notices that it is a reverse charge invoice and he is not like it would usually be the case liable to pay VAT but the recipient is. VAT on services from abroad. Reverse charge applies. Convert the value of the services into sterling.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vat reverse charge example uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.