Your Withholding tax meaning with example images are ready. Withholding tax meaning with example are a topic that is being searched for and liked by netizens now. You can Find and Download the Withholding tax meaning with example files here. Find and Download all royalty-free photos.

If you’re looking for withholding tax meaning with example pictures information connected with to the withholding tax meaning with example keyword, you have visit the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

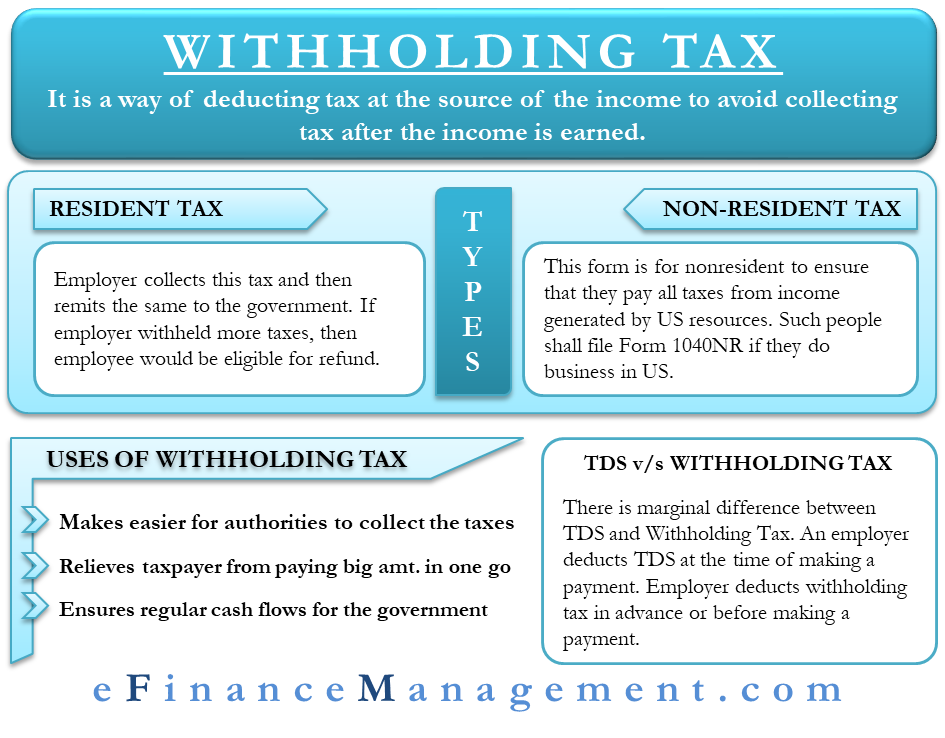

Withholding Tax Meaning With Example. How to use withhold in a sentence. Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. Withholding tax is a set amount of money that employers take or withhold from an employees paycheck. With the yearly salary of 36000 his monthly income comes to 3000 36000 12.

Tax Planning How To Plan Investing Budgeting Finances From pinterest.com

Tax Planning How To Plan Investing Budgeting Finances From pinterest.com

Withholding is an operation in which money is deducted from a payment issued to a third party. Net amount 1000 and tax amount 200. With the yearly salary of 36000 his monthly income comes to 3000 36000 12. Abolition of withholding tax. Withholding allowances are indicated by employees on the IRS Form W-4 and appropriate state income tax form. Meaning pronunciation translations and examples.

Recent Examples on the Web The move will enable investors to avoid a new withholding tax on dividends.

A withholding tax is an amount of money that is taken in advance from someones income. Many reasons could trigger backup withholding as it is a method used by a tax body like the Internal Revenue Service IRS to receive taxes. Gross amount 1000 net amount 200 tax 1200. The following are aspects of federal income tax withholding that are unchanged in 2022. What Does Tax Withholding Mean. For example dividends are subject to tax withholding at the rate of 25 percent to 30 percent and interest paid to a foreign corporation is subject to tax withholding at the corporate tax rate currently 23 percentThese rates may be reduced under an applicable treaty.

Source:

Source:

IRS Form W-4 allows all employees to claim at least one allowance for his or her self. Withholding tax is an amount that is directly deducted from the employees earnings by the employer and paid to the government as a part of individuals tax liability. No withholding allowances on 2020 and later Forms W-4. Those who have too much money. Royalties are usually subject to withholding taxes.

Source: pinterest.com

Source: pinterest.com

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Withholding tax is a set amount of money that employers take or withhold from an employees paycheck. As we know WTH tax percentage is applied on gross amount. Abolition of withholding tax. This money is then remitted to both the local and federal government on behalf of the employee.

Source: in.pinterest.com

Source: in.pinterest.com

The publication includes worksheets and examples to guide taxpayers through these special situations. Withholding tax definition. In India the Central Government is liable and empowered to levy and collect taxes. To change their tax withholding employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer. Between 2021 and 2022 many of the changes brought about by the Tax Cuts and Jobs Act of 2017 remain the same.

Source: pinterest.com

Source: pinterest.com

The meaning of WITHHOLD is to hold back from action. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. Examples of withholding tax in a Sentence. WTH tax 10 on gross amount 10 on 1200 120. What Does Tax Withholding Mean.

Source: pinterest.com

Source: pinterest.com

Certain laws require that taxes be taken first before the money is paid. To change your tax withholding use the results from the Withholding Estimator to determine if you should. 2022 income tax withholding tables. The money thats withheld by the employer acts as a credit against the employees annual income taxes. With the yearly salary of 36000 his monthly income comes to 3000 36000 12.

Source: pinterest.com

Source: pinterest.com

Withholding is an operation in which money is deducted from a payment issued to a third party. Each country has a different percentage of withholding tax. Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. Withholding is an operation in which money is deducted from a payment issued to a third party. Examples of withholding tax in a Sentence.

Source: in.pinterest.com

Source: in.pinterest.com

No Matter What Your Tax Situation Is TurboTax Has You Covered. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Certain laws require that taxes be taken first before the money is paid. In the UK and Ireland it is 20 however it can change depending on the circumstances of the payment. Many reasons could trigger backup withholding as it is a method used by a tax body like the Internal Revenue Service IRS to receive taxes.

Source: pinterest.com

Source: pinterest.com

Gross amount 1000 net amount 200 tax 1200. Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. These taxes are paid to the central government of India. The money thats withheld by the employer acts as a credit against the employees annual income taxes. A withholding tax is an amount of money that is taken in advance from someones income.

Source: pinterest.com

Source: pinterest.com

Net amount 1000 and tax amount 200. Withholding tax is efficient in that tax authorities can collect tax as taxable events take place. How to use withhold in a sentence. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Gross amount 1000 net amount 200 tax 1200.

Source: pinterest.com

Source: pinterest.com

To sum up it means a discount made to a given payment. However a 10 withholding tax is deducted from the same and hence he takes home only 27000 30000 3000 and balance 3000 is deducted at source as retention tax. X earns a salary of 36000 per year. Withholding tax is efficient in that tax authorities can collect tax as taxable events take place. What Does Tax Withholding Mean.

Source: efinancemanagement.com

Source: efinancemanagement.com

Withholding tax is also referred to as a retention tax and is paid from the source rather than the recipient. Get Your Max Refund Today. Backup withholding refers to the withholding of a certain percentage of the investment income earned by an investor. Examples of withholding tax in a Sentence. In case of a withholding tax part of the interest payment is not paid to the investor but.

Source: in.pinterest.com

Source: in.pinterest.com

For example dividends are subject to tax withholding at the rate of 25 percent to 30 percent and interest paid to a foreign corporation is subject to tax withholding at the corporate tax rate currently 23 percentThese rates may be reduced under an applicable treaty. Dont file with the IRS. How to use withhold in a sentence. Abolition of withholding tax. As we know WTH tax percentage is applied on gross amount.

Source: pinterest.com

Source: pinterest.com

Withholding tax is a set amount of money that employers take or withhold from an employees paycheck. Examples of withholding tax in a Sentence. 2022 income tax withholding tables. Gross amount 1000 net amount 200 tax 1200. Withholding allowances are indicated by employees on the IRS Form W-4 and appropriate state income tax form.

Source: pinterest.com

Source: pinterest.com

In case of a withholding tax part of the interest payment is not paid to the investor but. Royalties are usually subject to withholding taxes. However a 10 withholding tax is deducted from the same and hence he takes home only 27000 30000 3000 and balance 3000 is deducted at source as retention tax. A withholding tax is an amount of money that is taken in advance from someones income. Dont file with the IRS.

Source: pinterest.com

Source: pinterest.com

The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. Synonym Discussion of Withhold. Tax is charged based on the. Company purchases raw material from vendor of 1000 with 20 input tax. Examples of withholding tax in a Sentence.

Source: pinterest.com

Source: pinterest.com

Net amount 1000 and tax amount 200. In case of a withholding tax part of the interest payment is not paid to the investor but. To change their tax withholding employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer. These taxes are paid to the central government of India. 2022 income tax withholding tables.

Source: pinterest.com

Source: pinterest.com

To change your tax withholding use the results from the Withholding Estimator to determine if you should. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. As we know WTH tax percentage is applied on gross amount. The publication includes worksheets and examples to guide taxpayers through these special situations. Many reasons could trigger backup withholding as it is a method used by a tax body like the Internal Revenue Service IRS to receive taxes.

Source: pinterest.com

Source: pinterest.com

Certain laws require that taxes be taken first before the money is paid. Certain laws require that taxes be taken first before the money is paid. The following are aspects of federal income tax withholding that are unchanged in 2022. IRS Form W-4 allows all employees to claim at least one allowance for his or her self. Gross amount 1000 net amount 200 tax 1200.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title withholding tax meaning with example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.